Voice Will Tie the Connected Economy, and Banking, Together

To gain insight into just how connected we’re becoming in everyday life, where technology fuses and synthesizes a range of activities into an uninterrupted flow … just listen.

Literally.

The human voice is the glue that might tie the Connected Economy together — a 21st century operating system that transcends iOS and Android, and is pretty much universal.

Recent data underscore just how pervasive voice can become as a means and mechanism of accessing and controlling the most important aspects our lives.

Take financial services, for example, and in particular, banking.

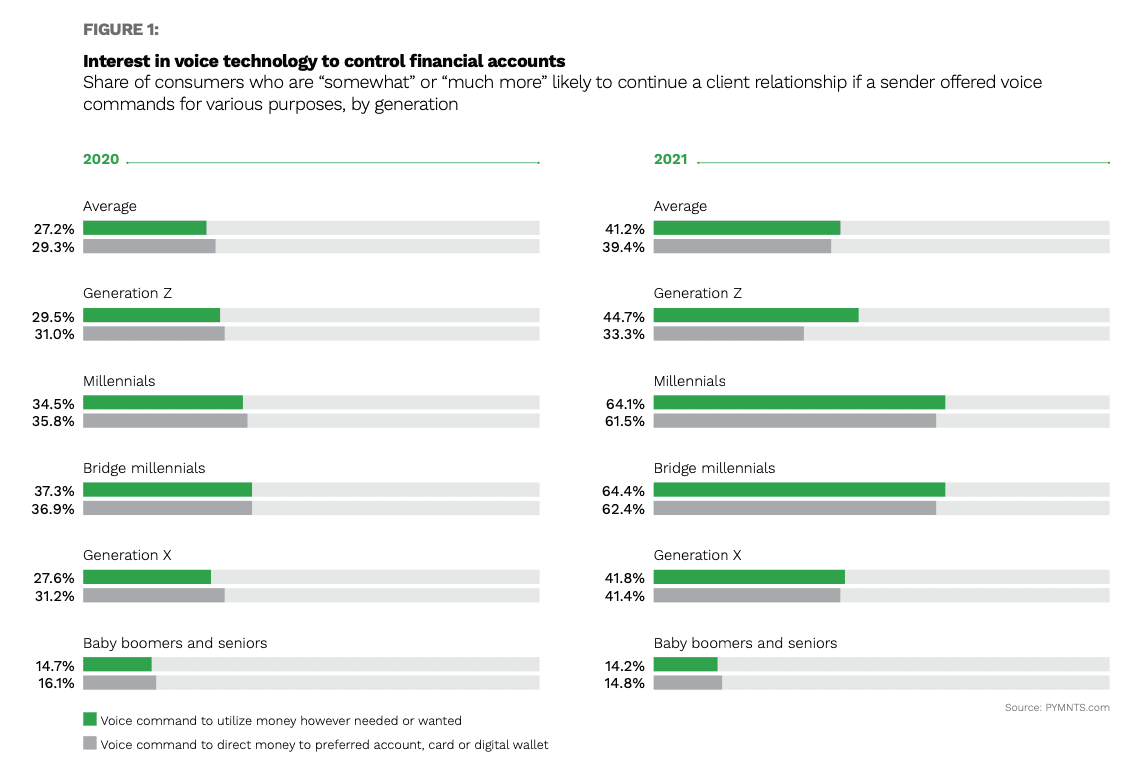

In The Money Mobility Playbook: Delivering Money-Out Mobility At Scale, a PYMNTS and Ingo Money collaboration, the data show that 64% of bridge millennials would be “more” loyal to providers who offered voice commands to control their financial accounts, up from 37% a year ago. In fact, all generations, with the exception of boomers and seniors, showed marked interest in being able to use voice to use money however, and wherever, they wanted — and would reward those forward-thinking financial services firms with their loyalty, too.

The numbers show, then, a growing recognition of wide range of use cases in which the spoken word makes everything a bit, well, easier. And the data also show a growing trust in voice as an on-ramp into the Connected Economy itself.

The numbers show, then, a growing recognition of wide range of use cases in which the spoken word makes everything a bit, well, easier. And the data also show a growing trust in voice as an on-ramp into the Connected Economy itself.

Through the pandemic, after all, PYMNTS found that across a national sample of 10,000 U.S. consumers, use of voice activated speakers grew, and individuals were increasingly comfortable with using that connectivity to order groceries and food.

That familiarity now is extending to finance, and along the way can and will transform banking into an always on, omnichannel experience. Other PYMNTS research shows that 18% of consumers would use a financial super app to manage their finances. Voice would be part of that functionality, we note, and brings banking into a 24/7/365 experience akin to eCommerce/

Picture, then, the ability to give a spoken command to your voice assistant to deposit funds into your checking account, and then later in the day “staging” a transaction to be ready for you at the ATM, again powered by voice, where cash is withdrawn without punching in numbers on screen.

For the banks, themselves, there’s an advantage inherent in the automation, in serving the customer quickly and in real time. Security improves, too, because the sensitive info that is being accessed is not “stored” on the devices themselves, and each person’s voice is unique (and analyzing who you literally say you are offers yet another level of security).

As noted at the end of last month, 19 million more consumers here in the U.S. went online to do everything from buying to banking to paying bills. We’re moving toward a tipping point that sees a more hands-free approach to physical life lived digitally, in a sense. And underpinning it all will be the spoken word.