Consumers Prioritize Mobile Phone Bills Over Credit Cards When Financial Pressures Mount

For those with issues making ends meet, deciding what gets paid can have long-term consequences.

Inflation’s gradual ebb could signal the start of a potential reprieve from the current economic landscape and bring a collective sigh of relief from policymakers and business leaders alike, but the increased cost of essentials such as food and shelter remain stubbornly high — 7.7% and 8.1%, respectively — and it may be some time before price decreases benefit their wallets.

The resulting reduced financial stability may lead some consumers, especially those currently living paycheck-to-paycheck, to become unable to pay all their monthly bills, especially when surprise charges arise. As noted in the PYMNTS collaboration with Mastercard, “The One-Stop Bill Pay Playbook,” in those situations, consumers are faced with difficult choices, and the biller’s sector matters.

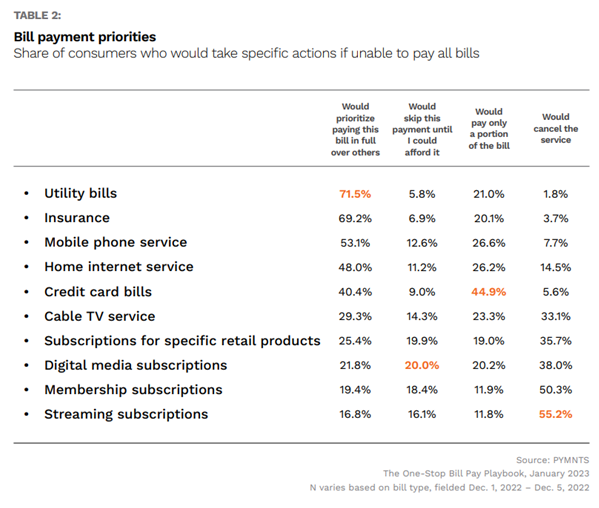

Bills considered essentials (like utilities and insurance) are what consumers ensure they pay in full when they are unable to cover all their monthly expenses. However, after that, the choices become murkier the less essential the products or services being paid for become. A smaller share of consumers would prioritize paying off mobile phone and home internet services in full the same manner as utilities or insurance, although over one-quarter in both categories would partially pay what is owed.

This pattern is perhaps worrying, however, when it comes to paying credit card bills. While 40% of surveyed consumers would prioritize paying charges off in full, a greater share — 45% —would only pay a portion of the monthly bill. The problem for consumers in this position is that partially paid credit card bills incur interest on their revolving balances, and rates are high. Credit card interest rates are already surpassing predictions that they would reach 20.5% by the end of the year, and no reprieve is in sight. For consumers already struggling to make ends meet, these high rates could force them to pay less on their card balances and generate more interest.

One missed payment, an option 9% of consumers would take if necessary, almost certainly would lead to late charges and a lower credit score, causing a ripple effect in which future loans, including credit card offerings, carry higher interest terms. Only 5.6% would cancel their credit cards, whereas auxiliary services like streaming services or memberships would get the ax by 55% and 50%, respectively.

Deciding which bills get paid and which to forego or partially remit when under financial pressure is a choice many are unfortunately faced with every day, with potentially serious ramifications. For those consumers, the cost of goods and services driven up by inflation can’t return to normal fast enough.