One-Third of Consumers Don’t Plan to Cut Luxury Retail Spend

This next installment of PYMNTS’ miniseries based around consumer spending patterns focuses on the luxury retail sector.

One would think that as consumers pull back on pricier purchases such as electronics and other appliances amid bargain-seeking behavior, the luxury retail sector would be feeling the pinch. Instead, brands such as Hermes are reporting record earnings, with the French fashion house’s sales up 26% in Q4 2022 and 29% over the year. LVMH, too, reported that its revenue was up 23% in 2022, with sales up 17% in Q1 2023.

A clue as to how these brands continue to report record profits may be found the January PYMNTS collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report.”

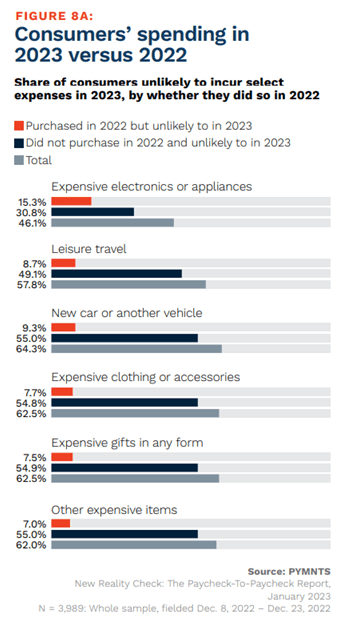

Approximately two-thirds of consumers surveyed do not plan on making a purchase falling under the expensive clothing or accessories, expensive gifts or other expensive item spend categories in 2023. That still leaves a sizable one-third of consumers who do — and these customers likely make up the luxury retail sector’s prime target market.

A record-setting 48% of U.S. adults aged 18 to 29 are still living at home, and some thus have a greater discretionary budget to spend on luxury goods, making for an unlikely driver of increased sales in the sector. As previous PYMNTS research has found, these younger generations are also most interested in payment plans such as buy now, pay later to fund luxury purchases.

Alternative payment plans are starting to be embraced by luxury brands as well, presumably to widen their market without a targeted sales drive or discount push that could cheapen the brand.

In an interview with PYMNTS, Movado Group president of commercial, chief digital officer and chief technology officer Behzad Soltani emphasized the importance of BNPL plans in the company’s overall sales strategy. “We partner both with Affirm and Klarna. Klarna is for our Olivia Burton brand in the U.K. That’s deployed there. Our MVMT brand in the U.S. also uses Klarna. Movado, because it has a higher price point, we use Affirm on that site.

“About 50% of our transactions are traditional credit cards, and then another 50% are all these alternative payment methods. It is a pretty significant part of our payments at this point.”

Fueled in part by a core customer base who continues to spend in the sector, luxury retail’s revenue seems unlikely to falter in the foreseeable future. It goes to show that some sectors really are seemingly “inflation-proof.”