Millennials Have the Most Difficulties Making Ends Meet

Millennials were born between 1981 and 1996. They entered the workforce during the economic recession that followed the 2008 crash. They endured years of job insecurity and low wages. Then they suffered the consequences of the COVID pandemic, as one of the most vulnerable segments of the economy. On top of all that, the inflationary spiral of the last years has eroded their purchasing power. Millennials are the first generation to embrace many activities digitally, and have had better access to university and specialized education. However, they have faced a more challenging economic context than any of the previous generations.

According to PYMNTS Intelligence research done in collaboration with LendingClub, 62% of U.S. millennials live paycheck to paycheck as of September 2023, and nearly 25% struggle to pay bills regularly, a share that has remained unchanged in the last year, despite the slowdown of inflation in this period. These figures place them as the generation with the most difficulties in making ends meet. In comparison, 18% of baby boomers and seniors, who are the most financially secure generation, have difficulties paying bills.

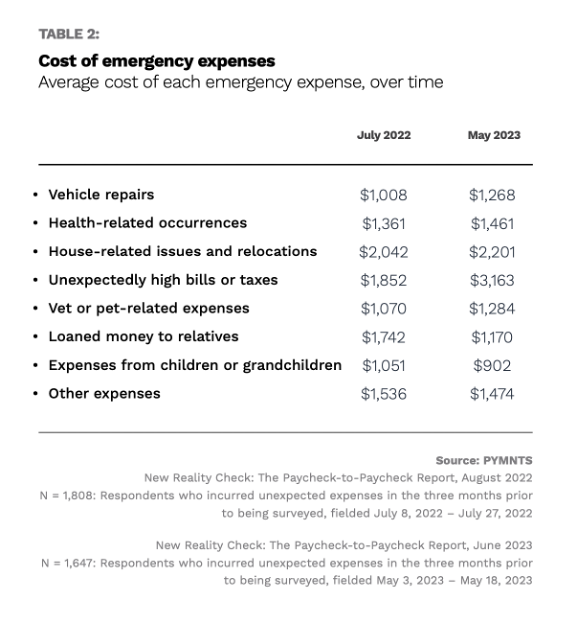

This weak economic situation makes millennials the generation most vulnerable to unexpected or emergency expenses, such as vehicle repair, taxes or other unplanned bills. So, one such unforeseen event may put them in a risky financial situation and lead them to fail bill payments. In “The Emergency Spending Deep Dive Edition” of the “New Reality Check: The Paycheck-to-Paycheck Report,” another PYMNTS Intelligence and LendingClub collaboration, data shows that 48% of U.S. individuals faced expenses of this nature in the last three months and were not able to pay bills. The numbers for the millennial generation are even more troubling: 55% of this demographic cohort could not cope with this type of unforeseen event and missed payments in the end. And this share has increased from 51% one year ago.

The most common unexpected and urgent expenses millennials face are vehicle repairs, health-related expenses and housing or relocation costs. And 10% say they live without savings, the highest share among all age groups. With this data in hand, it is no surprise that they are the ones who most often turn to credit options to cover unexpected expenses. Specifically, they do so 44% of the time, while 30% stated they had to postpone a large expense due to not being able to afford it.

As inflation returns to normal levels, wages rise, and millennials’ purchasing power recovers accordingly, we expect to see this generation suffer less from economic constraints. However, there are important challenges to overcome that have become almost structural in this generation, such as low savings capacity or difficulties in dealing with unforeseen events.