Gen Z Consumers Save Nearly 10% of Their Monthly Income

Generation X consumers, baby boomers and seniors all allocate more than 60% of their monthly incomes to housing, supplies and other regular bills. Generation Z consumers, meanwhile, allot just 47% to those expenses.

In fact — according to PYMNTS Intelligence’s recent Paycheck-to-Paycheck Report, “Why 60 Percent of Gen Z’s Live Paycheck to Paycheck” — Gen Z consumers anticipate spending just 20% of their income on housing, a share that is well below the 30% Gen X consumers expect to spend on housing.

Why the disconnect? Our report, which draws on surveys with more than 3,400 U.S. consumers, found that Gen Z consumers — more so than the other generations surveyed — tend to live with others, such as family or friends, who help pay the bills.

If they do have any surplus income, data shows that they most likely spend it on personal items. Thirteen percent of Gen Z consumers say they expect to spend more than other age groups on everyday personal expenses.

The good news for anyone concerned about the spending habits of Gen Z consumers is that Gen Z consumers are also saving a slightly larger portion of their income, 9.8%, than other age groups.

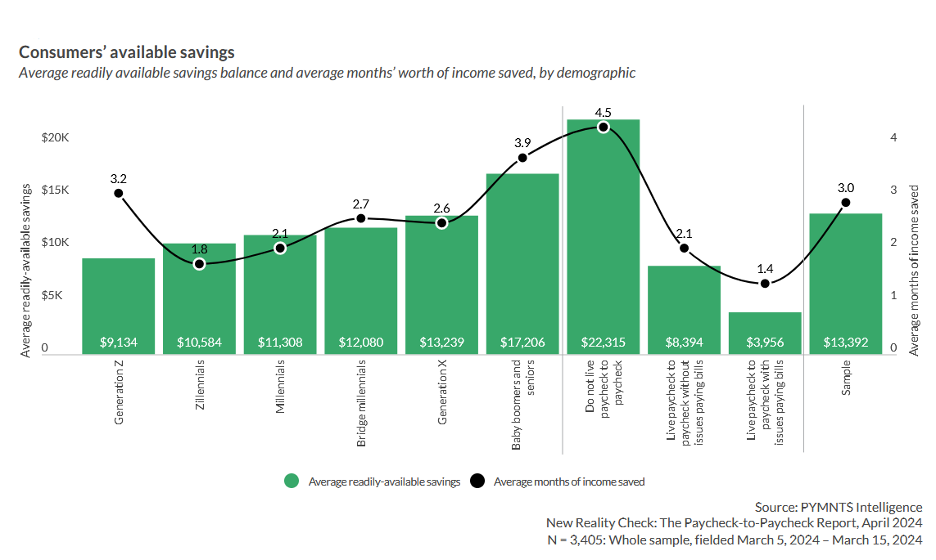

Yet, despite this diligence, the average amount Gen Z consumers have set aside roughly $9,100 in savings, which is lower than all other age groups. (It’s only slightly over half of what baby boomers and seniors have socked away.)

To break it down another way, Gen Z consumers have, on average, 3.2 months’ worth of income available in savings. Millennials, meanwhile, have just 2.1 months’ worth. As already mentioned, Gen Z consumers may be able to save more than their older counterparts because their other expenses like housing costs are lower, but Gen Z consumers are also 10% less likely to face emergency expenses than the average consumer. While 55% of millennials and bridge millennials navigated unexpected costs over a 90-day period, just 42% of Gen Z consumers had to do so.

This may be creating a false sense of security. The combination of being able to save more while dealing with less unexpected costs may paint a prettier picture than reality can support. Most Gen Z consumers have yet to land well-paying jobs or established careers, so they earn less, and six in 10 live paycheck to paycheck. Should their safety net of shared rent be taken away, their resulting lack of spending power could leave them particularly vulnerable.

At the risk of sounding parental, given their smaller shares of essential expenditures, Gen Z consumers would be wise to rebalance the scales by slashing their discretionary habits and instead capitalize on their clear instincts to put money away.