Data: Credit Unions Look To Close The Touchless Payments Gap

It has been almost a year since United States credit unions (CUs) first closed their brick-and-mortar branches to help slow the pandemic’s spread, and there are still no sign that they will soon reopen and operate as they did before the health crisis began.

It has been almost a year since United States credit unions (CUs) first closed their brick-and-mortar branches to help slow the pandemic’s spread, and there are still no sign that they will soon reopen and operate as they did before the health crisis began.

Members’ relationships with their CUs are stronger than ever in many ways, however. The shift away from in-person banking has ushered in a new, digital-first and primarily remote CU ecosystem in which members engage with their CUs online and via mobile banking apps.

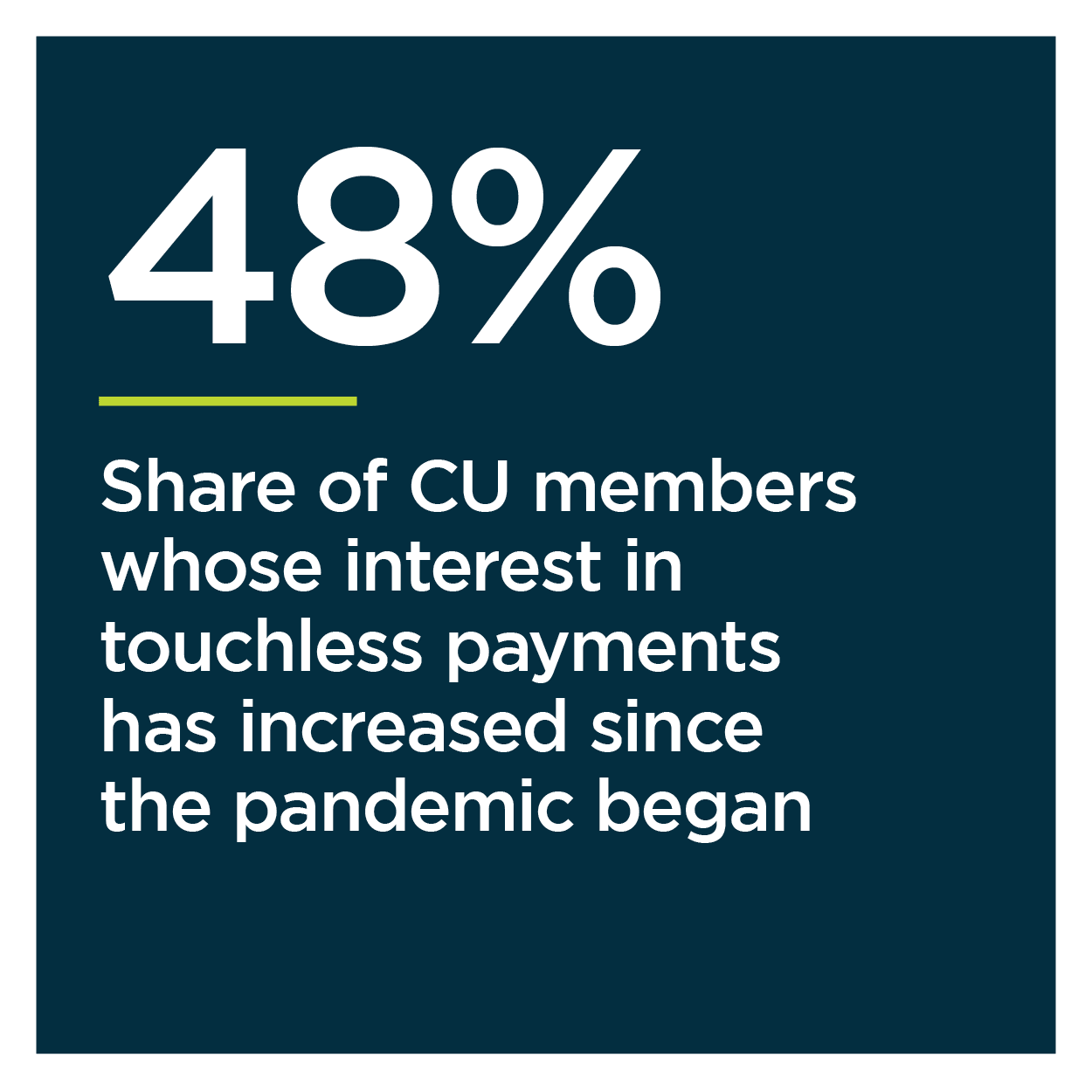

Simply offering re mote banking options is not enough for many CU members, however. Pressure is mounting for CUs to deliver touchless payments options that can allow them to transact in brick-and-mortar stores without making physical contact with card readers, cash and coins. Roughly half of all CU members say they are more interested in touchless payments now than they were before the pandemic began, in fact. This increase is even more pronounced among millennials and Generation Z consumers, 54 percent and 58 percent of whom, respectively, say their interest in touchless payment options has grown since the pandemic’s onset.

mote banking options is not enough for many CU members, however. Pressure is mounting for CUs to deliver touchless payments options that can allow them to transact in brick-and-mortar stores without making physical contact with card readers, cash and coins. Roughly half of all CU members say they are more interested in touchless payments now than they were before the pandemic began, in fact. This increase is even more pronounced among millennials and Generation Z consumers, 54 percent and 58 percent of whom, respectively, say their interest in touchless payment options has grown since the pandemic’s onset.

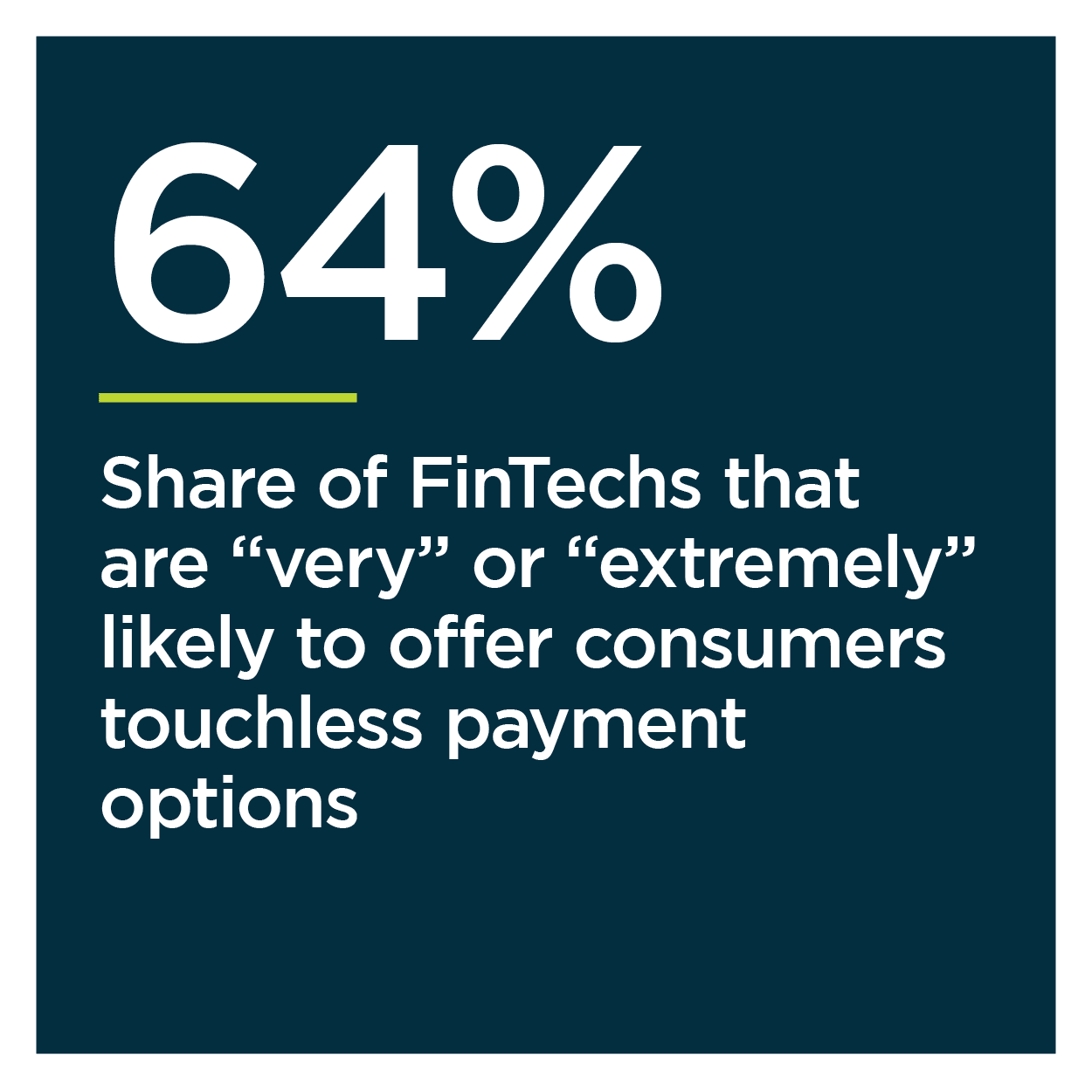

Innovating new touchless payment experiences has therefore become a critical part of any successful CU member engagement strategy. The big question is: Which types of touchless payment capabilities will go the furthest toward meeting CU members’ rapidly shifting demands and expectations?

In the Credit Union Innovation Playbook: Touchless Payments Edition, PYMNTS and PSCU collaborated to examine how consumers’ heightened interest in touchless payment technologies is reshaping the CU innovation ecosystem. We surveyed a census-balanced panel of 4,817 United States consumers, 101 CU decision-makers and 50 FinTech executives to identify the touchless payment technologies in which consumers are most interested, the innovation areas in which CUs are investing and the competitive threat that FinTechs might pose if they choose to offer touchless technologies directly to consumers.

PYMNTS research shows that although many CUs are aware of touchless payment innovations’ importance, many also underestimate their members’ interest in them. Thirty-five percent of CU decision-makers say they believe their members are “very” interested in touchless payments, when in fact 48 percent report being “very” or “extremely” interested in them.

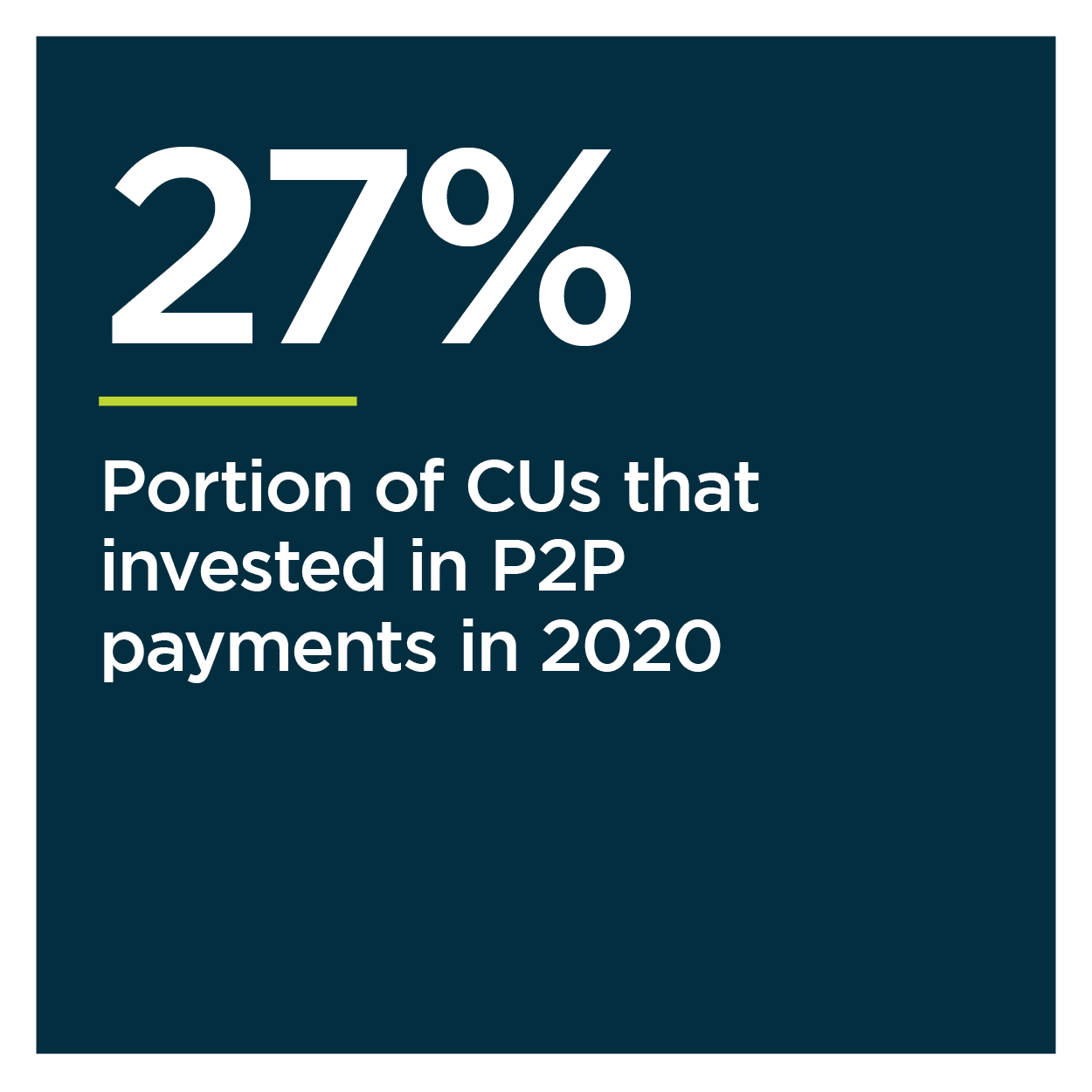

Many C Us also misjudge which types of touchless payments their members value, leading them to overinvest in technologies in which members have little interest and underinvest in those they want most. Eighty-six percent of CUs have invested in mobile wallet innovations in the last year, for example, even though only 30 percent of members are “very” or “extremely” interested in using mobile wallets. Meanwhile, only 34 percent of CUs report investing in contactless cards in 2020, while 47 percent of members are “very” or “extremely” interested in using contactless credit or contactless debit cards.

Us also misjudge which types of touchless payments their members value, leading them to overinvest in technologies in which members have little interest and underinvest in those they want most. Eighty-six percent of CUs have invested in mobile wallet innovations in the last year, for example, even though only 30 percent of members are “very” or “extremely” interested in using mobile wallets. Meanwhile, only 34 percent of CUs report investing in contactless cards in 2020, while 47 percent of members are “very” or “extremely” interested in using contactless credit or contactless debit cards.

Narrowing this gap between CU members’ demands for different touchless payment types and their CUs’ investment in them is just one step CUs must take to design and implement successful innovation strategies.

To learn more about how CUs can ensure they are investing in the right types of touchless payments, download the playbook.