Gen Z Shoppers Want Things, Not Experiences

As consumers save for big purchases, Gen Z is proving to be the only generation that would rather save up for an object they will get to keep than an experience that will make a memory, PYMNTS Intelligence research finds.

By the Numbers

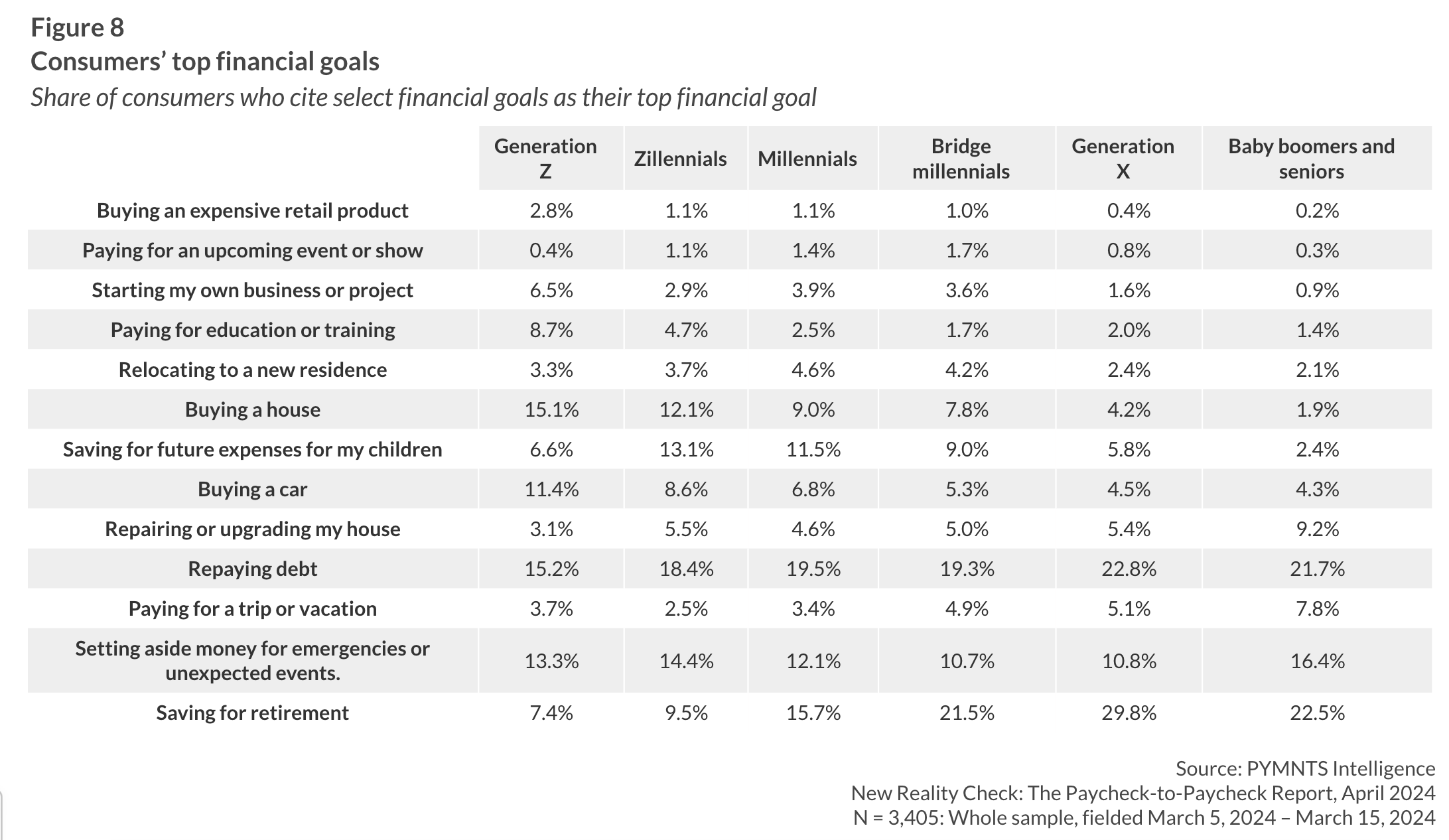

The new PYMNTS Intelligence study, “New Reality Check: The Paycheck-to-Paycheck Report – Why 60 Percent of Gen Z’s Live Paycheck to Paycheck,” draws from a survey of more than 3,500 United States consumers to examine financial habits and lifestyles across generations.

The results reveal that Generation Z is the only age group to be more likely to cite buying an expensive retail product as their top financial goal than to cite paying for an upcoming event or show. In fact, consumers in this group are seven times as likely to prioritize the former as the latter. Conversely, millennials and bridge millennials are the most likely to list paying for an event or show as their main goal.

The one notable exception to this trend is that even Gen Z is more likely to cite paying for a trip or vacation as their top financial goal than buying an expensive product.

The Data in Context

Jacqueline White, president at i2c, discussed Gen Z’s impact on the digital payments landscape in an interview with PYMNTS last year, emphasizing their status as “the first generation of digital natives” with a clear preference for “digital payment methods over traditional ones.”

“By 2030, barely five years from now, Gen Z will represent a third of the workforce. Their disposable income is projected to increase by sevenfold and their spending by sixfold as their incomes rise and they begin to benefit from the $90 trillion transfer of wealth headed their way from parents and grandparents,” PYMNTS’ Karen Webster observed in a recent feature. “For that reason, Gen Z is the generation that all businesses are courting — they are their future workers, customers, business partners and investors.”