Credit Card Retail Payments Fall by 18% Amid Budget Pressures

As consumers continue to face financial pressures, many are shifting away from credit payments for retail purchases, instead playing it safe with debit.

By the Numbers

A PYMNTS Intelligence study in April for the Last Transaction Report series surveyed 1,730 United States consumers who bought non-grocery retail items in 30 days before being surveyed. The findings examined how shoppers paid for these items and compared the trends with consumers’ past preferences.

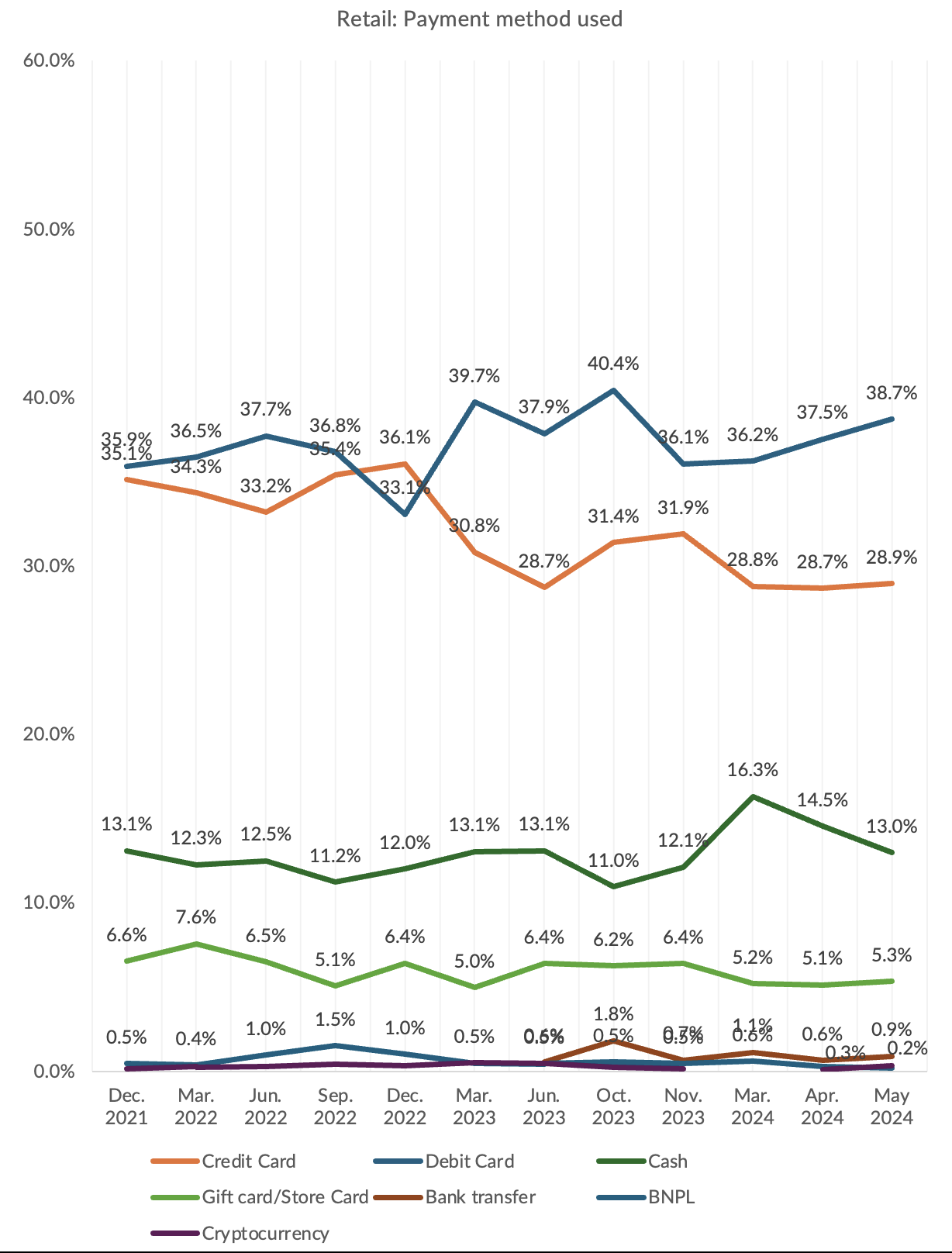

The study found that only 28.9% paid with credit cards, down from 35.1% in December 2021. Back then, consumers used credit and debit cards about the same amount to pay for retail purchases, with 35.9% having paid for their most recent purchase with debit. Yet by April, that share grew to 38.7%, widening the gap between credit and debit card retail payments even further.

Cash payments, meanwhile, saw ups and downs but remained roughly steady, on average, throughout the period, hovering around 13%.

A Deeper Dive

The shift to debit and cash comes as consumers face ongoing financial pressures, prompting them to choose payment methods that better enable them to manage their cash flow.

“Unsurprisingly, financially stressed consumers use debit or cash to make most of their purchases — 27% more often than the average consumer — and more out of necessity than choice,” PYMNTS CEO Karen Webster observed in a June feature. “These consumers are also highly leveraged, and their credit options are more limited.”

She later added that they tend to choose physical stores because they “are willing to trade off the value of their time for the chance to examine products, compare prices and pay with cash on hand (debit or cash) at checkout.”

Consumers do make more conservative budgeting decisions when paying via debit card. The “Contrasting the Consumer Credit Habits of Choice and Necessary Financers” installment of the Last Transaction Report found that necessary financers — those who tend to use credit out of necessity rather than by choice — spend $109.02 on retail products on average when using their credit cards compared to $61.27 with debit cards.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.