$100K+ Households Saw Biggest Increase in Paycheck-to-Paycheck Living

Living paycheck to paycheck is the most common financial lifestyle in the United States, with an increasing share of high-income consumers now doing so.

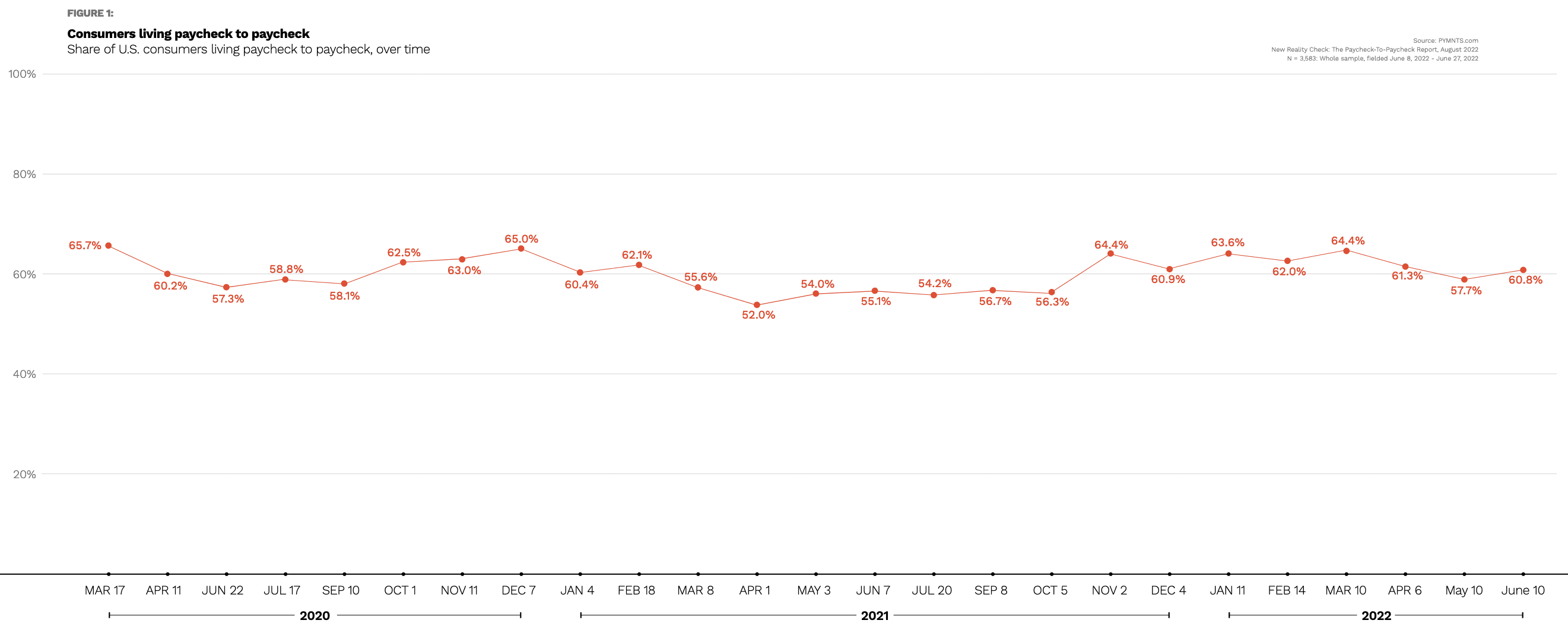

About six in 10 consumers lived paycheck to paycheck in June, according to “The New Reality Check,” a PYMNTS and LendingClub collaboration based on a survey of 3,583 U.S. consumers.

Get the report: The New Reality Check

The survey found that 61% of consumers were living paycheck to paycheck in June, up from 58% the previous month and 55% a year earlier.

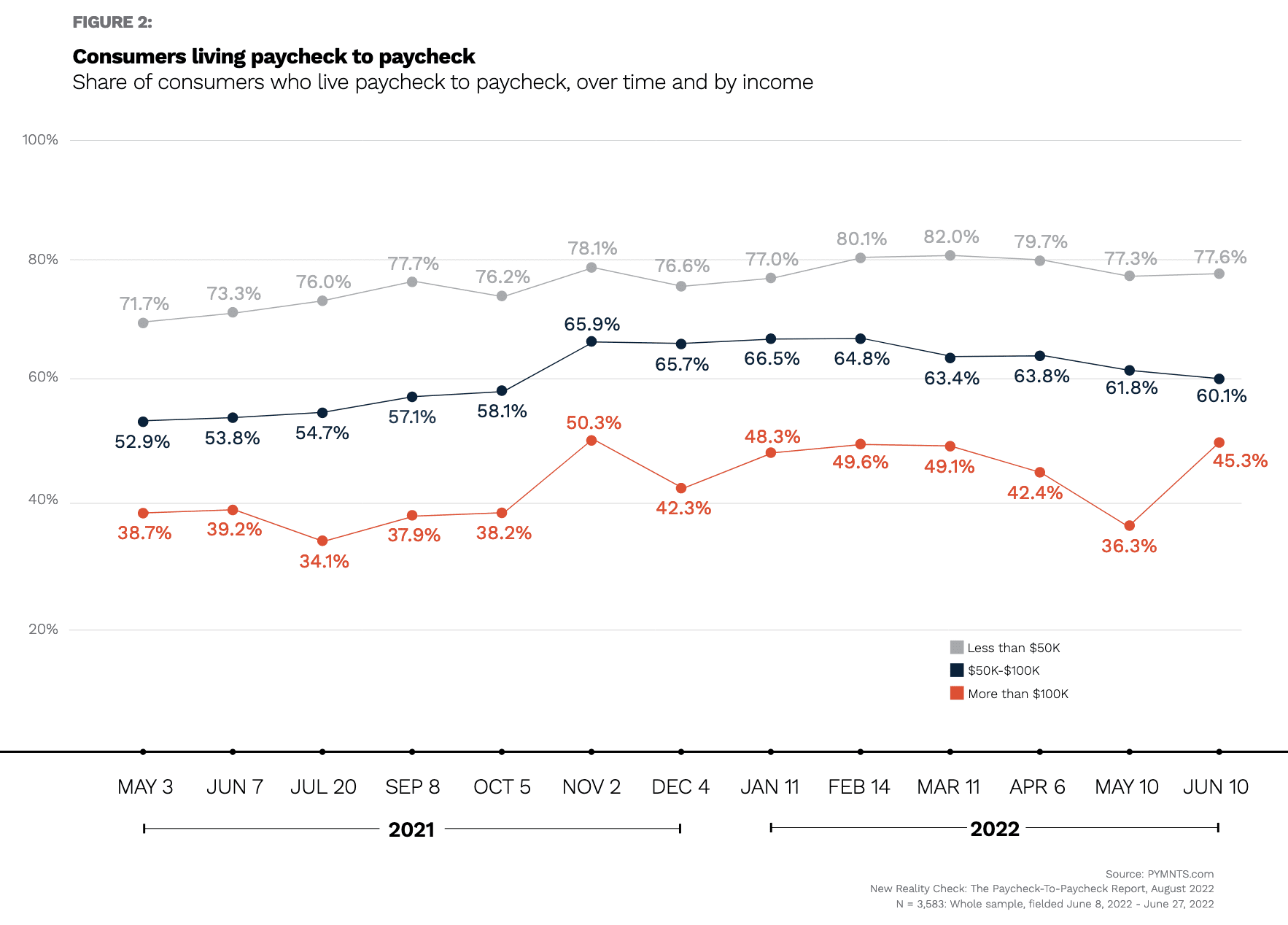

The share of high-income consumers living paycheck to paycheck increased by nine percentage points in June. The survey found that the share of consumers earning more than $100,000 a year who were living paycheck to paycheck leapt from 36% in May to 45% in June.

The share of high-income consumers living paycheck to paycheck increased by nine percentage points in June. The survey found that the share of consumers earning more than $100,000 a year who were living paycheck to paycheck leapt from 36% in May to 45% in June.

Among the other incomes groups identified in the report, the share of consumers earning less than $50,000 a year who were living paycheck to paycheck inched up from about 77% to 78%, while that of consumers earning between $50,000 and $100,000 dipped from roughly 62% to 60%.

As inflation continues its upward swing, it is impacting consumers’ financial lives, with many across the globe finding it more difficult to manage spending and put aside savings under mounting financial pressures.

As inflation continues its upward swing, it is impacting consumers’ financial lives, with many across the globe finding it more difficult to manage spending and put aside savings under mounting financial pressures.

The U.S. government’s June 2022 Consumer Price Index report found that inflation had risen 9% over the previous 12 months, with energy and food prices increasing the most.

PYMNTS data also found that among all consumers, the average savings balance dropped from May to June. Also, while paycheck-to-paycheck consumers’ average savings balance remained almost unchanged during that time, savings among consumers not living paycheck to paycheck dropped.

Such decreases may indicate that inflation has had an impact on all consumers’ ability to save.