42% Of Consumers Say They’ll Try Digital Wallets

Move over BNPL; after an arduous slog, the digital wallet is finally making major inroads with consumers.

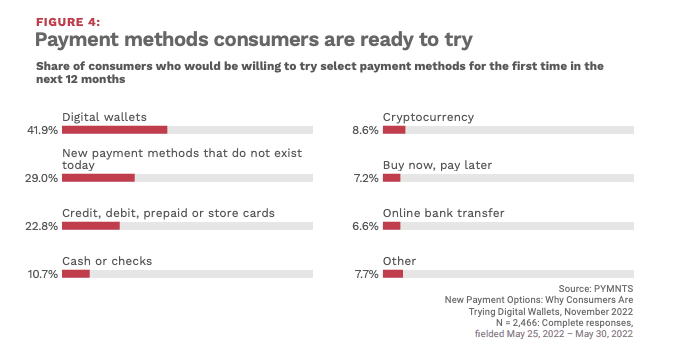

In the study New Payments Options: Why Consumers Are Trying Digital Wallets, a PYMNTS and Nuvei collaboration, we surveyed nearly 2,500 U.S. consumers and found that digital wallets are pulling ahead of other digital payment methods in consumers’ willingness to try them out.

Per the study, “Few consumers appear willing to try specific payment methods with which they are unfamiliar. Less than 23% of consumers we surveyed had an interest in trying any given payment method they had not used before, except for one. The lone exception is digital wallets.”

Get Your Copy: New Payments Options: Why Consumers Are Trying Digital Wallets

While crypto has diehard devotees and popular forms like buy now pay later (BNPL) has considerable cachet, it’s the digital wallet that’s captured more consumer imaginations.

“Our data shows that digital wallets are the lone payment method that many consumers are willing to give a first-time try: 42% of the consumers who have not used them are willing to try them in the next year. Other existing payment methods generate barely half as much interest from consumers,” the study states, adding that “If merchants and banks can demonstrate that

certain newer payment methods are easy to use while also protecting consumers’ personal information, they may be able to help nascent methods reach a broader base of consumers.”

See it Now: New Payments Options: Why Consumers Are Trying Digital Wallets