Credit Unions That Fail to Innovate Risk Losing Members

Sixty-four percent of all credit union (CU) members want their primary financial institutions (FIs) to offer more payment capabilities. Many — a record-setting share within our research — are willing to go as far as switching to find more innovative products. This widespread search for ever-more innovative products is a strong indicator of the extent to which competitive pressures are increasing for credit unions.

For “Credit Union Innovation: Product Development Slowdown Tests Member Loyalty,” a PYMNTS and PSCU collaboration, we surveyed 4,282 consumers about their views on product innovation and the impact on their interactions with financial services providers.

Key findings from the report include the following:

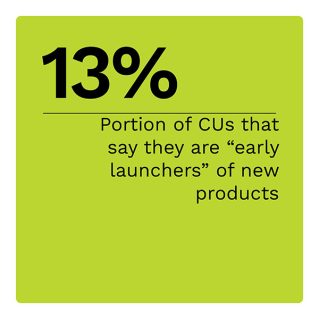

• Credit unions are scaling back product development despite members’ growing interest in innovative products.

Budget constraints are forcing CUs to scale back product development plans at the same time that CU members want more innovative products and are willing to take their accounts to other FIs to find that innovation. Twenty-seven percent of CU members say they would switch where they keep their financial accounts to find product innovation, and this figure has been increasing steadily for four years.

• More than any other innovation, CU members want additional payment methods.

Sixty-four percent of CU members want their primary FIs to offer more payment capabilities, demonstrating their strong influence on consumers. In addition, 79% of the FI account holders who would switch where they bank to obtain more innovative products would like to see more payment products and services from their current FIs.

• Innovative and readily available credit products can help credit unions respond to competitive threats and attract new members.

Consumers and businesses are aiming to borrow more and employ more types of credit. Seventy-one percent of CUs received more applications for personal loans in the last 12 months, and 74% of the CUs offering credit cards to members say applications have also risen in the past year. CUs, as a result, are moving aggressively to speed up the loan approval process: 53% of CU executives say they are making very or extremely significant steps to reduce the time to set up a loan for a borrower, and the remaining 47% say they are making slightly significant or somewhat significant steps to speed up the process.

Consumers and businesses are aiming to borrow more and employ more types of credit. Seventy-one percent of CUs received more applications for personal loans in the last 12 months, and 74% of the CUs offering credit cards to members say applications have also risen in the past year. CUs, as a result, are moving aggressively to speed up the loan approval process: 53% of CU executives say they are making very or extremely significant steps to reduce the time to set up a loan for a borrower, and the remaining 47% say they are making slightly significant or somewhat significant steps to speed up the process.

Because of members’ increased discernment — and willingness to jump ship — CUs should target their limited resources at innovations members will see and appreciate. The loyalty of credit union members is being tested to an unprecedented extent, and successful CUs will overcome resource constraints and product development slowdowns to pass the test and keep their membership strong.

To learn more about what CU members want from their institution, download the report.