PYMNTS Report: 60% of Well-Off Consumers Still Buy Crypto as Investment

New research on the demographic differences between who’s buying crypto and who’s is not show that the new asset class is as polarizing on a household income basis as it is in terms of marketplace volatility.

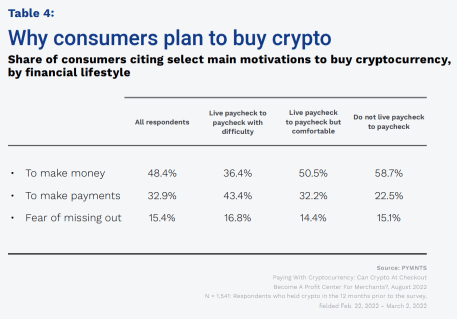

For example, PYMNTS’ “Paying With Cryptocurrency: Can Crypto At Checkout Become A Profit Center For Merchants?” report done in collaboration with BitPay, showed that people who have trouble making ends meet were substantially more likely to buy cryptocurrency to make payments.

Specifically, more than 43% of the respondents who described themselves as living paycheck-to-paycheck with difficulty paying their bills said making payments was their main motivation for dabbling in digital currencies, whereas as roughly 60% of those living comfortably said they did so to as an investment to make money.

That decreased as the respondents’ financial lifestyle improved.

Less than one-third (32%) of those living paycheck-to-paycheck comfortably and just 23% of those not living paycheck-to-paycheck chose making payments as their main motivation.

Still, given that paying with crypto in stores and online is still fairly uncommon, it’s pretty clear that many people in all three income brackets are coming to see cryptocurrencies as a payment method.

On the other hand, only 36% of the financially tightest group said crypto purchases were an investment, compared to 51% of the comfortable group and 59% of the best off. All three groups put “fear of missing out” at about 15%.

The first group, living paycheck-to-paycheck with difficulty, was also substantially more likely to purchase cryptocurrency in the coming year, with 38% saying they are either very or extremely likely to do so. That’s versus 22% of those living paycheck-to-paycheck comfortably and 17% of those not living paycheck-to-paycheck.

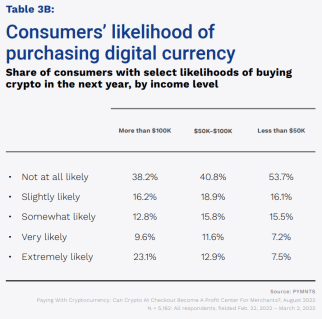

Interestingly, those numbers didn’t match up very well when respondents were divided up by income instead of financial lifestyle.

In the wealthiest demographic, those earning more than $100,000, 33% were very or extremely likely to buy crypto in the next year. That grew to 27% for those earning $50,000 to $100,000, but then dropped precipitously, to just 15%, for those earning under $50,000. Which suggest that living within a budget is not the same as living on a low budget.

With one exception, when looking at purchasing crypto by age group was more or less what you’d expect. The very and extremely likely group was miniscule for boomers and seniors (7%) and got progressively larger as the demographic grew younger: Gen X 28%, Bridge Millennials 38%, Millennials 42%.

But then something interesting happens.

Generation Z, the group generally considered to be most comfortable with and educated about cryptocurrencies took a big dive, coming in slightly under Gen X with 27% very and extremely likely to buy digital assets in the next year. One possible reason that comes to mind is that Gen Z is also the group with the lowest disposable income.