New Report: 53 Pct Of Upper-Income Americans Live Paycheck-To-Paycheck

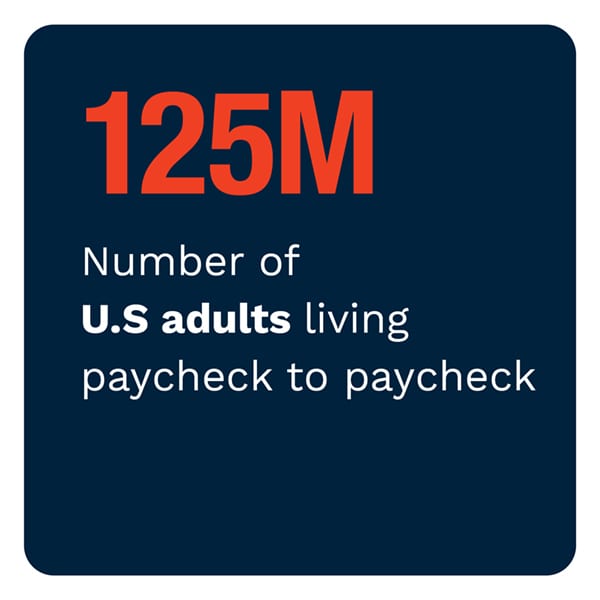

Living paycheck to paycheck is sometimes seen as synonymous with being poor, an unfortunate but relatively uncommon circumstance. In fact, it is far more widespread than one might think: Fifty-four percent of consumers in the United States today live paycheck to paycheck, including 53 percent of those who earn $50,000 to $100,000 per year.

Living paycheck to paycheck is sometimes seen as synonymous with being poor, an unfortunate but relatively uncommon circumstance. In fact, it is far more widespread than one might think: Fifty-four percent of consumers in the United States today live paycheck to paycheck, including 53 percent of those who earn $50,000 to $100,000 per year.

These are among the surprising findings to emerge from PYMNTS’ latest research project, Reality Check: The Paycheck-to-Paycheck Report, a PYMNTS and LendingClub collaboration. The inaugural report, The Impacts Of A Changing Economy edition, is part of a series of research briefs documenting how consumers are managing their finances during today’s turbulent and evolving economic conditions. The series is based on periodic surveys of nearly 30,000 U.S. consumers that began in March 2020.

These are among the surprising findings to emerge from PYMNTS’ latest research project, Reality Check: The Paycheck-to-Paycheck Report, a PYMNTS and LendingClub collaboration. The inaugural report, The Impacts Of A Changing Economy edition, is part of a series of research briefs documenting how consumers are managing their finances during today’s turbulent and evolving economic conditions. The series is based on periodic surveys of nearly 30,000 U.S. consumers that began in March 2020.

The pandemic and its aftermath have complicated the long-complex task of making ends meet for U.S. consumers. Millions of jobs have been lost, yet stimulus funds have provided crucial support for consumers and businesses alike. Our research offers a window into these changing circumstances.

The share of consumers living paycheck to paycheck was at its highest — 66 percent — in late March 2020, shortly after the pandemic began. This declined sharply after the first round of stimulus funding in the spring of 2020. It then rose in the fall and declined sharply again after another round of payments in early 2021, falling 20 percent between early December 2020 and April 2021.

The share of consumers living paycheck to paycheck was at its highest — 66 percent — in late March 2020, shortly after the pandemic began. This declined sharply after the first round of stimulus funding in the spring of 2020. It then rose in the fall and declined sharply again after another round of payments in early 2021, falling 20 percent between early December 2020 and April 2021.

Bolstering their savings appears to be one of the main ways consumers have used their income sources over the past year. The average savings of struggling paycheck-to-paycheck consumers increased nearly threefold over the past year, from $2,400 in March 2020 to $6,200 in April 2021. More recently, the average savings among these consumers has dropped by approximately 40 percent, which could indicate that they are starting to feel comfortable opening their wallets again.

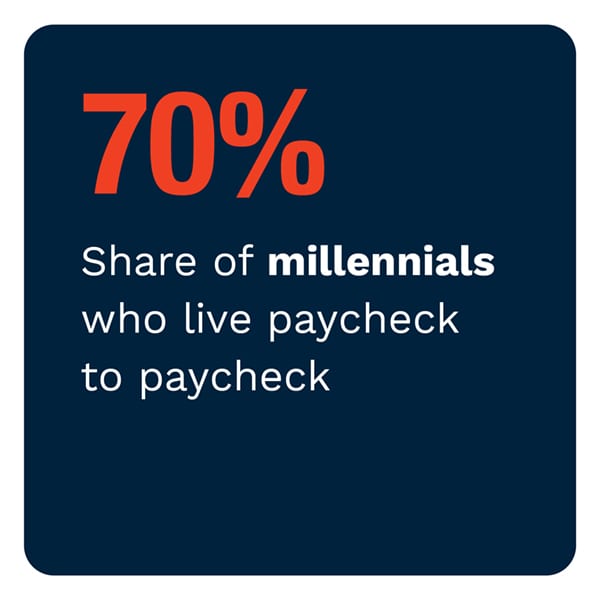

One of the main themes to emerge from our research is that living paycheck to paycheck reflects consumers’ economic needs and wants as much as it does their incomes or levels of wealth. This may help explain why millennials make up such a large share of those living paycheck to paycheck. They are more likely than other generational groups to be starting families or purchasing first homes and new vehicles. Our research shows that 70 percent of millennials are living paycheck to paycheck, including 33 percent who struggle to pay their bills.

One of the main themes to emerge from our research is that living paycheck to paycheck reflects consumers’ economic needs and wants as much as it does their incomes or levels of wealth. This may help explain why millennials make up such a large share of those living paycheck to paycheck. They are more likely than other generational groups to be starting families or purchasing first homes and new vehicles. Our research shows that 70 percent of millennials are living paycheck to paycheck, including 33 percent who struggle to pay their bills.

These are just a sampling of the findings from our research. To get the full story, download the report.

About The Report

Reality Check: The Paycheck-to-Paycheck Report, a PYMNTS and LendingClub collaboration, is a research-based study that seeks to document how consumers are making ends meet in the U.S. today.