Black Friday’s Generational Divide: Millennials Spend More Online, Embrace Deferred Payments

PYMNTS Intelligence illuminated the generational divides that marked Black Friday’s shopping, as younger consumers differed from their elders in terms of how they shopped, where they shopped, and how they paid for it all.

Among the notable findings: Millennials were among the consumers most keen to use online channels, to spend more than other cohorts and — in a read-across on the use of credit and installments — embrace the concept and practice of paying over time.

Overall, as the latest PYMNTS report on Black Friday 2023 showed, consumers spent an average of $533, but those using “pay later” options spent $598 — indicating that the option of staggering payments over time, and with buy now, pay later (BNPL) in the mix, gives more firepower to keep consumers spending.

Wait and See for Gen Z?

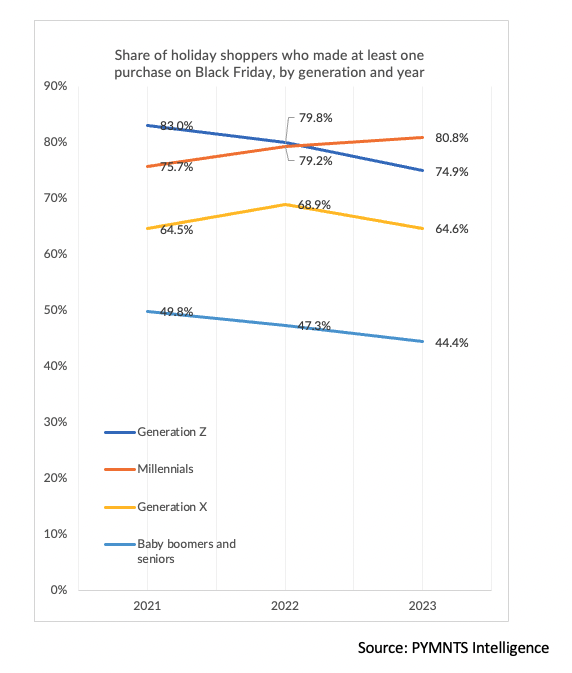

There’s at least some spending power being kept in reserve by younger consumers. The latest report detailed that Generation Z participation in Black Friday slipped several percentage points to 75% this year, down from 83% three years ago. And since roughly half of them said the deals were not as appealing as they were in previous years, the lower participation rate seemed to imply that they are holding off in favor of waiting till they see what they want for the price levels they want — or they might stagger their purchases right down to the wire.

Millennials are the lone demographic of consumers to ramp up their participation rate — to about 81%, up from nearly 76% in 2020.

Overall, 43% of consumers said they made Black Friday purchases online, up from 41.7% in 2021. Conversely, the data showed that in-store shopping declined a bit, from 33.7% in 2021 to a more recent 25.6%.

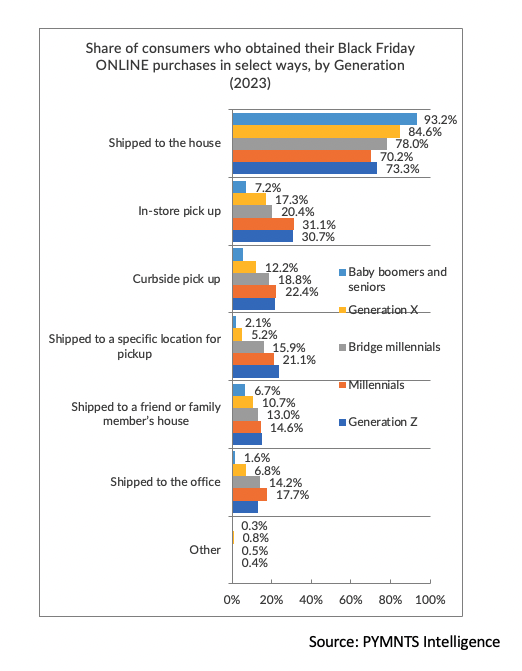

When it came to deciding how to get their online purchases into their hands, all generations opted for delivery to the doorstep. But roughly a third of millennials and Gen Z also looked to get their goods through an in-store pickup option. Omnichannel has its appeal, but convenience is the overarching theme, as visiting brick-and-mortar locales is less about staying in the aisles than it is about walking in, getting what’s paid for and walking out.

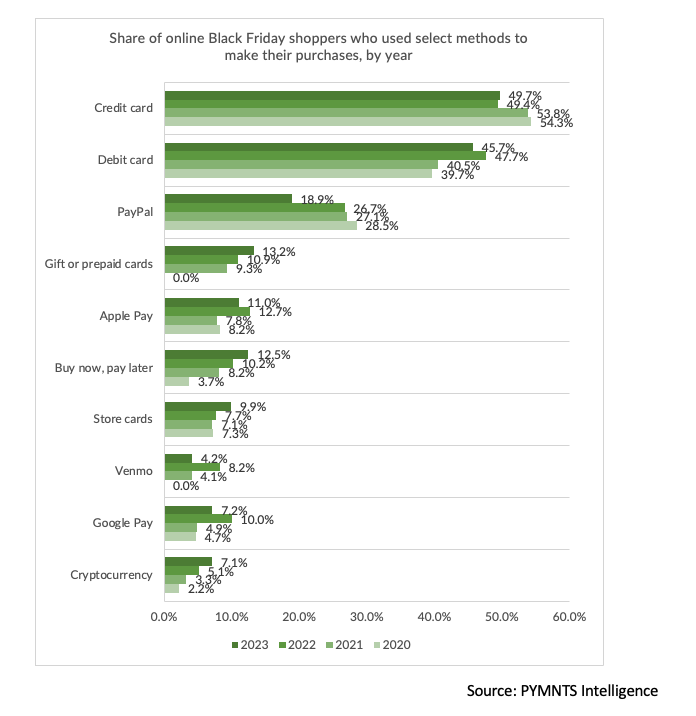

As for paying for it all, at least online, PYMNTS Intelligence data indicated that a two-pronged strategy is in place. Credit cards are still in favor, although they are declining a bit. A few years ago, credit cards were used for most purchases at more than 54% of transactions. Most recently, they accounted for just under half.

At the same time, the use of BNPL rose by several multiples, from a little less than 4% to a more recent 12.5% in 2023. Staggering payments over time has had its allure, especially among younger individuals. In addition, the use of debit tends to be a budgeting tool, as it demands that consumers keep their spending to the available cash on hand.

Black Friday is over; Cyber Monday is here. Millennials may help determine how far and wide the holiday cheer spreads to merchants.