Half of Millennials Use Dating Apps Every Day

Dating apps have never been more popular, with more than 60 million downloads last year in the United States. PYMNTS’ research finds that their use has risen 7% over the past year to 28% in March 2023, a share that represents 73 million consumers. Over half of these users are urbanites, with 19% of city dwellers logging into dating apps daily.

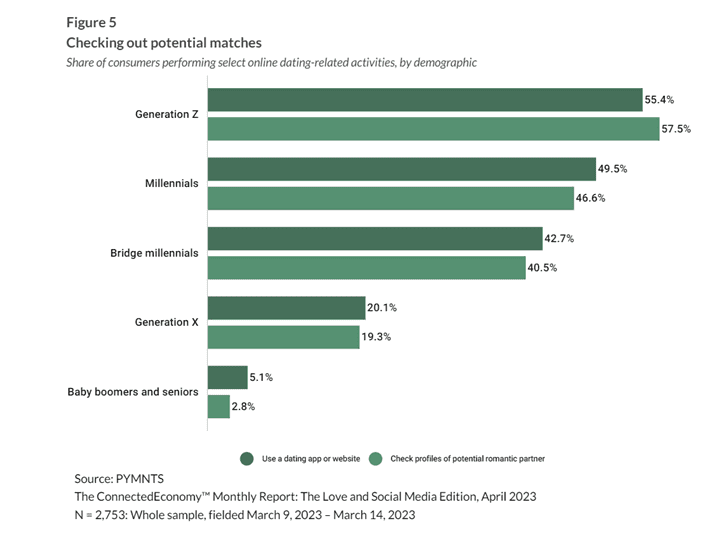

Gen Z and millennial consumers, who are statistically less likely to be married than other age demographics, are most likely to be using dating apps and sites. We find that 55% of adult-age Gen Z consumers and 50% of millennials use these platforms daily.

However, these singles do not lose sight of security concerns, as PYMNTS’ “ConnectedEconomy™ Monthly Report: The Love and Social Media Edition” notes that 78% of consumers who use dating apps specifically log into social media to verify potential dates’ social media profiles.

As the chart notes, Gen Z dating platform users are by far the most likely to use social media to check up on potential dates. Overall, 58% of the surveyed age cohort overall have conducted these checks, and 10% do so daily. Closely following are millennials and bridge millennials, whose use more than doubles Gen X for both using dating platforms and checking profiles of potential romantic partners via social media.

The significant share of frequent users concentrated in urban areas who are at least somewhat concerned with safety makes for some potentially unique opportunities among related businesses. As noted earlier this year by The Wall Street Journal, along with frequent dating platform use comes “swipe fatigue,” giving rise to speed dating and other events. Sometimes put on in partnership with dating platforms or independently through sites such as Eventbrite, these group meetups provide greater security than simply meeting a potential date in public may provide. And as 15% of users on these platforms pay for their access, there may be some wiggle room in these consumers’ willingness to spend when finding potential matches.

Businesses and organizations have an opportunity, if done correctly, to leverage consumer desire in finding a romantic connection within safer parameters. Through sponsorship or organization of group events, companies might use such events to gain local “word of mouth” promotion all the way up to classically branded events that include labeled swag. The types of organizations possibly participating in such events may only be limited by budget and imagination. Examples range from a Main Street firm-sponsored singles softball game to a multi-partnered cooking class and wine pairing within a unique setting as a local event hosted by a dating platform Name recognition stemming from this participation, and the potential revenue it could accordingly bring, may more than make up for business’ investment in the event itself.

As dating app use is on track to continue rising, businesses can partner up and offer safer environments to meet potential partners. With a large amount of room in how that manifests, organizations may explore some creative strategies to help their consumer base find love.