Gen Z Wants Credit Card Rewards, Just Not the Ones Banks Offer

Generation Z has emerged as a pivotal demographic for financial institutions (FIs), even as they challenge traditional loyalty strategies. The generation, whose adult members are 18 to 25 years old, is dissatisfied with many existing reward structures and instead tends to prefer more innovative, personalized incentives. Three in 5 members of Gen Z prefer nontraditional rewards such as flash sales or event access, contrasting with older generations’ long-held affinity for cashback rewards.

Generation Z has emerged as a pivotal demographic for financial institutions (FIs), even as they challenge traditional loyalty strategies. The generation, whose adult members are 18 to 25 years old, is dissatisfied with many existing reward structures and instead tends to prefer more innovative, personalized incentives. Three in 5 members of Gen Z prefer nontraditional rewards such as flash sales or event access, contrasting with older generations’ long-held affinity for cashback rewards.

Gen Z consumers might be the proverbial canaries in the mine. While loyalty programs have a broad participation base, with 72% of credit card holders using rewards in the past three months, there is notable friction. As many as 31% of consumers report difficulty redeeming rewards within the past 90 days. These pain points are not just operational glitches — they represent a deeper disconnect between consumer expectations and the programs’ design.

These are some of the findings explored in “The Credit Economy: The Role of Reward Programs in Consumer Credit Usage,” a PYMNTS Intelligence and i2c collaboration. We surveyed 3,233 U.S. consumers to examine their behaviors and attitudes related to credit card loyalty programs. The report explores the forces driving consumers’ interest in and usage of rewards across various spending categories and demographic groups.

Other key findings from the report include:

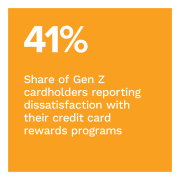

Millennial and Gen Z cardholders are the most likely to be interested in credit rewards programs, but Gen Z cardholders are also the most likely to report dissatisfaction with them.

Millennial and Gen Z cardholders are the most likely to be interested in credit rewards programs, but Gen Z cardholders are also the most likely to report dissatisfaction with them.

Although millennial and Gen Z cardholders show the most interest in credit card rewards programs, members of Gen Z are highly likely to report dissatisfaction, with 41% expressing discontent. For comparison, just 28% of millennials share this feeling, and Generation X and baby boomer and senior cardholders are more content with current offerings. These generational divides suggest that FIs must adapt their reward strategies to win over younger consumers.

Younger consumers want personalized rewards and digital offers and are interested in additional cards from FIs that offer them.

Loyalty programs tailored to their preferences strongly appeal to younger consumers: 59% of Gen Z and 64% of millennials say they are more interested in personalized rewards programs. FIs that want to stay competitive need to take this preference seriously since nearly half of millennials and 43% of Gen Z consumers are highly likely to apply for a new credit card offering their preferred type of reward.

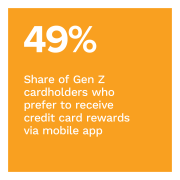

The delivery method for rewards also matters, with younger consumers preferring app-based offers to options like mail or email.

Younger consumers tend to prefer instant access and ease of use, which helps explain why 49% of Gen Z and 46% of millennial cardholders prefer receiving offers through mobile apps. In contrast, 46% of baby boomers and seniors choose email as their preferred method of receiving rewards, along with 37% Gen X.

The loyalty program status quo does not cut it for younger generations, especially Gen Z cardholders who do not find cashback rewards sufficient and exhibit a distinct inclination toward nontraditional rewards and digital delivery methods.

Download the report to learn more about how FIs can use innovative rewards programs to meet the expectations of today’s cardholders.