Nearly Half of US Consumers Earning $100K+ Live Paycheck to Paycheck

According to PYMNTS Intelligence, 62% of U.S. consumers now live paycheck to paycheck, and that includes 48% of consumers earning more than $100,000 annually.

In other words, higher incomes do not necessarily protect people from the financial stress that comes from living from one paycheck to the next. In fact, according to a recent edition of PYMNTS Intelligence’s “New Reality Check: The Paycheck-to-Paycheck Report: Why One-Third of High Earners Live Paycheck to Paycheck,” 36% of those earning more than $200,000 annually also say they live paycheck to paycheck.

The report, based on surveys with 4,285 U.S. consumers, also found that roughly three-quarters of low-income consumers (those earning less than $50,000 per year), and approximately two-thirds of middle-income consumers (those earning between $50,000 and $100,000 per year) report living paycheck to paycheck.

For those making more than $200,000 each year, our data shows that recreation, personal care and everyday transactions account for about 28% of their budgets. We also found that high-income consumers are more likely to say that education costs and expenditures for nonessential assets significantly affect their financial situation. Put another way, high-income consumers spend more on discretionary items, which makes saving money more difficult.

Which expenses absorb the lion’s share of high-earning, paycheck-to-paycheck budgets?

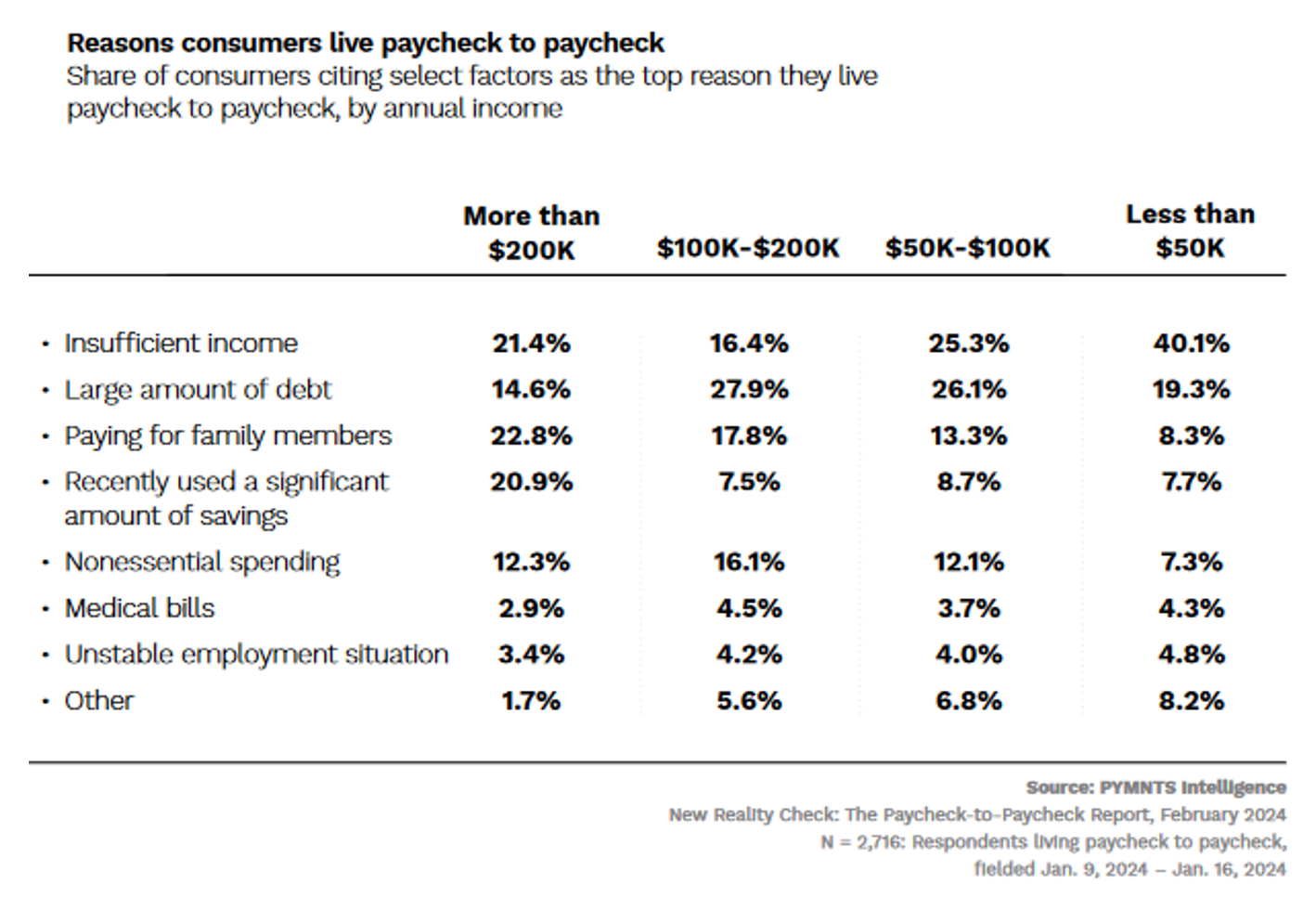

Twenty-one percent of high earners say they simply don’t earn enough to keep pace with their expenses, which include covering costs associated with family members (23%), carrying large amounts of debt (15%), and spending on nonessential items (12%).

Compare these findings to those earning less than $50K annually, 40% of whom say they earn insufficient incomes. Only 8% of them help cover family member expenses. Nineteen percent carry heavy debt, which might account for the fact that only 7% say nonessential spending contributes to their financial woes.

The most obvious difference in how high-income earners allocate their funds versus lower-income consumers is the amount allocated toward nonessential spending. Those earning $100,000 per year are around twice as likely to report nonessential spending as a major factor in why they live paycheck to paycheck than low-income earners.

PYMNTS Intelligence research also found that high-income consumers are among the first to increase their discretionary spending when inflationary pressures begin to subside. With the cost of housing and groceries rising right now, it might be a good time for those paycheck-to-paycheck consumers who earn north of $100,000 to curb nonessential purchases from their budgets.