Many Paycheck-to-Paycheck Consumers Seek Relief in New Jobs

With paycheck-to-paycheck living now the norm for U.S. households including the highest earners, many consumers are trying to improve their lot by switching jobs, but the latest research suggests this tactic is iffy at best, and unlikely to move the needle for most.

In “New Reality Check: The Paycheck-To-Paycheck Report: The Employment Edition,” a PYMNTS and LendingClub collaboration and based on a survey of nearly 4,000 consumers, we find that various attempts to keep pace with inflation via wage hikes and job changes are falling short.

We found that that 65% of employed consumers were living paycheck to paycheck in September 2022, up 5 percentage points from September 2021. This oscillating number has shown “a gradual upward slope” from a low of 57% in May 2022, per the report.

Among those of working age, consumers who live paycheck to paycheck without difficulty are the most likely to be employed. In fact, inactive workers make up a significant share of those who do not live paycheck to paycheck.

PYMNTS’ research categorizes paycheck-to-paycheck consumers into two categories: those who can pay their monthly bills without difficulty, and those who struggle to meet expenses.

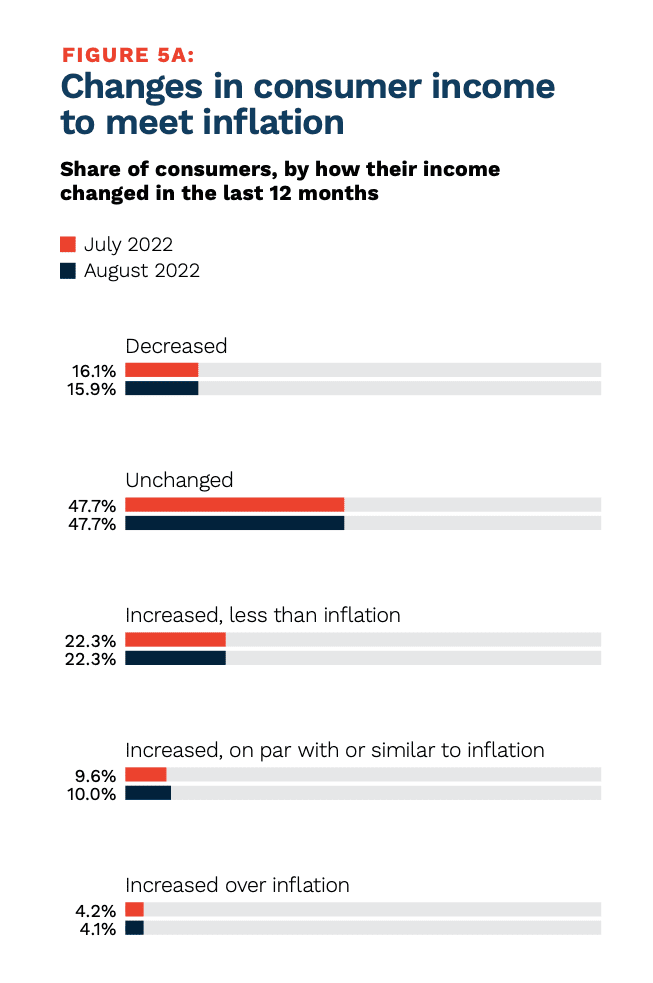

While unemployment remains low and wages increased nearly 5% (4.9%) in the 12 months prior, inflation ballooned by over 8.2% in the same timeframe, more than negating wage gains.

Per the study, “48% of workers state their incomes have remained unchanged over the course of the last year, and just 14% say their earnings grew to match or exceed inflation in that same period. Women are less likely to say their earnings grew on par or above inflation than men, at 11% versus 18%, respectively.”

Some Pin Hopes on Job Change

Squeezed by wage sluggishness and 40-year high inflation, some consumers are trying to trade up jobs and earnings to outmaneuver these economics. It doesn’t appear to be working.

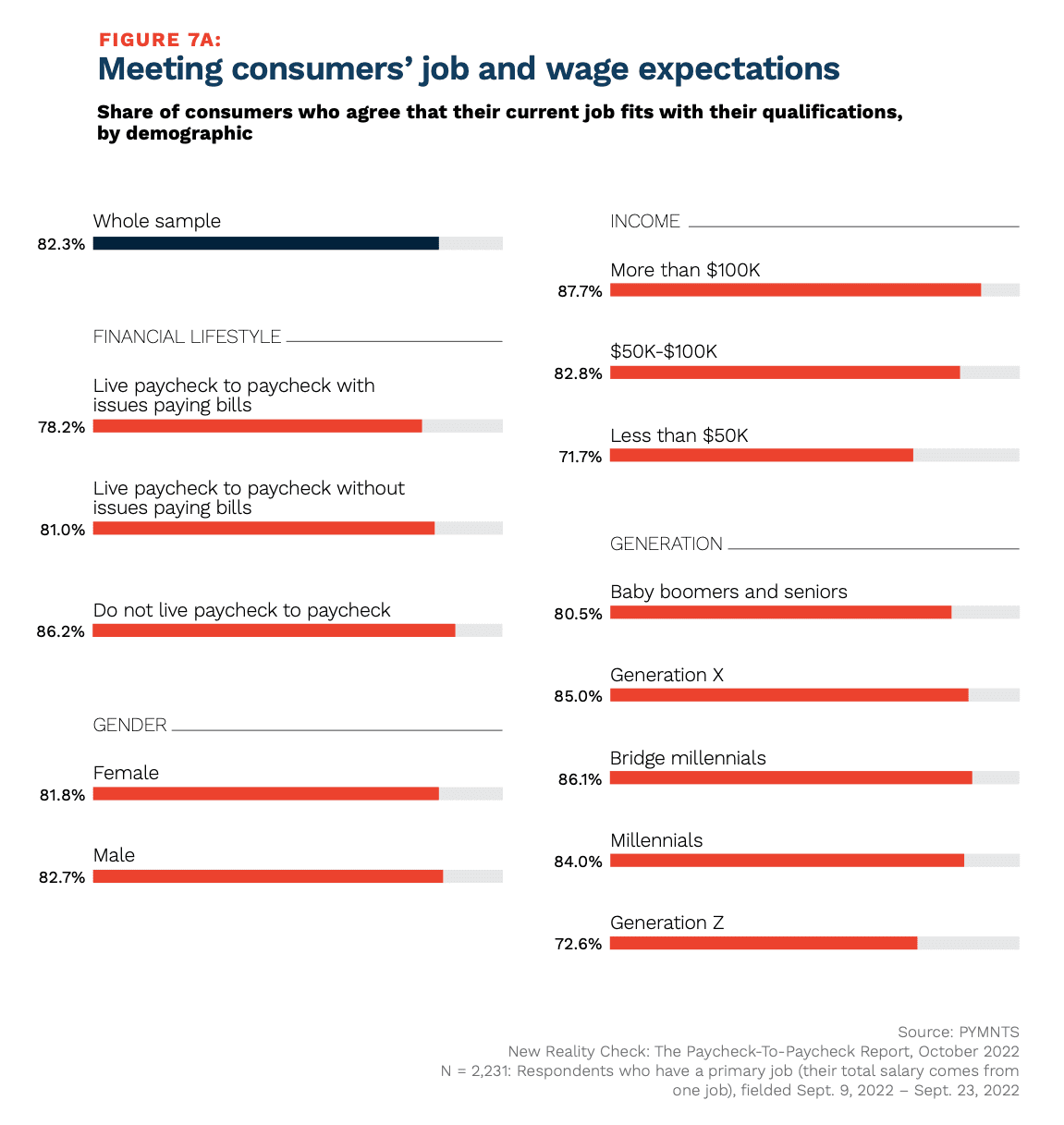

According to the new PYMNTS data, “only 38% of consumers are satisfied with their current salaries, with those living paycheck to paycheck with issues paying their bills the least likely to agree that their current jobs meet their wage demands, at 16%.”

High-income consumers are also likely to be dissatisfied with salaries, with less than half (47%) of those earning over $100,000 annually saying they’re contented with current pay, compared to 37% earning between $50,000 and $100,000 annually, and 25% earning under $50,000.

The clincher here is the pessimism exhibited by most respondents on the prospect of finding new jobs with better pay that can lift them out of paycheck-to-paycheck ranks.

“Optimism about finding a new job that fits both wage demands, and an employee’s qualifications is generally low, regardless of demographic: Only 34% of consumers find it very or extremely likely they will find such a job in the next three months,” the study states.

Still, it’s those on the lower end of the earnings scale who are most likely to say they’ll switch jobs, or try to, in the next three months.

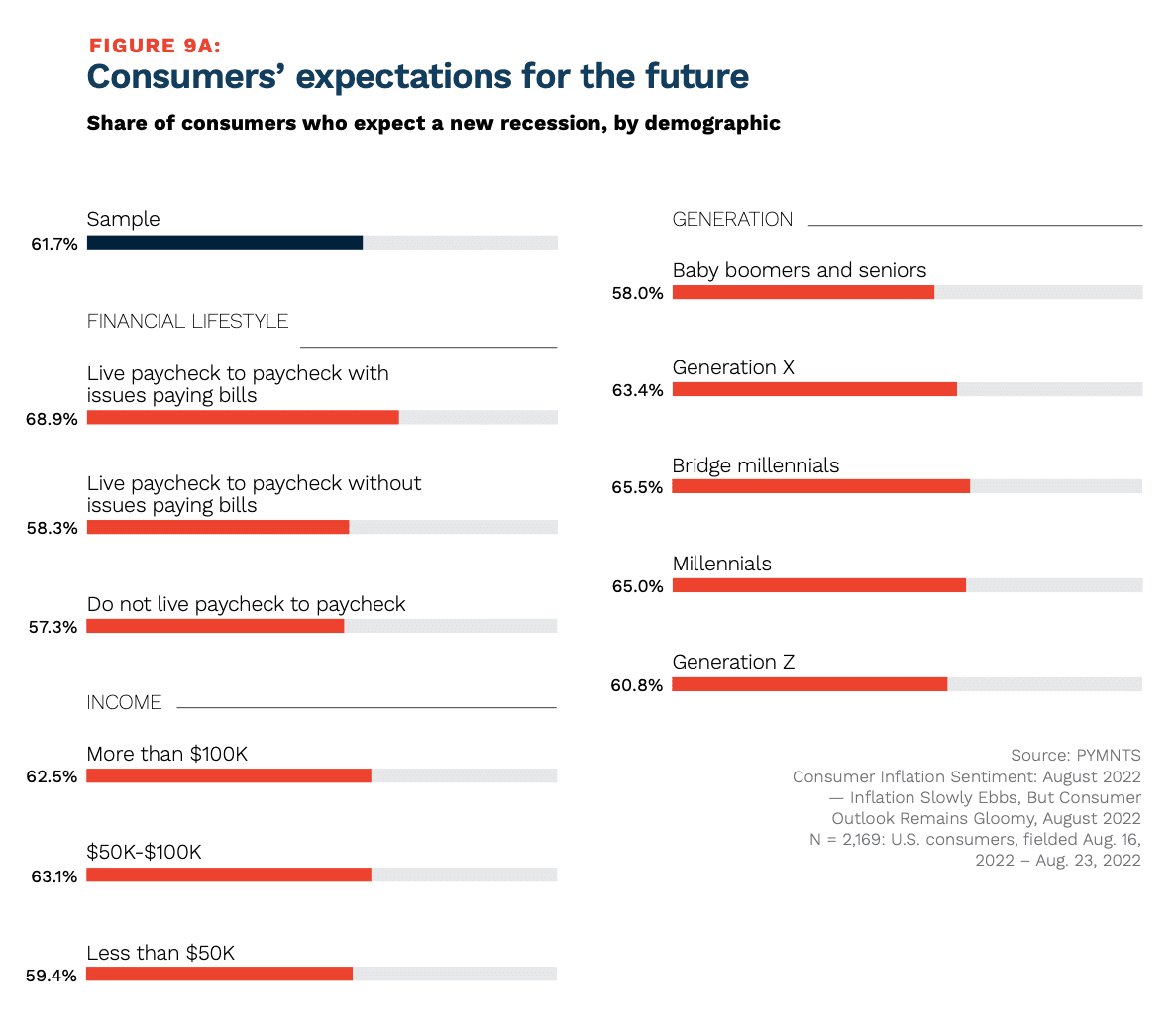

Add to this recession fears seen in the latest sounding, and it paints a portrait of high and low earners feeling that things will get worse before they get better. We found that nearly half (48%) of all consumers believe the economy is already in a recession, and 69% of consumers who live paycheck to paycheck with issues paying their bills concur.

Consumers in more stable positions are more optimistic: 58% and 57%, respectively, of consumers who live paycheck to paycheck without difficulty and consumers who do not live paycheck to paycheck think the U.S. is heading into a recession currently.