27% of Consumers Skip Restaurant Purchases Altogether

As restaurants look to drive traffic amid menu price inflation, more than 1 in 4 consumers are not making restaurant purchases at all, PYMNTS Intelligence revealed.

By the Numbers

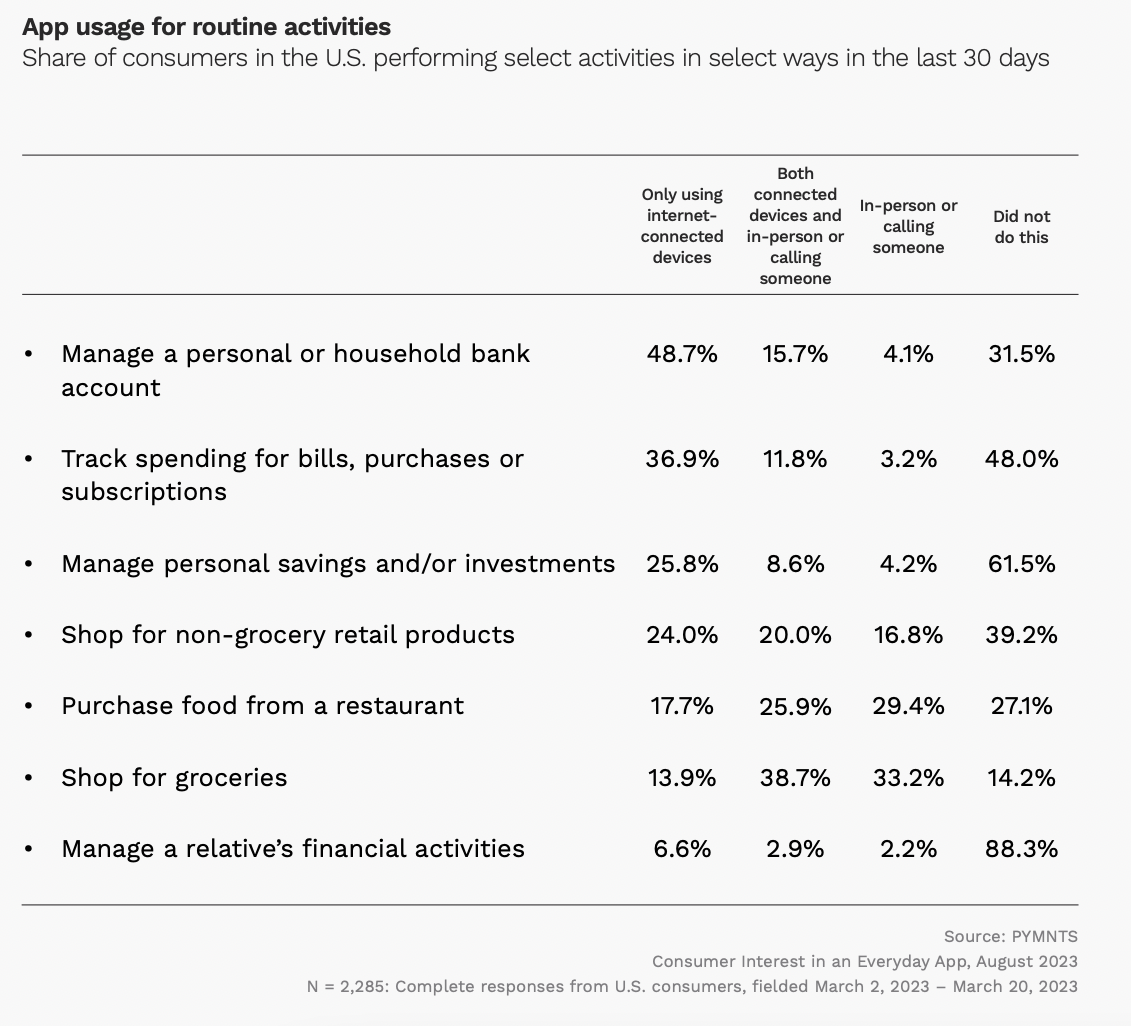

PYMNTS’ study “Consumer Interest in an Everyday App,” created in collaboration with PayPal, drew from a March survey of more than 3,300 consumers in the United States and Australia. It found that 27% of consumers in the U.S. had not made a restaurant purchase at all in the previous 30 days.

This abstention comes as restaurant inflation persists, with Consumer Price Index (CPI) data from the U.S. Bureau of Labor Statistics (BLS) revealing that menu prices have crept up every month this year so far, amounting to a 6.5% increase year over year in August.

The Data in Action

Restaurants are indeed seeing consumers hold off.

Casual dining giant Darden Restaurants, for instance, saw a roughly 7% decrease in traffic year over year in the first quarter of fiscal year 2024 at its The Capital Grille and Eddie V’s brands, according to a presentation shared with investors Thursday (Sept. 21).

As many restaurant chains step up their discounting efforts to reengage consumers and drive traffic, Darden is taking a different tack.

“We believe that the best [thing for the] long-term health of our business is to keep our strategy overall of pricing below inflation, running [a] better restaurant and not getting into huge deep discounting to buy guests,” President and CEO Rick Cardenas explained.

Meanwhile, food giant General Mills predicted that with restaurant inflation exacerbating the gap between dining out and eating at home, more consumers will get their food at the grocery store this fall.

“[P]eople aren’t eating less, and we don’t anticipate that they will eat less,” CEO Jeff Harmening said during the company’s earnings call Wednesday (Sept. 20). “… And now the cost of eating out is roughly four times what it is eating at home. And so, as consumers get more squeezed, and as people get in their normal routines in the fall, we would think that at-home eating will probably pick up a little bit.”