40% of First-Time Diners Try Independent Full-Service Restaurants

When trying out new eateries, consumers flock to independent full-service restaurants (FSRs).

For the November edition of PYMNTS’ Restaurant Digital Divide study, “The 2022 Restaurant Digital Divide: Turning First-Time Diners Into Loyal Customers,” we surveyed 2,256 United States consumers in October about their habits around trying out new restaurants. What we found is that consumers are looking for local spots where they can sit down and be waited on.

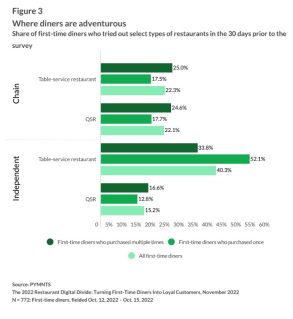

Of the 34% of respondents who had tried out a new restaurant in the 30 days prior to being surveyed, the most common type was independent FSRs, with 40% reported having tried a new one in that period. Yet, not all independent restaurants are so popular when it comes to first-time dining. Only 15% of those diners tried out a new independent quick-service restaurant (QSR) in that time, making these spots the least popular for curious customers.

In contrast, chain restaurants of all kinds are similarly in demand for first-time customers. Twenty-two percent of those who had tried out a new restaurant in the previous 30 days did so at a chain FSR, and effectively the same-sized share — also 22% — did so at a chain QSR.

Those who are more hesitant to go outside their culinary comfort zone are especially likely to opt for independent FSRs. The study found that 52% of diners who ate at only one restaurant for the first time the prior 30 days chose an independently owned restaurant with table service, making these the most popular choice for the majority of those cautiously curious diners.

In fact, adventurous diners are less likely to try out independent FSRs — only 34% did so.

“Restaurant patrons who dine out regularly at a variety of new locales also prefer independent eateries, but by a smaller margin, the study notes. “Thirty-four percent of consumers who try new places several times each month went to independent restaurants with table service.”

Meanwhile, adventurous diners over-index on all other kinds of restaurants. Of those who purchased from multiple new eateries in those 30 days, 25% did so at a chain QSR, 25% at a chain FSR and 17% at an independent QSR.