Less Than a Quarter of Credit Unions Offer Real-Time Payments, Disappointing Members

Credit unions (CUs) may find attracting and retaining members challenging if they lag behind major banks and FinTechs in providing enhanced payment capabilities, such as real-time payment solutions.

Credit unions (CUs) may find attracting and retaining members challenging if they lag behind major banks and FinTechs in providing enhanced payment capabilities, such as real-time payment solutions.

Our research found that real-time payments are an area of weakness for both account holders and executives. But this is not the case for FinTechs and their management. Real-time payments are gaining importance and may become even more vital when the Federal Reserve launches its FedNow service later this year. Financial institutions (FIs) participating in the FedNow service will give customers more choices in managing their finances, emphasizing the importance of innovation in choosing a primary FI.

Our research found that real-time payments are an area of weakness for both account holders and executives. But this is not the case for FinTechs and their management. Real-time payments are gaining importance and may become even more vital when the Federal Reserve launches its FedNow service later this year. Financial institutions (FIs) participating in the FedNow service will give customers more choices in managing their finances, emphasizing the importance of innovation in choosing a primary FI.

“Credit Union Innovation: Staying Ahead Through Payments Innovation,” a collaboration with PSCU, explores the growing importance of innovative payment options. We examined CU and FI account holders’ dispositions toward payment innovations, especially real-time payments. Our findings are based on a census-balanced survey of 4,282 U.S. consumers conducted from Oct. 17, 2022, to Nov. 17, 2022, a survey of 100 CU executives conducted from Oct. 7, 2022, to Oct. 31, 2022, and a survey of 50 FinTech executives conducted from Oct. 12, 2022, to Oct. 31, 2022.

Key findings from the report include the following:

• CU members want more contactless and innovative payment options and products.

• CU members want more contactless and innovative payment options and products.

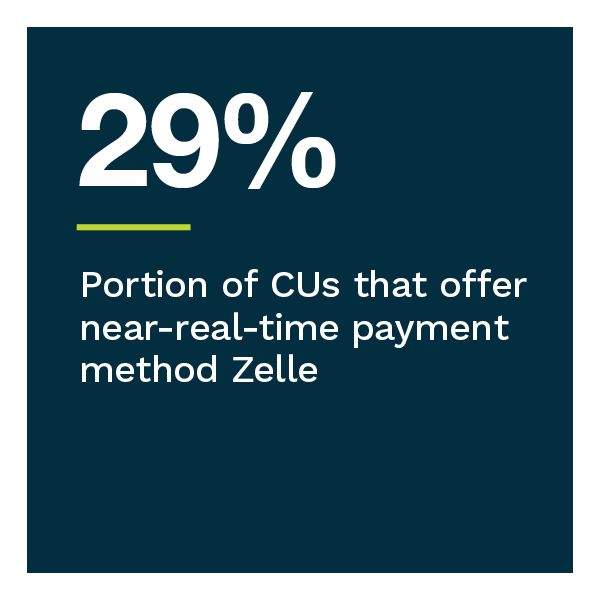

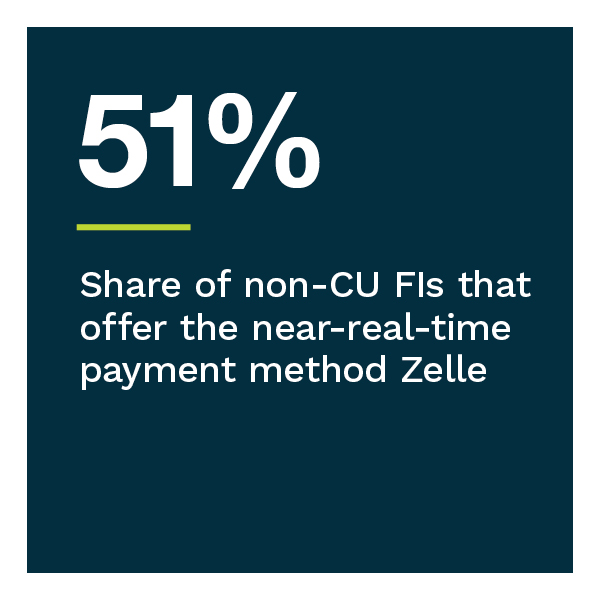

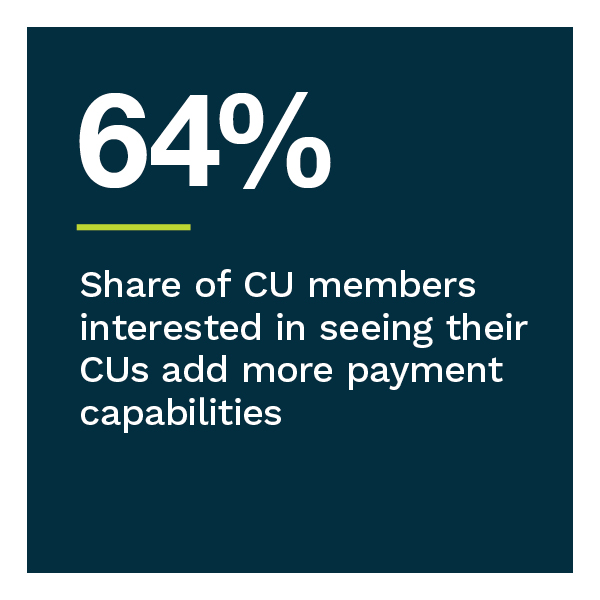

CU members report using as many payment methods as the average bank account holder but tend to use more traditional methods, such as checks, credit cards and debit cards. These consumers would rather have new digital payment innovations that other FIs provide. CU members CUs are much less likely to offer members contactless card options or Zelle, a real-time payment solution.

• Account holders are serious about payment innovation from their FIs, which could lose out to rivals that offer customers what they need.

PYMNTS’ data finds that 29% of account holders would switch FIs for more innovative solutions, including 27% of CU members. This sentiment shows how innovation is an increasingly important factor consumers consider when deciding which FI to use. CU members are no different than the average bank account holder in their interest in adopting innovative payment products. Sixty-four percent say they want their CU to offer more innovative products.

• Most FI account holders and CU executives have little knowledge about real-time payments, a factor FinTechs could capitalize on.

Less than 50% of CU executives reported being very or extremely well acquainted with real-time payments. This knowledge gap may prove costly, as FinTechs are seizing the opportunity presented by rising demand for real-time payments. More than 70% of FinTech executives say they provide real-time payment capabilities, and 40% plan to strengthen their real-time payments architecture to increase competition.

Consumer demand for more innovative payment methods and competition from FinTechs will continue to grow. CUs must increase their awareness of these methods and respond by offering innovative products to keep consumers at their door. Download the report to explore consumers’ changing needs surrounding payments innovation.