Three-Quarters of City Dwellers Now Order From Restaurants Online

As digital ordering platforms look to drive adoption, engagement with restaurants’ eCommerce channels is becoming the norm in urban areas, but for the suburbs and rural areas, there is a long way to go.

By the Numbers

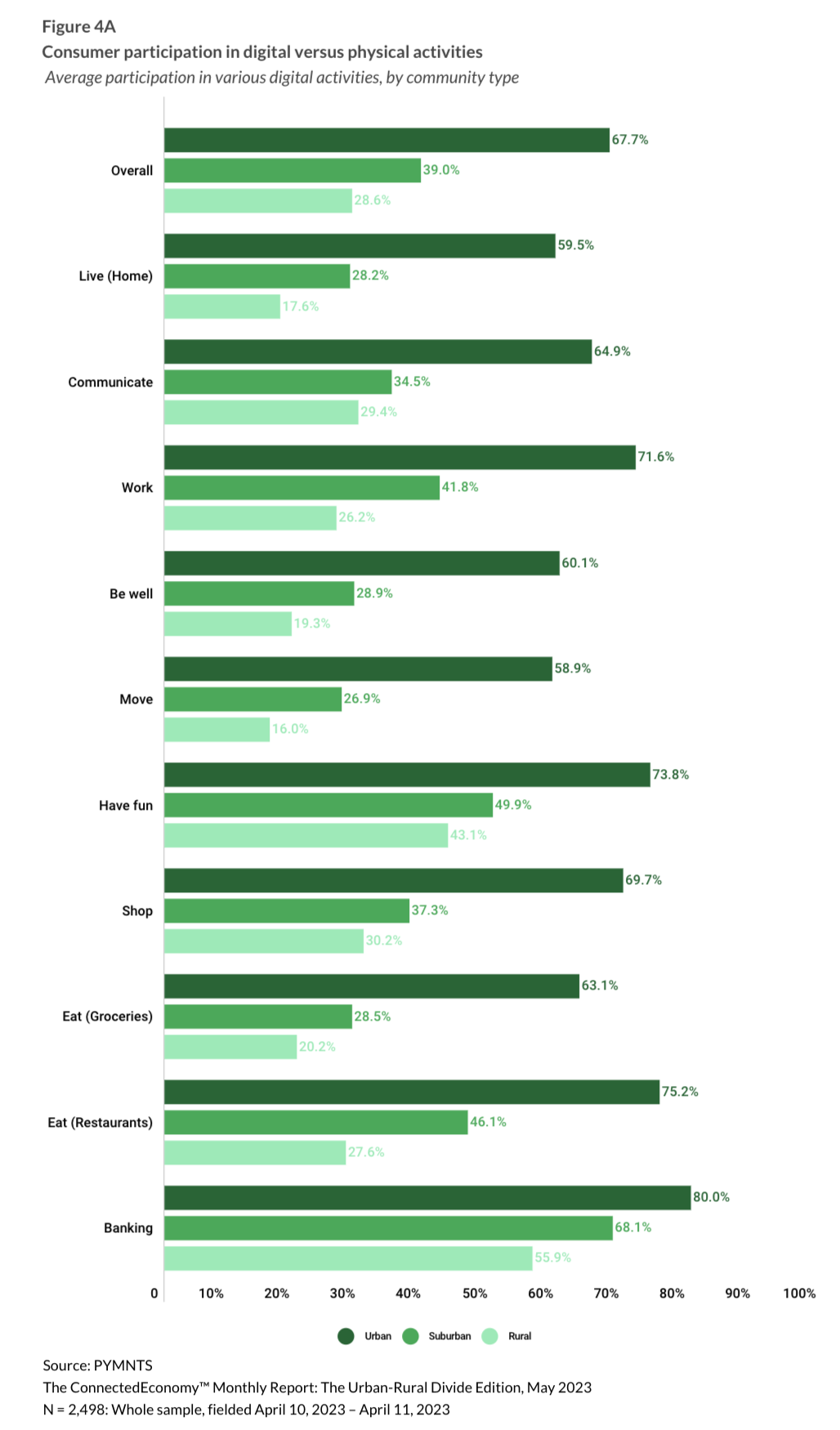

Research from PYMNTS’ study last month “ConnectedEconomy™ Monthly Report: The Urban-Rural Health Divide Edition,” which drew from a survey of nearly 2,500 U.S. consumers, revealed that 75% of urban consumers engage with restaurants digitally, a share higher than the average 68% digital participation among this group.

Conversely, digital engagement with restaurants among consumers residing in the suburbs and the country were lower — 46% and 28%, respectively.

The Data in Action

Part of this gap may come down to the delivery divide across geographies, with aggregators more willing to build out their networks in dense, urban areas where customers live short distances from one another than in sparser areas where it takes their drivers longer to fulfill the same amount of orders, increasing the labor cost.

DoorDash, for its part, has differentiated its offerings and gained share by going after this underpenetrated demographic in spite of the costs.

CEO Tony Xu discussed the company’s continued strength in these underpenetrated regions last year, after being asked whether DoorDash was facing “any pressure from competitors in nonurban markets.”

“So far, we haven’t seen an impact [from] recent competitor announcements or moves to invest in certain types of geographies versus other types of geographies in the numbers,” Xu said at the time.

Also last year, Uber discussed Uber Eats’ underperformance relative to DoorDash in suburban areas.

“Our selection in urban markets, I think, is excellent and is on par or better than our competition. … In the suburbs today, we do have certain gaps, and we’re going to work really, really hard to make up for those gaps,” Uber CEO Dara Khosrowshahi said at the time.