Nearly Half of Enterprise Merchants Are Beefing Up Security Online

Eighty-two percent of eCommerce merchants experienced cyberattacks or data breaches in the last year, according to PYMNTS Intelligence’s “Fraud Management in Online Transactions.

The study was based on surveys with 300 heads of payments or fraud departments from international eCommerce companies. It detailed the steps these merchants are taking to combat fraud and reduce customer churn.

Fraud-related incidents can inflict pain on a business’s bottom line, but they can also damage customer relationships — which may end up doing more harm in the long run. Forty-seven percent of the eCommerce businesses PYMNTS surveyed said they lost both revenue and customers due to fraud in the previous 12 months, but 68% also said they saw a decline in customer satisfaction, which they attributed to security breaches.

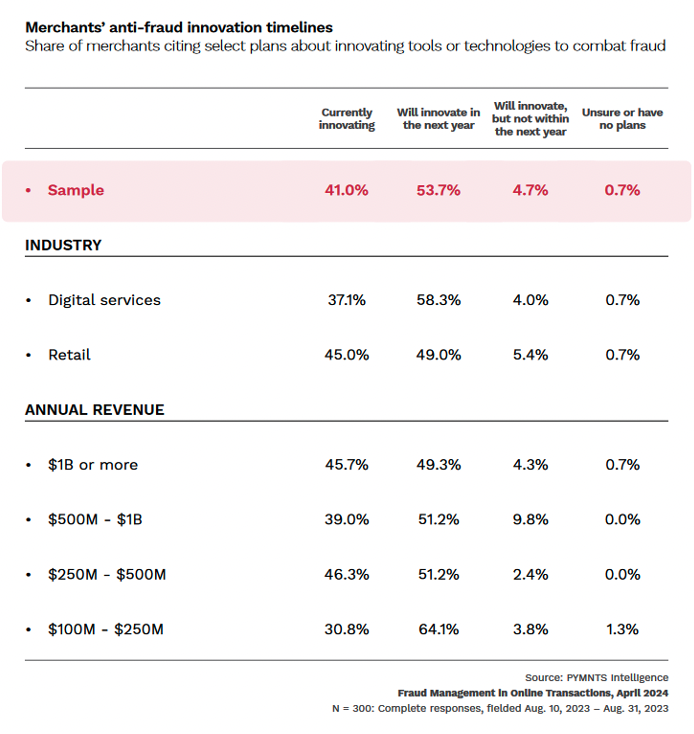

It is little wonder then that 95% of eCommerce merchants said they have either begun revamping their anti-fraud capabilities or are committed to doing so soon. Overall, 41% have already begun enhancing their anti-fraud protections while another 54% plan to do so within the year. Only about 5% plan to but lack a timeline.

How much revenue an eCommerce merchant generates appears to correspond to their eagerness to enhance their fraud-prevention measures. Merchants generating between $100 million and $250 million in annual revenue, the smallest in the sample, are behind the curve, with 31% upgrading their anti-fraud systems, although 64% plan to innovate in the next 12 months.

Meanwhile, a larger share of businesses operating in higher revenue brackets already have anti-fraud upgrades underway. Forty-six percent of companies earning $1 billion or more are currently innovating, while nearly 50% are committed to doing so soon. Thirty-nine percent of merchants earning between $500 million and $1 billion annually are now upgrading their anti-fraud tools, while 51% will do so in the next year.

Companies earning between $250 million and $500 million appear to be the most eager of all, as 46% are now upgrading and 51% plan to follow through in the next year.

The stratified pace of security investments likely reflects access to resources and expertise, with smaller merchants less willing — or simply unable to — proactively invest in anti-fraud innovations now. Yet nearly all eCommerce merchants are enhancing or plan to enhance their fraud prevention tools and technology, confirming they recognize the need to do so to stem both financial losses and customer churn.