Nearly Half of Consumers Who Tried to Increase Their Credit Scores Did

Consumers across income levels, credit scores and generations have accumulated high levels of debt. In fact, credit card debt recently surpassed $1 trillion for the first time. With this backdrop, high credit scores are pivotal to accessing credit and maintaining purchasing power.

Consumers can improve their credit scores through different avenues, such as via credit-builder applications, increasing their knowledge of credit management and using buy now, pay later (BNPL) plans. Consumers’ efforts to learn more about credit and money management practices are the fastest way to increase their credit scores by more than 100 points.

Consumers can improve their credit scores through different avenues, such as via credit-builder applications, increasing their knowledge of credit management and using buy now, pay later (BNPL) plans. Consumers’ efforts to learn more about credit and money management practices are the fastest way to increase their credit scores by more than 100 points.

These are just some of the findings detailed in “The Credit Accessibility Series: Declining Purchasing Power Pushes Consumers to Improve Credit Scores,” a PYMNTS Intelligence and Sezzle collaboration. This edition explores consumers’ success in improving their credit scores and key related variables. We surveyed 2,558 U.S. consumers between Aug. 21 and Sept. 2 to examine their success or struggles in their objective to improve their credit scores using different tools available in the market.

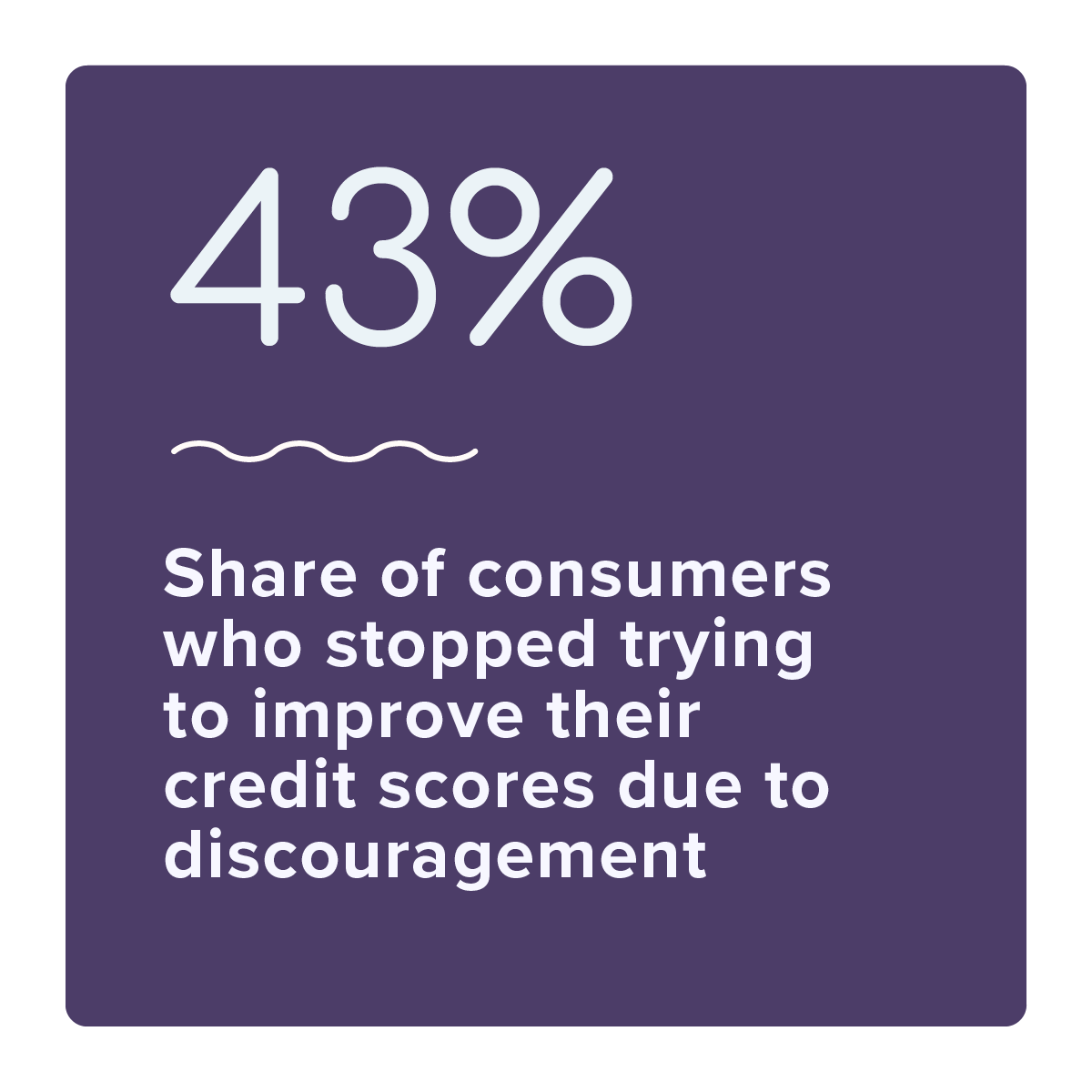

Other findings from the report include:

BNPL users are 24% more likely to have raised their credit scores than the typical credit card user.

Data shows that 44% of BNPL users increased their credit scores in the past two years — a greater success rate than credit card users who saw increased scores. As consumers usually think of credit cards as having a lot of sway in determining credit scores, the relative success of BNPL users stands out. Specifically, 29% of BNPL users with improved credit scores were able to increase their scores by more than 100 points, more than the share of average consumers, and average credit card users were able to produce the same results.

Knowledge is key: Learning more about credit and money management practices is the fastest way to increase one’s credit score by more than 100 points.

Although the average consumer needed 10 months to one year to elevate their score by more than 100 points, consumers who learned more about credit and money management could do this in nine months, on average. Consumers should consider this strategy since just 6.9% of all consumers achieved an increase in their credit score of more than 100 points in the last two years.

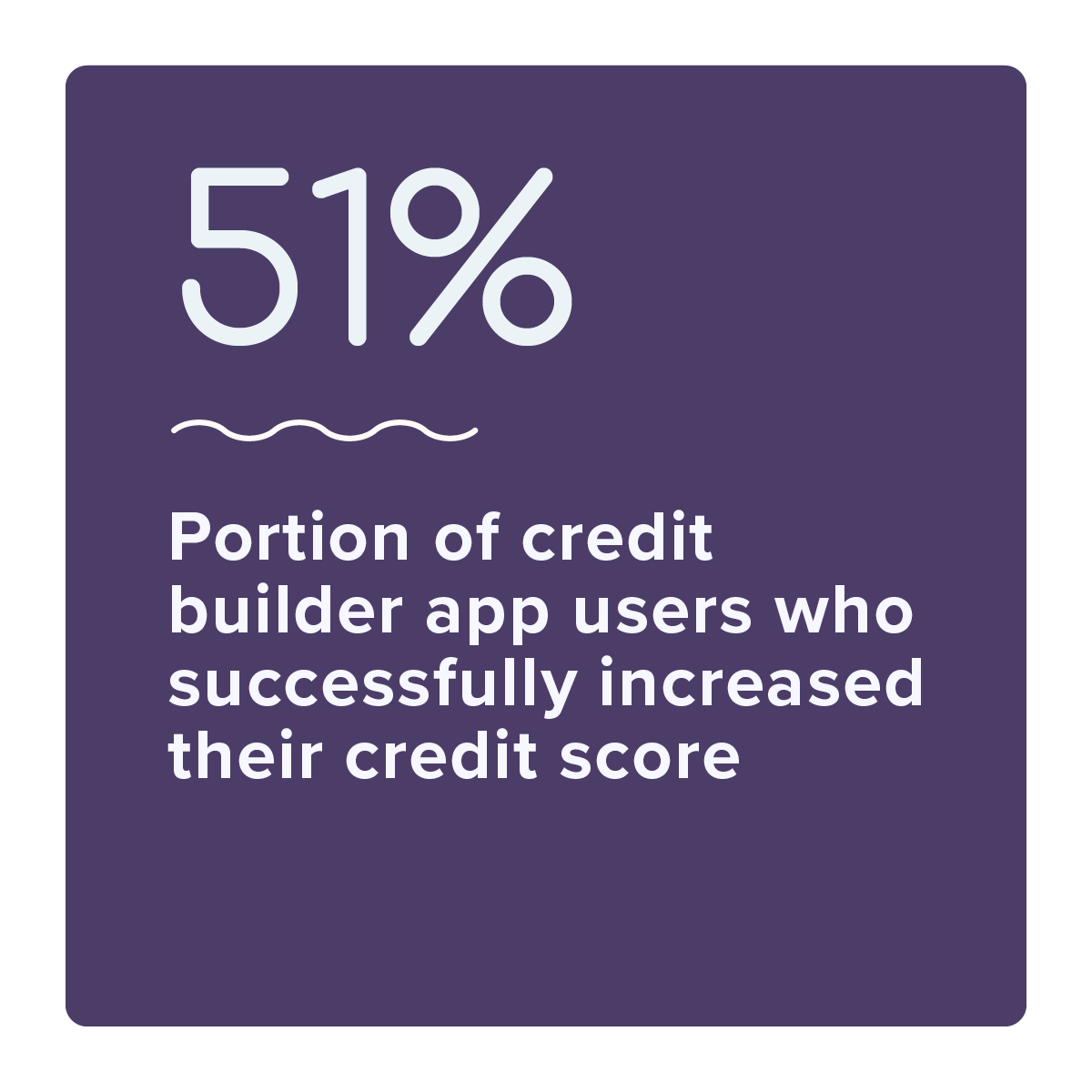

Credit-builder app users were 76% more likely than the average consumer to raise their scores by more than 100 points.

Data shows that 51% of credit-builder app users successfully increased their credit scores. We also found that 59% of credit-builder app users who successfully increased their scores said it was easy, while 41% of consumers who increased their credit scores said the same.

In an economic environment marked by price increases, consumers are turning to credit to keep up. Improving credit scores is necessary to access the greatest amount of credit and the most favorable terms. Download the report to learn more about strategies consumers use to improve their credit scores.