95% of FIs Tap Power of Receipt Data

Receipts aren’t just pieces of paper that end up at the bottom of your shopping bag.

With the right information in the mix, they can foster collaboration between financial institutions (FIs) and merchants to help them craft compelling loyalty programs, prevent fraud, manage expenses more effectively and make consumers understand their spending patterns.

But realizing these benefits requires banks, FinTechs and other service providers to invest in innovations that help them leverage item-level receipt data in a simple, secure way. And joint research between PYMNTS and Banyan found growing interest in the technology.

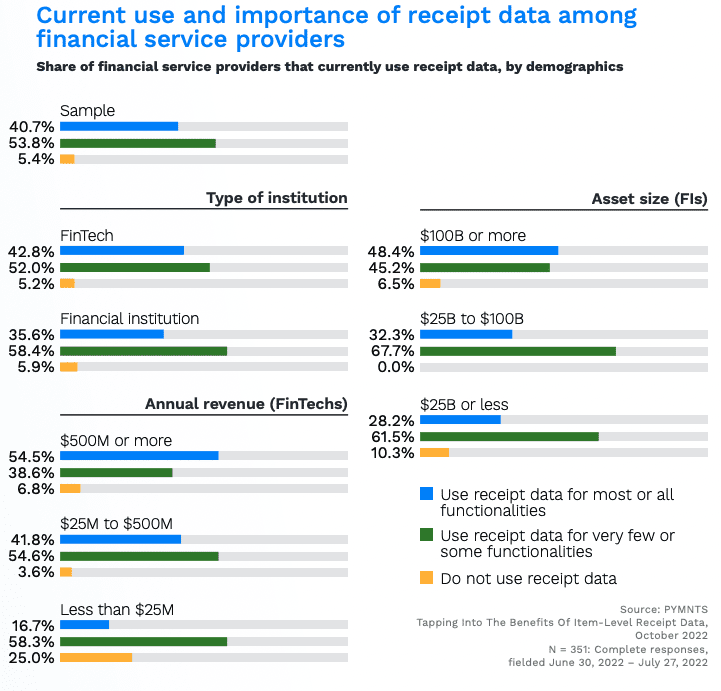

Of the 351 executives at FIs and FinTechs we surveyed for “Tapping Into the Benefits of Item-Level Receipt Data,” a full 95% said their organizations use receipt-level data to support some operations, while 41% use it for all of them.

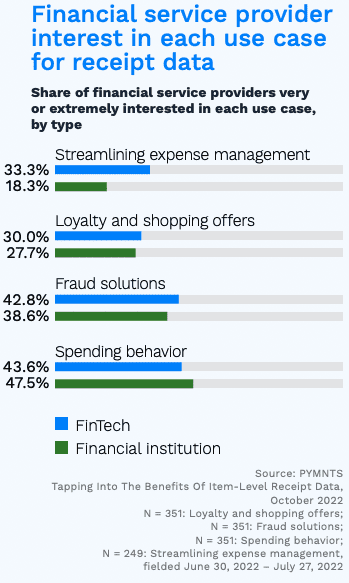

Meanwhile, financial education and fraud prevention emerged as top priorities in the study. About 45% of respondents said they were “very or extremely interested” in using receipt-level data to better understand customers’ spending behavior and 41.6% expressed interest in using receipt-level data to better protect themselves and their customers against fraud.