Nearly 60% of Consumers Without Paycheck Pressures Have a Side Hustle Just For Fun

Inflation has heightened the cost of living, prompting consumers, especially those living paycheck to paycheck, to look for extra ways to supplement their regular income.

In The Supplemental Income Edition of the “New Reality Check: The Paycheck-to-Paycheck Report,” PYMNTS Intelligence draws on insights from a survey of over 4,100 U.S. consumers to examine how U.S. consumers are embracing alternative income streams to complement their primary full-time employment, all in an effort to enhance their financial stability.

Findings from the study done jointly by PYMNTS and LendingClub show that nearly half of employed consumers have a side job or other source of supplemental income. Among those who live paycheck to paycheck, 35% of those who struggle to pay bills have an extra source of income, and so do 33% of those who don’t have this issue. Both of these shares are higher than the average of 29% across the board.

But it’s not just consumers struggling financially who are keen on supplementing their income with additional work. Consumers not living paycheck to paycheck often pursue side jobs and other income sources for non-financial reasons.

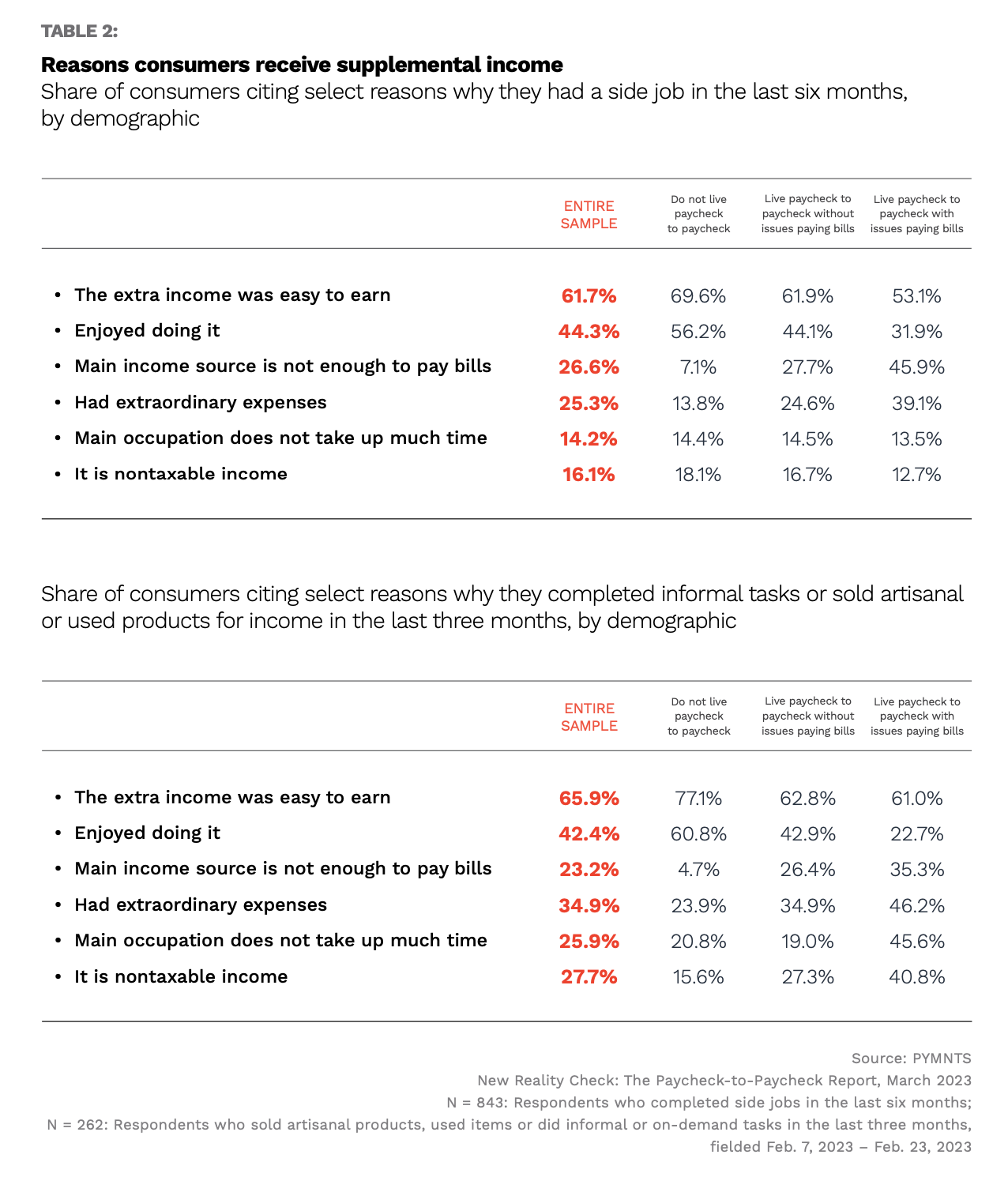

As the report noted, 70% of this group got a side job because the extra income was easy to earn, and 56% did it because they enjoyed the work. Consumers not living paycheck to paycheck also said the same about making money from informal tasks or selling handmade or used items, at 77% and 61%, respectively.

On the other hand, those living paycheck to paycheck and having trouble paying bills are far less likely to say that earning money from side jobs (53%) or informal tasks and selling handmade or used items (61%) is easy. Instead, nearly half of these struggling consumers are most likely to say they have a side job because their current income isn’t enough to pay all their bills.

Examining the data further shows that nearly 40% of paycheck-to-paycheck consumers with bill issues said they have a side job because of unexpected expenses, while 46% said the same for making money from informal tasks or selling handmade or used items.

Forty-one percent of struggling consumers also said that making money from informal tasks or selling handmade or used items is nontaxable, which is a reason they chose to do it. Less than 20% of those who don’t live paycheck to paycheck said the same.