Interest Rate Hikes Threaten Higher Income Paycheck-to-Paycheck Consumers’ Card Spending

So far into 2023, there’s been cautious optimism from payment networks on card spending.

Earnings results from Mastercard, Visa, American Express and others show that households have been willing — and able — to use credit to navigate inflationary pressures and a slew of interest rate hikes. Those hikes, of course, make all sorts of debt, especially short-term, revolving debt (that would include credit cards) more expensive.

But things look tenuous, and recent research from the Bank of International Settlements (BIS) — the authors claim it’s the first assessment of how monetary policy impacts consumer spending — signals the slowdown will continue. And high-income, relatively higher-spending consumers won’t buck the trend.

The January working paper from the Monetary and Economic Department of the BIS, measuring card data over the 2017-2021 timeframe, finds that “a positive interest rate shock — measured an as increase in the 2-year yield during policy announcements — has a significant negative impact on spending.” The lag period is about six months and involves a reduction in both the number of credit card transactions and average spending amounts. Monetary policy “operates similarly on on-line and in-person spending, as well as across gender and age groups,” the BIS paper states.

Higher Income Households Get Hit

Elsewhere, the paper reports that “we also find evidence that monetary tightening may have stronger effects on higher income households” and notes that “a positive interest rate shock” (interest rate increases) “triggers a significant contraction of credit card spending if it is associated with a contemporaneous decline in stock prices.”

As for how tenuous things might be: The statement above shows that interest rate hikes (the Fed has signaled they will continue) are already a drag on spending; a stock market rout would compound the pressure.

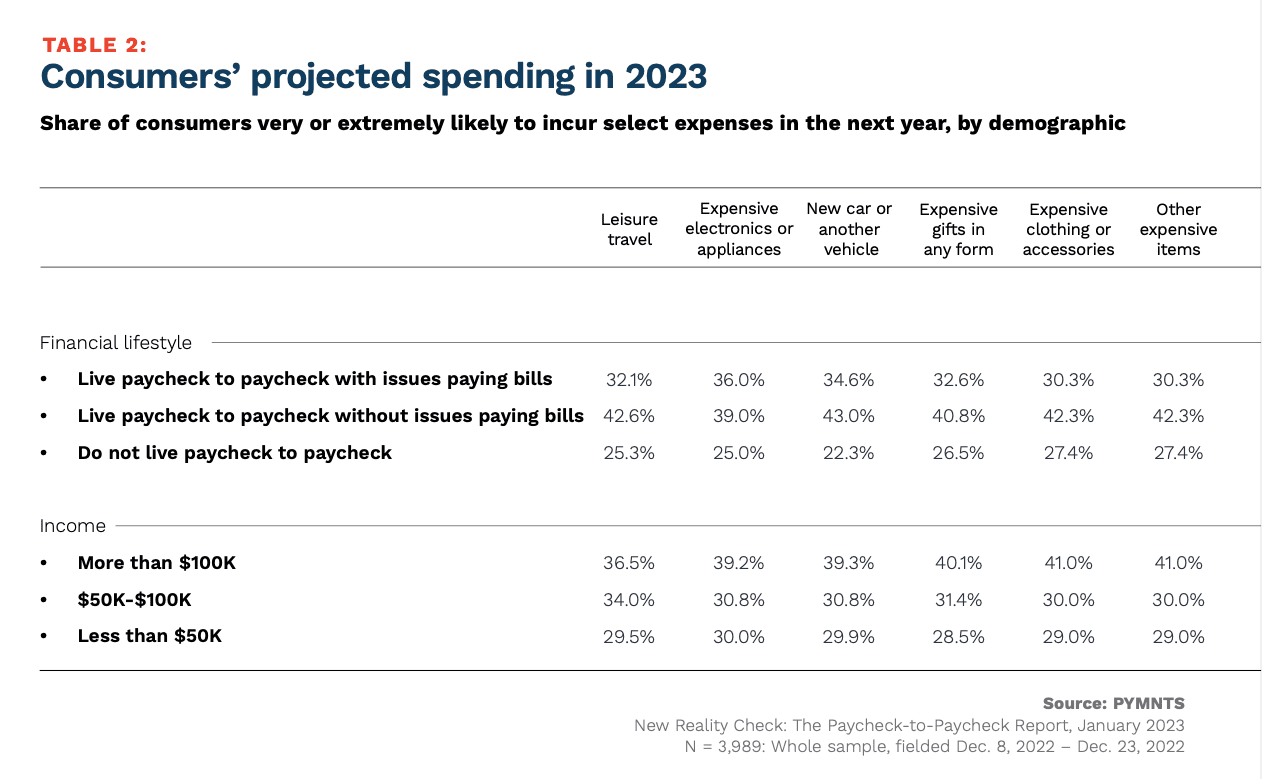

And here in the states, reality mirrors the research. PYMNTS data, as detailed in the most recent “Paycheck to Paycheck Report: The Economic Outlook and Sentiment Edition,” shows that overall, 64% of consumers live paycheck to paycheck. In December 2022, 51% of consumers earning more than $100,000 annually said they lived paycheck to paycheck, up 9 percentage points from 42%. As many as 16% of these high-income paycheck-to-paycheck consumers struggled to pay their monthly bills. Only a bit more than a third of those earning more than $100,000 annually say they’ll look to spend on leisure travel this year; less than half of that segment sees a likelihood of buying expensive gifts or clothing during the same year.

The slowdown is evident in the payment networks’ data, which shows — as evidenced in Mastercard’s data — that gross dollar volumes on credit and charge programs were up 14% in the fourth quarter, down from a more than 49% growth rate seen in the middle of 2021. As measured in the rest of the world, the respective growth rates were 9%, down from more than 25% in the middle of 2021. Visa’s materials show a 10% growth rate in credit activity in the most recent quarter, where that rate had been north of more than 27% (in the U.S.) as recently as the middle of last year.

The Fed is widely expected to boost rates this week, and the latest 0.25% hike is slated to come tomorrow. The “policy” rate will be around 4.5% to 5%, leading to a re-calibration of credit card interest rates (on track to be more than 20% by the end of this year). The pinch will be acutely felt — even among the relatively well-to-do.