Report: 60 Pct Of Credit Union Members Look To Other FIs For Credit Products

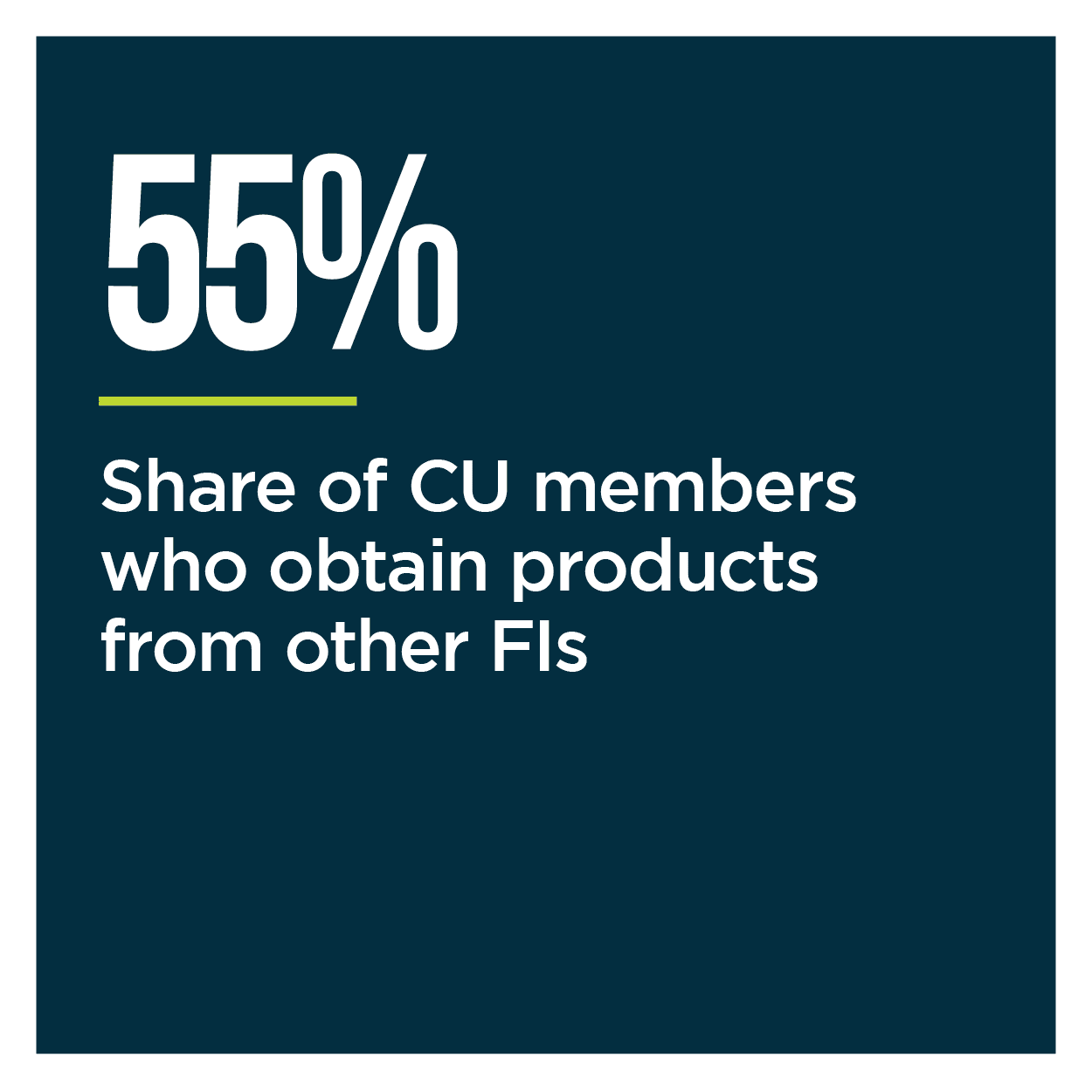

Credit union (CU) members often feel a strong affinity for their CUs, but that is not always enough to keep them from using other financial institutions’ (FIs’) financial products. Fifty-five percent of members use credit or financial products offered by FIs other than their primary CUs, in fact, meaning that their CUs are losing out on an opportunity to expand their portfolios.

Credit union (CU) members often feel a strong affinity for their CUs, but that is not always enough to keep them from using other financial institutions’ (FIs’) financial products. Fifty-five percent of members use credit or financial products offered by FIs other than their primary CUs, in fact, meaning that their CUs are losing out on an opportunity to expand their portfolios.

This so-called “portfolio leakage” issue can have a very real impact on CUs’ bottom lines. All CU executives say that it would have a “very” or “extremely” detrimental impact on their bottom lines if their members were to obtain credit cards through other FIs, for instance, and 96 percent say the same about mortgage refinancing. CUs therefore have dire need to rein in this portfolio leakage problem, lest they lose more of their revenue to competitors.

This so-called “portfolio leakage” issue can have a very real impact on CUs’ bottom lines. All CU executives say that it would have a “very” or “extremely” detrimental impact on their bottom lines if their members were to obtain credit cards through other FIs, for instance, and 96 percent say the same about mortgage refinancing. CUs therefore have dire need to rein in this portfolio leakage problem, lest they lose more of their revenue to competitors.

The Credit Union Innovation Playbook: Portfolio Leakage Edition, a PYMNTS and PSCU collaboration, examines the extent of the portfolio leakage problem in the United States CU ecosystem. We surveyed a census-balanced panel of 5,239 U.S. consumers, 100 CU decision-makers and 50 FinTech executives to learn which types of contactless payment innovations CU members would like their CUs to prioritize and to discover whether CUs are investing in these areas of interest.

PYMNTS’ research shows that in many instances, the credit products that would have the greatest impact on CUs’ bottom lines if their members obtained them from other FIs are the very same products that members are most likely to obtain from other FIs. Eighty-six percent of CU members with credit cards who obtain products from other FIs say that their credit cards are one of those products, for example. Also, 62 percent of members refinancing their homes who use other FIs say that they are using those FIs to refinance their mortgages. Auto loans, first-time mortgages and business lines of credit are also among the most common products that members source through FIs that are not their primary CUs.

from other FIs are the very same products that members are most likely to obtain from other FIs. Eighty-six percent of CU members with credit cards who obtain products from other FIs say that their credit cards are one of those products, for example. Also, 62 percent of members refinancing their homes who use other FIs say that they are using those FIs to refinance their mortgages. Auto loans, first-time mortgages and business lines of credit are also among the most common products that members source through FIs that are not their primary CUs.

Many CUs misunderstand why so many of their members obtain products from other FIs. The most common reason that CU executives believe their members are driven to use other FIs is that their CUs do not offer the products and services that their members want, with 90 percent believing that this is the case.

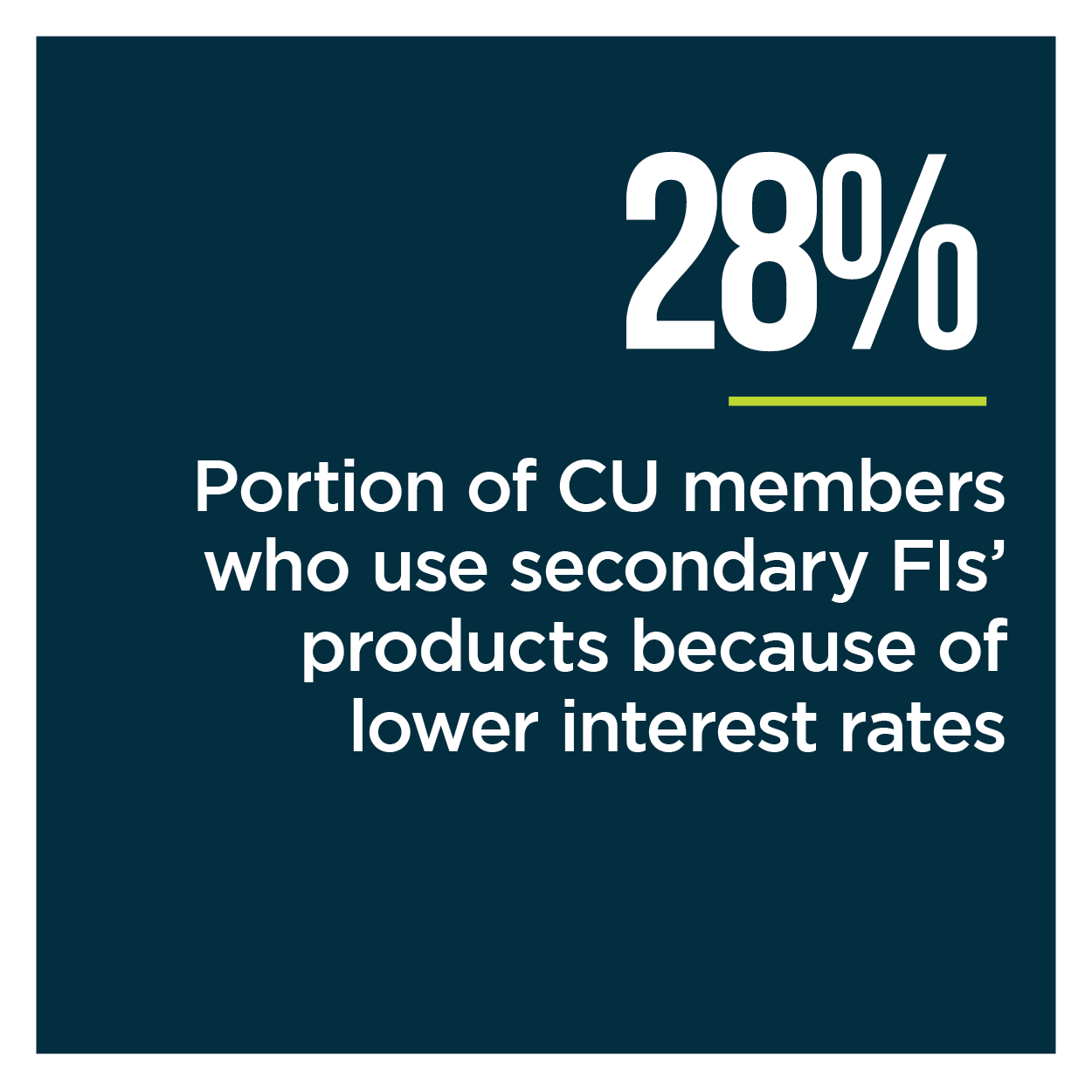

The truth is a bit more complicated. Twenty-eight percent of members who obtain financial and credit products from other FIs say it is because those FIs offer lower interest rates, for example, and 22 percent do so because they believe other FIs’ products are easier to use. This shows that it is not always the lack of availability but rather the cost and quality of the products being offered that drives members to bank elsewhere.

The truth is a bit more complicated. Twenty-eight percent of members who obtain financial and credit products from other FIs say it is because those FIs offer lower interest rates, for example, and 22 percent do so because they believe other FIs’ products are easier to use. This shows that it is not always the lack of availability but rather the cost and quality of the products being offered that drives members to bank elsewhere.

Innovation can be key to helping CUs overcome this portfolio leakage problem, but doing so requires that they have a thorough understanding of what it is that their members want and expect from their products and services. The Credit Union Innovation Playbook: Portfolio Leakage Edition delves into what CUs need to know about their members’ needs and demands to provide an overview of how innovation can help keep their members from banking with competitors.

To learn more about how CUs can curb their portfolio leakage problem, download the Playbook.