Decreased Consumer Savings Mean Holiday Spending Cutbacks

Despite positive Black Friday numbers, where consumers stretched their budgets to do some shopping, data suggests that the rest of the holiday shopping season may be more moderate. The loss of purchasing power resulting from the persistent inflation of recent years, as well as the current economic uncertainty, might finally lead households to contain holiday spending. Voices warning of spending restraint in the coming months are sounding from multiple fronts, from market analysts to brands and merchants themselves. Recent PYMNTS Intelligence research anticipates a contraction of consumer spending in non-gift categories during this holiday season, simultaneous to an anticipated uptick in gift expenditures by 2.2%.

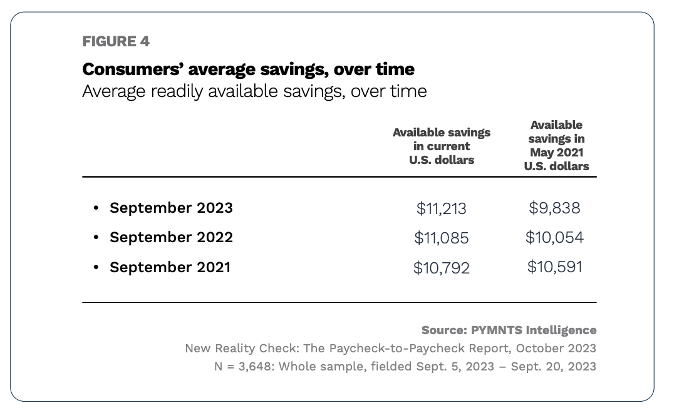

To compensate for the erosion of purchasing power in last years, many U.S. households have been forced to dip into their savings. According to “New Reality Check: The Paycheck-to-Paycheck Report – The Saving Deep Dive Edition,” a PYMNTS Intelligence study in collaboration with LendingClub, on average and considering the effect of inflation, U.S. consumers have seen their savings decreased by 2.1% over last year, and accumulated a 7.1% drop since 2021.

The increase in gift expenditure points to a consumers’ conscious effort to maintain the basic customs of the holiday season, a priority despite economic strains and pervasive uncertainty. To maintain this level of expenditure, consumers are cutting back on almost all non-gift categories. According to the PYMNTS Intelligence study “How Consumers Are Approaching Holiday Spending and Travel,” consumers plan to spend 26% less this holiday overall. Looking at the numbers by spending category more in detail, 79% of respondents intend to cut back on restaurants, 67% on live entertainment and 61% on leisure and travel expenses, to name a few examples.

Although not at the same level, the contraction in savings and its impact on spending seems to be occurring across all demographic groups. Not even high-earning individuals are immune to spending shocks, as their savings have dropped 7% in real terms since 2021, as per PYMNTS Intelligence data. As spending restraint in the upcoming holiday shopping season seems to be widespread, this group of consumers could potentially record the highest cutback spending in non-gift categories — around 29%, which means nearly $500 in spending on average.

This generalized downshift trend of consumer expenditure reflects a broader reconsideration of discretionary spending in the face of economic headwinds. In this sense, banks may play an important role in helping consumers in financial difficulties to build savings. At the same time merchants might strengthen retail sales by offering more payment options to help consumers to better manage their budget.