NEW DATA: 60 Percent Of US Consumers Now Live Paycheck-To-Paycheck

The COVID-19 pandemic has triggered an unprecedented wave of business closures, placing millions out of work with no telling when they will be back to business as usual.

The COVID-19 pandemic has triggered an unprecedented wave of business closures, placing millions out of work with no telling when they will be back to business as usual.

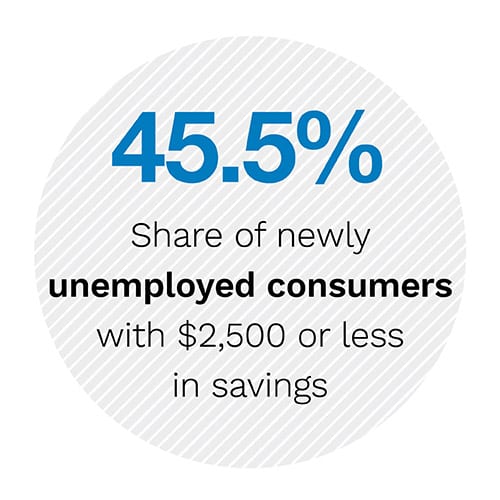

It has also exposed and exacerbated a deeper, more structural problem with the United States economy that has been looming just beneath the surface for some time: A large portion of Americans are living hand-to-mouth and have almost no savings. PYMNTS latest research shows that about six out of 10 U.S.  consumers now report living paycheck-to-paycheck, and almost half have less than $2,500 in savings. Now that the pandemic has stopped their steady cash flows, they are being faced with difficult choices.

consumers now report living paycheck-to-paycheck, and almost half have less than $2,500 in savings. Now that the pandemic has stopped their steady cash flows, they are being faced with difficult choices.

How are consumers — especially those who live paycheck-to-paycheck — coping with the sudden and indefinite loss of reliable incomes?

In the latest Navigating The COVID-19 Pandemic: How The Paycheck-To-Paycheck Economy Is Beginning To Buckle edition, PYMNTS surveys 2,118 consumers to learn more about how the COVID-19 pandemic has disrupted their personal finances, and how millions of individuals in crisis can lead to long-term economic damage.

Our research shows that among consumers who have lost their jobs, about 55 percent anticipate that they will need to begin pulling from their savings within two months — not even half as long as the 134 days they expect the pandemic to last.

Consumers who were living paycheck-to-paycheck before the pandemic began are the most vulnerable of all, with 55 percent saying they had access to enough cash to last them two weeks before having to dig into their savings.

With so little time before they run out of funds, many are making drastic changes in their spending habits to help cope with the nation’s new economic reality. The latest installment in our report series explores how.

With so little time before they run out of funds, many are making drastic changes in their spending habits to help cope with the nation’s new economic reality. The latest installment in our report series explores how.

To learn more about how COVID-19 is impacting both individual consumers’ finances and the economy at large, download the report.