Rewards Drive Higher Credit Card Use Among Boomers and Seniors

Baby boomers and seniors — consumers born before 1965 — were the first generations to have access to credit cards, back to the 1960s and ‘70s. That is the reason cards took root as the predominant credit option for them, becoming part of their financial culture that persists to this day.

However, this tendency has not been passed down to younger generations, especially millennials and Gen Z, who have different consumption priorities and a wider range of credit options than their predecessors.

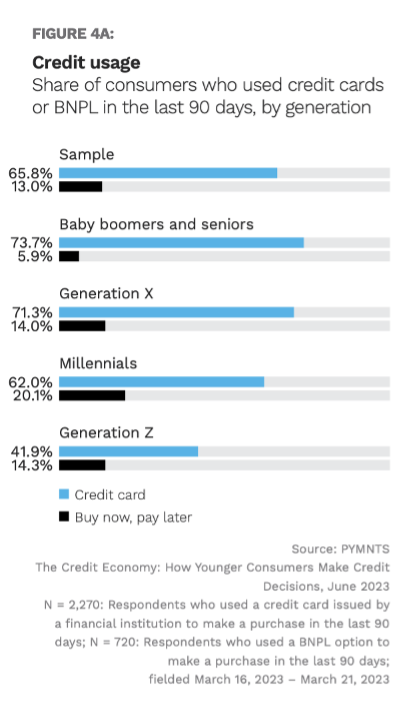

According to the report “The Credit Economy,” a PYMNTS Intelligence and i2c collaboration that examines behaviors and attitudes related to credit use among U.S. consumers across generations, the share of boomers and seniors who use credit cards for shopping reached 74%, the highest across generations. This proportion decreases gradually with younger consumers, especially among Gen Z members (42%), partially because some of these young consumers do not need or can’t have credit cards yet.

On average, boomers and seniors dedicated $477 to credit card purchases in the last 90 days, almost half that of Gen X and a third of millennials. Seniors and baby boomers are more likely than younger generations to pay the due balance of their credit cards in full at the end of the month; roughly half of boomers and seniors do so.

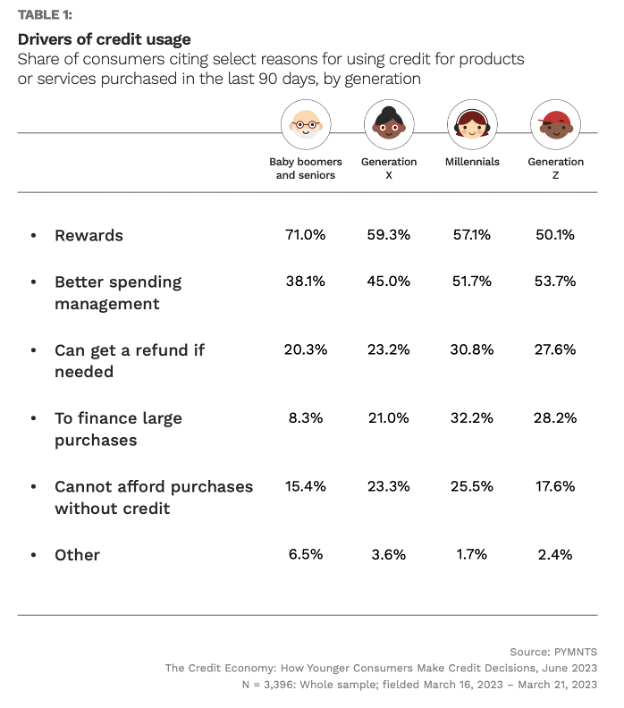

The reasons for using credit products also differ between generations. According to the study, younger individuals primarily use credit to help manage their expenses, while seniors and baby boomers do it not so much out of financial need, but to obtain benefits from reward programs (as affirmed by 7 out of 10).

Earning rewards drives more financially secure consumers to use credit cards. In the case of boomers and seniors, half of them claim to hold more than two cards that they use interchangeably. Consumers with fewer credit options or those using credit less frequently are not that concerned about rewards and focus more on simply having access to credit to better manage their spending.

Professor Sumit Agarwal from the National University of Singapore shares a similar view about this generation. In a recent interview, he pointed out, “The best payment method for a rational consumer is still a credit card. This method allows consumers to collect rewards, defer payment for a month, and get insurance.”

So, while boomers and seniors tend to opt for credit cards, they spend less than younger consumers and cancel their balances as soon as they can, confirming that this is a spending-conscious and rational generation that leverages multiple credit cards to manage spending — and reap rewards.