FinTechs Bring Payments Innovation to Connected Economy Leader Singapore

The world’s most digitally connected country is also a lead innovator in facilitating international business payments.

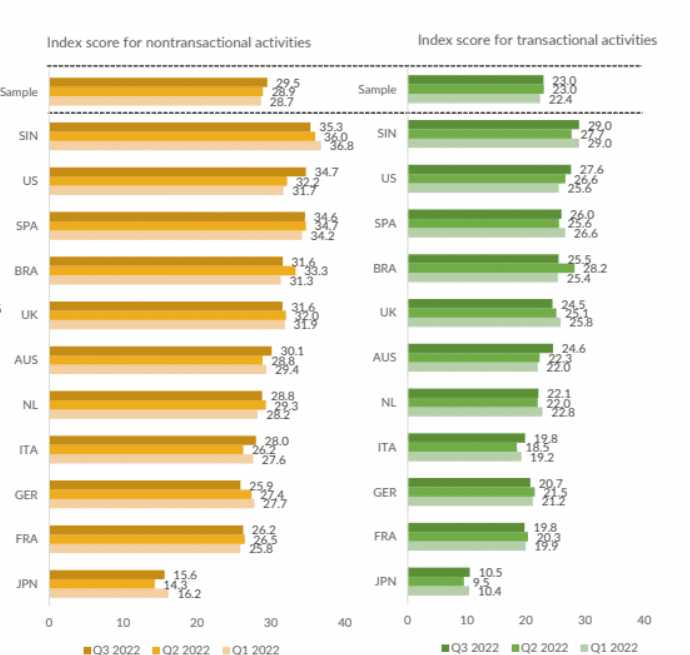

The PYMNTS Q3 2022 ConnectedEconomy™ Index, “How the World Does Digital,” tracks the current state of global digital adoption by measuring the online activities of over 30,000 consumers across 11 countries. As populations shift away from analogue, all-physical environments to an internet-based, connected society, consumers worldwide are incorporating digital platforms, conveniences and activities into nearly every facet of their lives. The study measures this transformation through the number of activities consumers perform, the percentage of adult consumers who use digital technology to do something at least once per month, and the frequency by which consumers engage in these activities. It includes both transactional activities — such as shopping on marketplaces or booking travel — and non-transactional activities, such as interacting with friends on social media or checking flight information. By all the study’s metrics, Singapore reigns supreme as most engaged nation in the ConnectedEconomy™, with only the U.S. and Spain particularly close behind.

Source: PYMNTS How The World Does Digital: Different Paths To Digital Transformation, December 2022

N varies based on quarter surveyed; N = 30,174: Whole sample for Q3 2022, fielded Aug. 10, 2022 – Sept. 16, 2022

Singapore’s lead has dwindled relative to its closest competitors in our study, and the country’s tech sector is heavily focusing on cross-border payments innovation, both singly and in partnerships. Examples of these efforts abound.

Last June, Jack Ma-owned FinTech Ant Group introduced ANEXT bank to the country after receiving one of the first banking licenses issued by the Monetary Authority of Singapore (MAS). With the licensing issuance preceded by a local hiring spree, ANEXT is primarily focused on serving small and medium-sized enterprises, especially those concentrating on cross-border payments. It represents Ant Group’s largest overseas expansions thus far. As part of the deal, Ant Group also signed a two-year memorandum of understanding with MAS-supported Proxtera to develop an open framework for all participating financial institutions. Proxtera’s mission is to “transform and enable holistic cross-border trade among SMEs and businesses through making marketplaces efficient and discoverable globally, with embedded financing, fulfillment services and SME empowerment.”

Stripe also announced entering the Singapore market last June, with the financial infrastructure platform Stripe Terminal now available for businesses operating in the country. It offers businesses a customizable checkout via web or mobile apps, fleet management features and readers that work with mobile wallets as well as contact/contactless cards. Terminal also works with other Stripe tools, including Payments, Connect and Billing.

In December, commerce tech company Payoneer said it would be able to offer additional services to Singapore-based companies after receiving in-principle approval as a Major Payment Institution License holder from the MAS. Once the license takes effect, Payoneer will have the ability to add mass payout and card offerings to Singapore businesses of any size through its secure payments platform. The anticipated MAS-issues license will join Payoneer’s licenses or registrations in the U.S., Europe, Hong Kong, Japan, Australia and India.

Last month, shortly after Payoneer’s approval, payments firm Fiserv was given the green light by the MAS to expand its offerings in Singapore. The approval will allow Fiserv to provide cross-border money transfer services and real-time account transfers as well as permit Fiserv to continue offering merchant acquiring services in Singapore.

Local FinTechs are also involved in this cross-border infrastructure effort. Singapore FinTech MatchMove Pay bought eCommerce startup Shopmatic, also based in Singapore, last year. The combined entity, dubbed the MatchMove Group, is targeting services to four million customers in over 15 countries by 2026, including India. Shopmatic’s services allow businesses to add eCommerce tools that include inventory digitization, social commerce, web stores and automated access to the global markets. MatchMove will combine those features with its tools allowing customers to customize and embed financial services like banking or credit card services.

And last June, Singapore’s Green Link Digital Bank began operations, with the new financial institution offering banking for micro, small, and medium-size enterprises to assist them with supply chain financing and tech solutions. With the goal of helping underserved businesses with accessible commercial banking, the bank is exploring expanding its its service coverage to the digital economy.

Each country in the ConnectedEconomy™ Index faces its own challenges and rewards finding its way towards a more digital society. Singapore’s cross-border payment efforts are just one approach to the increasingly connected digital economy PYMNTS tracks.