FIs Need More Than Refunds to Address Zelle Scams

For banks, reimbursing victims of Zelle-related fraud is only a partial solution.

It’s a retroactive redress. But to really address the issue, financial institutions (FIs) will need every technologically advanced tool at their disposal.

As reported this week, seven of America’s largest banks are crafting a plan to reimburse victims of peer-to-peer (P2P) and, specifically, Zelle scams. The roster includes JPMorgan Chase, Wells Fargo and Bank of America. The as-yet finalized rules regarding refunds will likely have a sweeping reach. Once codified, all banks using Zelle (1,700 member banks and credit unions) would have to agree to the refund protocols or might be barred from the payments network.

That risk of not participating in a system that is growing by leaps and bounds and has moved billions of transactions and $1.5 trillion over the past five years (per Zelle’s latest stats) is one those hundreds of banks will not want to take. The odds are that any rules embraced by the big banks will wind up being systemic. The refunds would apply to only a few scenarios: where true fraud is in evidence and where customers have been misled into parting with funds, such as in cases of impersonation fraud where scammers pose as bank officials. However, refunds would not apply in cases where someone pays for goods or services that are never tendered.

The financial impact will be significant. A report this past fall from Sen. Elizabeth Warren estimated that with a nod to only four of the largest banks in the U.S., scams and fraud tied to Zelle transactions could reach as much as $255 million in 2022 alone.

We note that the reimbursement strategy represents a seismic shift for the banks, in an age where, as noted in an interview between PYMNTS and Featurespace Founder David Excell, social engineering and the great digital shift have given criminals the ways and means to disguise themselves as company or bank officials, friends and even family. P2P transactions are irrevocable, and getting the funds back in authorized push payment fraud would be challenging. It’s hard to follow the money when it disappears instantly.

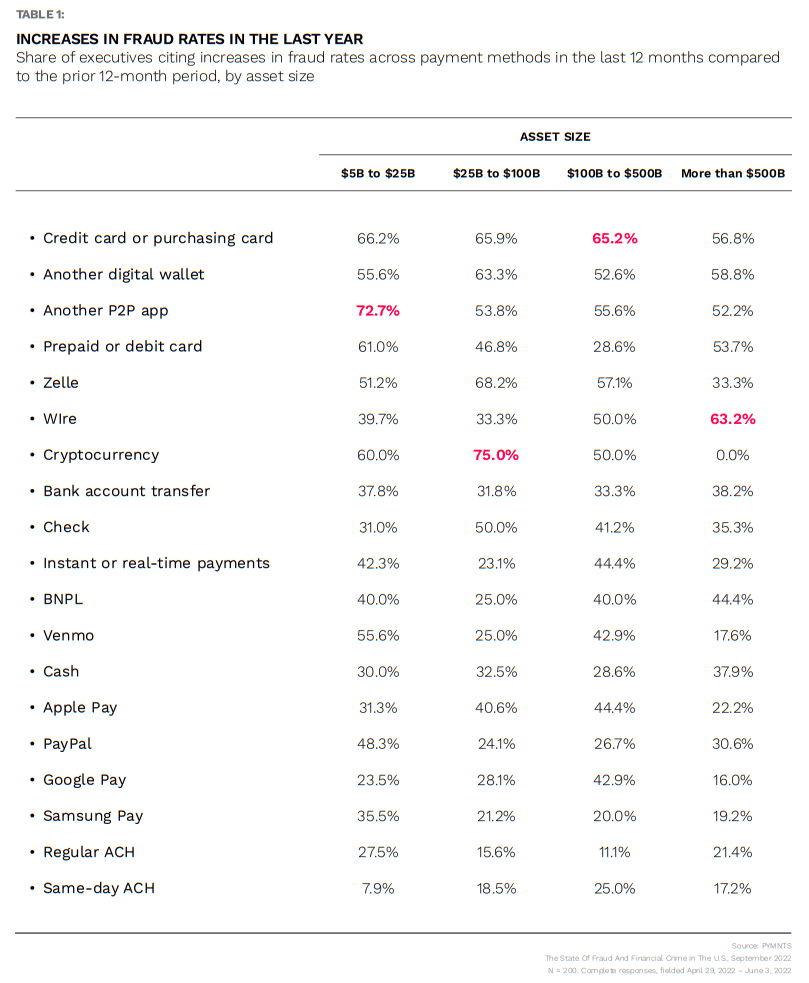

Joint research from PYMNTS and Featurespace, in the report titled “The State Of Fraud And Financial Crime In The U.S.,” shows that 62% of all FIs experienced an increase in financial crime, and an even greater share of smaller FIs — those with between $5 billion and $25 billion in assets — experienced such an increase. 51% of firms saw increased fraud rates related to payments made with Zelle.

The Technological Arrows in the Quiver

While our data did not show an elevated risk for Zelle scams, there’s a need for a proactive line of defense that intersects and compliments the strategy to offer refunds. And that proactive approach stems from deploying AI- and ML-based solutions.

FIs that employ ML- and AI- or cloud-based platforms to limit fraud attacks had the smallest shares of transactions that led to fraud losses among respondents to our survey. And the data show, too, that a significant percentage of FIs aim to bring those solutions on board at about roughly half of the banks surveyed (two-thirds will seek to improve communication with customers).

In a separate panel discussion, Excell and MidFirst Bank Vice President and Director of Enterprise Fraud Candler Eve said that the banks are developing the ways and means to keep money from leaving the ecosystem in the first place, aided by AI and ML.

“There’s an understanding of the context around what consumers are doing as they are transactions — and a full picture develops rather than looking at specific payments types and channels in insolation,” said Excell. There are ways to introduce healthy friction in the process — often at the point of transaction — that assure consumers that the FI is looking out for their best interests. In one example offered by Eve, and being used in the U.K., an FI will prompt a consumer (if the transaction is flagged as suspicious) to re-confirm if the transaction is needed to be made now — or it can wait for a future time.

As noted by the panelists, the advent of the Fed’s FraudClassifier system helps create a “common language” to help measure fraud and compare it across institutions — and indicate where FIs should concentrate their efforts.

Collaboration, education, high tech and yes, refunds may wind up being the best lines of defense against P2P fraud and the new waves of attacks yet to come.