New Data: Credit Unions Sharpen Mobile Payments Focus as Member Loyalty Slips

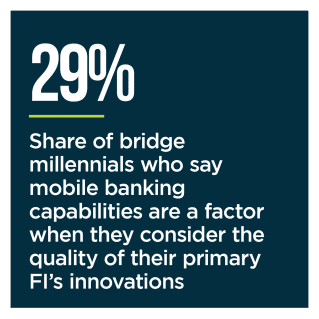

Keeping members satisfied will require credit unions (CUs) to step up their commitment to rolling out innovative digital products and services. The issue is growing more urgent, especially as member satisfaction with CUs has dropped from 92% in 2018 to 86% in 2021.  PYMNTS’ research shows that many consumers in or entering their peak earning years value innovative digital services like mobile deposit, digital wallets and instant card issuance to a digital wallet.

PYMNTS’ research shows that many consumers in or entering their peak earning years value innovative digital services like mobile deposit, digital wallets and instant card issuance to a digital wallet.

The most forward-thinking CUs are working to appeal to these consumers with innovative digital products and services. If more CUs follow their lead, the industry will be better prepared to reverse the decline.

Credit Union Innovation: Responding To Member Demands For Digital Financial Services, a PYMNTS and PSCU collaboration, provides a big-picture analysis of the current state of CU innovation in the United States, examining CU members’ interest in innovative digital financial products and services — and CUs’ efforts to satisfy this growing demand. We surveyed a census-balanced panel of 4,832 U.S. consumers, 101 CU decision-makers and 51 FinTech executives to learn which types of contactless payment innovations CU members would like their CUs to prioritize, and discover whether CUs are investing in these areas of interest.

Some additional key findings include:

Some additional key findings include:

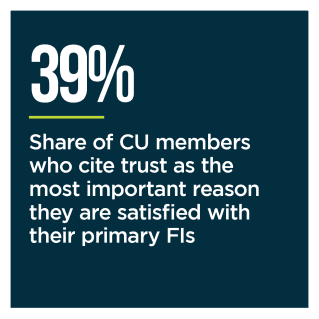

• Eighty-six percent of CU members said they were “very” or “extremely” satisfied with their primary financial institution (FI). This rate is a decrease of 6% from 2018, putting CUs on par with digital banks. The drop in member satisfaction highlights the challenges CUs face in incorporating innovative products and services to reestablish their edge over competitors.

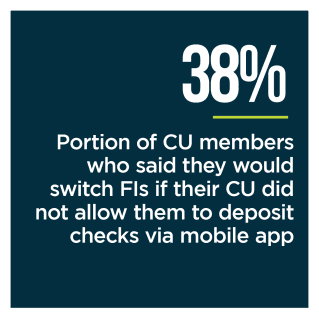

• Twenty-four percent of CU members would switch FIs for more innovative products. The CUs that provide these “potential switchers” with more digital products and services can discourage them from jumping ship. PYMNTS’ research shows that potential switchers are more likely than other consumers to want to deposit checks via mobile apps, have CUs issue cards directly to their mobile wallets and make and receive peer-to-peer (P2P) payments.

• Nineteen percent of CUs were classified as “early launchers” of digital products and services in 2021, a nearly fivefold increase from the 4% of CUs in this category in 2018. Just 17% of CUs were classified as “followers” in 2021, compared to 40% in 2018. Thirty-six percent of CUs are classified as “quick followers” and are slightly  behind the early launchers.

behind the early launchers.

As CUs work to keep and build membership, appealing to digital-first consumers can be a critical driving force. Investment in innovative products and services can be a path to success for those CUs looking to drive member satisfaction and reestablish their place in the financial sector.

To learn more about how credit unions are rolling out innovative digital products to sustain member satisfaction, download the report.