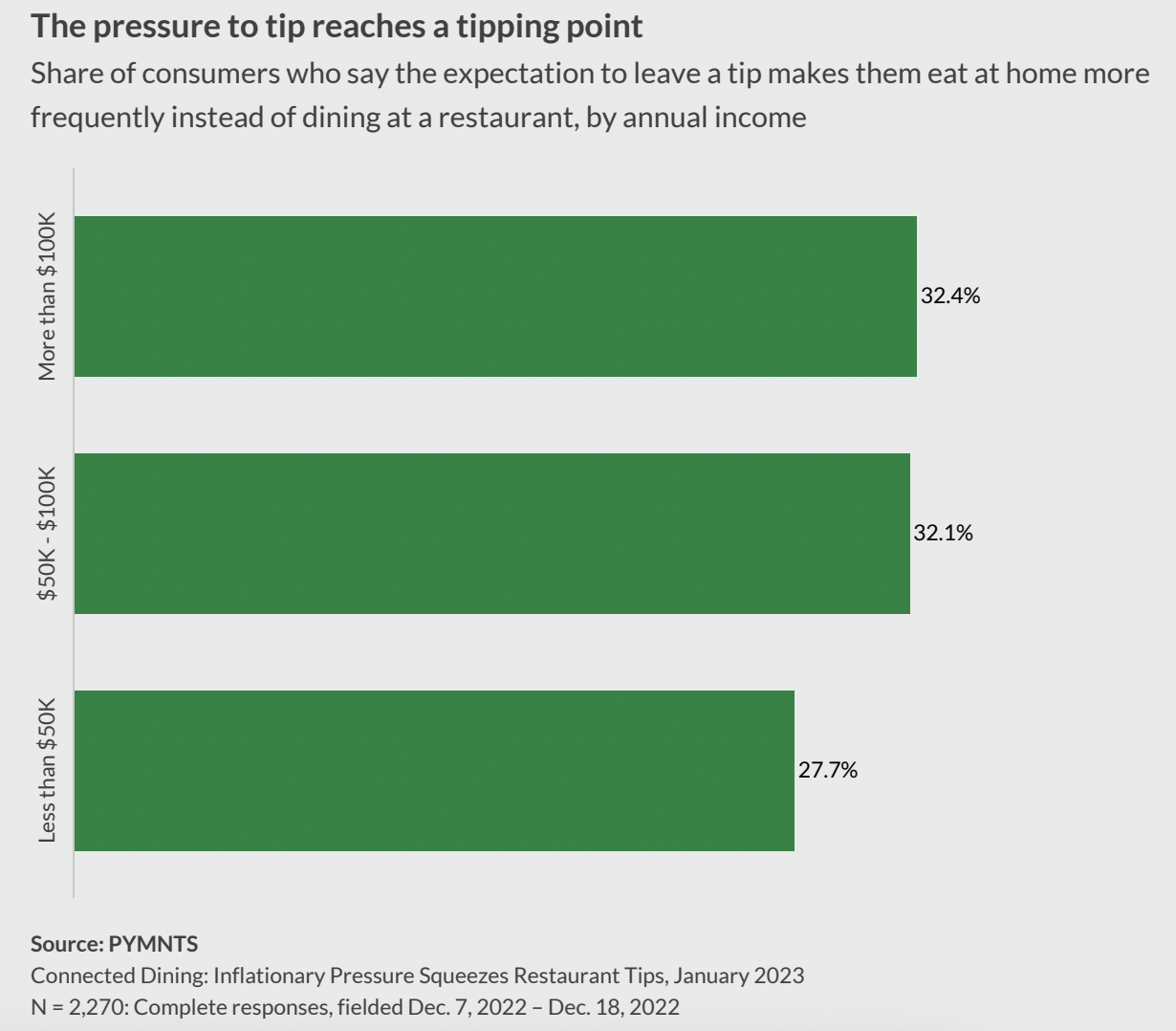

High-Income Restaurant Customers Chafe at Tipping Expectations

As consumers look to manage their food spending amid inflation, big earners are, ironically, the most likely of all to skip restaurants.

By the Numbers

For PYMNTS’ study “Connected Dining: Inflationary Pressure Squeezes Restaurant Tips,” we surveyed more than 2,200 U.S. consumers about how their tipping practices have evolved.

The results revealed that consumers who earn more than $100,000 a year are more likely than those in any other income bracket to say that the expectation to leave a tip makes them eat at home more frequently instead of dining at restaurants. Specifically, 32.4% of high-income consumers agreed to this statement, above the 32.1% of those who earn $50,000 to $100,000 a year and 27.7% of those who earn less than $50,000 that said the same.

The Data in Context

Tipping has become the norm at more and more kinds of food service venues, as Kickfin co-CEO Brian Hassan told PYMNTS in an interview for the March edition of the Money Mobility Tracker®, “Inflation Makes Technology Table Stakes for Restaurants,” created in collaboration with Ingo Money.

“The total addressable market of digital tipping … has grown in multiples,” Hassan said. “What used to be only in full service is now in full service, quick service, airports, stadiums, personal services and the list goes on. It touches our lives every day and almost every transaction we might encounter outside of retail.”

Plus, more kinds of restaurant workers are getting tipped, as Jordan Boesch, founder and CEO of restaurant team management platform 7shifts, told PYMNTS in October.

“Certainly, more consumers are tipping, but I would also say that we’re also seeing more restaurant brands looking at tipping more equitably across the organization,” Boesch said at the time. “Some of the great brands are looking at how they can make these processes more equitable to all of their staff, not just specific departments, and maybe not just specific seniority levels.”