PYMNTS Intelligence: How Open Banking Developments Are Shaping the Future of BaaS

The technologies behind baas are incredibly valuable, as they facilitate smooth, seamless experiences and pave the way for new players to enter the market. White-label banking—another term for private financial services or banking as a service (BaaS)—can speed up an organization’s go-to-market strategy by removing regulatory, legal and technical obstacles.  These services enable FinTechs and other parties to showcase a sleek, company-branded, front-end architecture while leveraging an existing financial institution’s (FIs) license, regulatory compliance and technology to offer banking services that rival—or even outclass—those of major institutions.

These services enable FinTechs and other parties to showcase a sleek, company-branded, front-end architecture while leveraging an existing financial institution’s (FIs) license, regulatory compliance and technology to offer banking services that rival—or even outclass—those of major institutions.

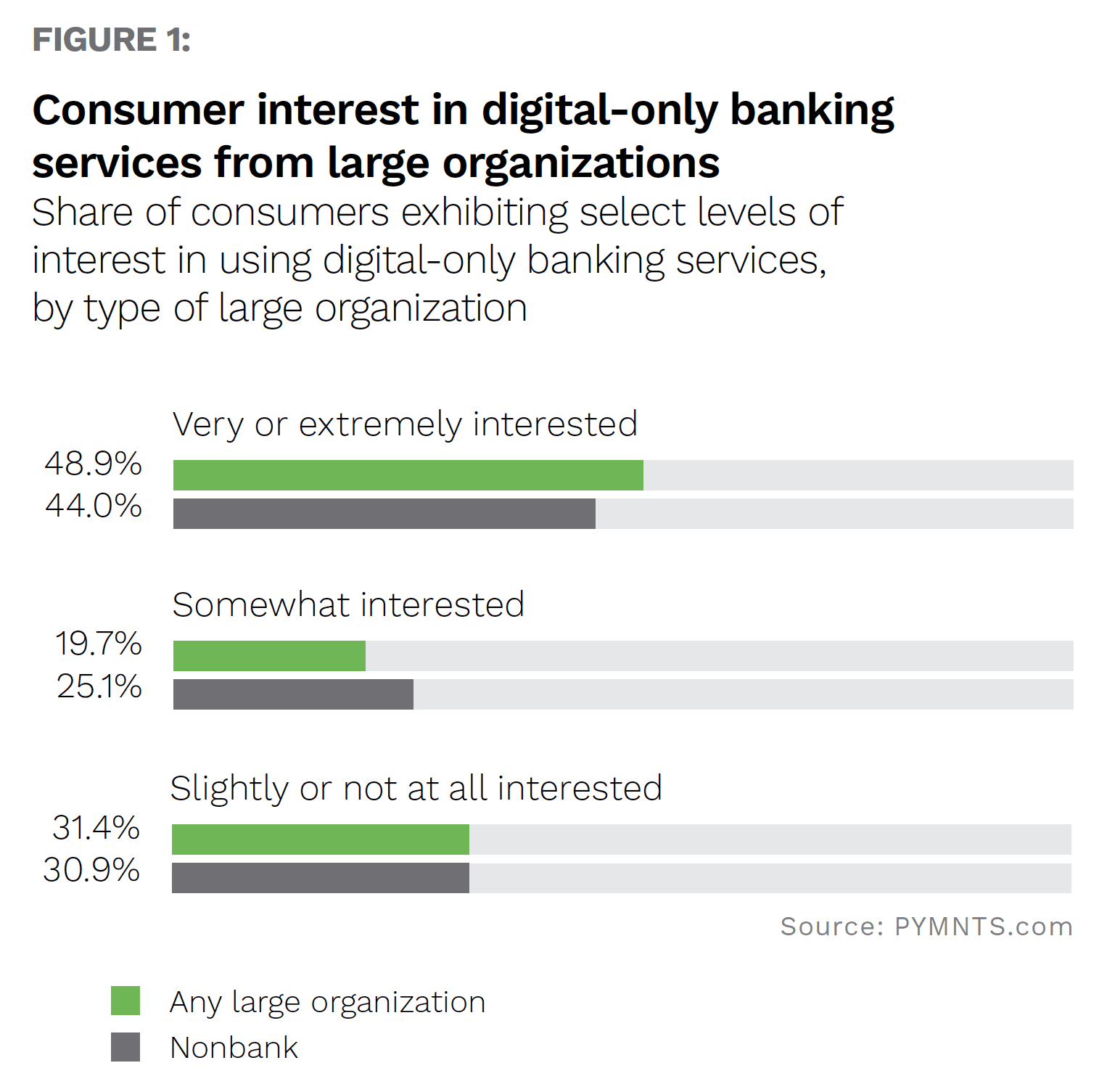

Digital and online technologies have consistently increased competition and innovation across industries—a trend that suggests white-label banking is going to continue to grow in popularity. Interest in these products is strong, with PYMNTS’ research finding that 49% of consumers report being “very” or “extremely” interested in digital-only banking services from large organizations.

Key to this movement have been open banking technologies, which have grown in popularity around the world over the past few years as white-label financial services and BaaS technologies have established themselves. The field is still fairly open, however, and the prospective benefits are clear: Direct banks that invest in open banking platforms now will be rewarded with new revenue streams and partnerships with the most capable FinTechs.

Open Banking Benefits

Banks maintain a highly intimate history detailing much of what we spend, save and borrow. Some of this data is shared with third parties in open banking, which has become something of a global movement, facilitating digital financial innovation and disruption around the world. Open banking technologies have empowered both financial and nonfinancial entities to access customer accounts and data and offer new products and services. For example, open banking can fuel money management solutions by increasing consumers’ visibility into accounts.

These advances could strengthen the position of nonbank organizations in the financial services industry. Over the last two years, many United Kingdom-based firms have started providing frameworks FinTechs and banks can adopt to offer digital financial solutions without building all elements of these platforms themselves. According to research, 70% of U.K. open banking license holders do not have to provide their own infrastructures. This allows other organizations greater latitude to innovate—and to do so quickly.

Trust Goes Beyond Banking

Some consumers might not feel quite ready to shift completely toward online banking or feel comfortable with their information being widely shared. Consumers generally said they were satisfied with their primary financial services providers through the second half of 2021, despite the difficult financial straits many found themselves in. Trust in providers has also remained relatively level, and banks and credit unions still hold an advantage in reputation over both online-only banks and credit card companies. Nonbank firms are ready to muscle their way into the sector, however, and it looks like consumers may finally be ready to embrace them.

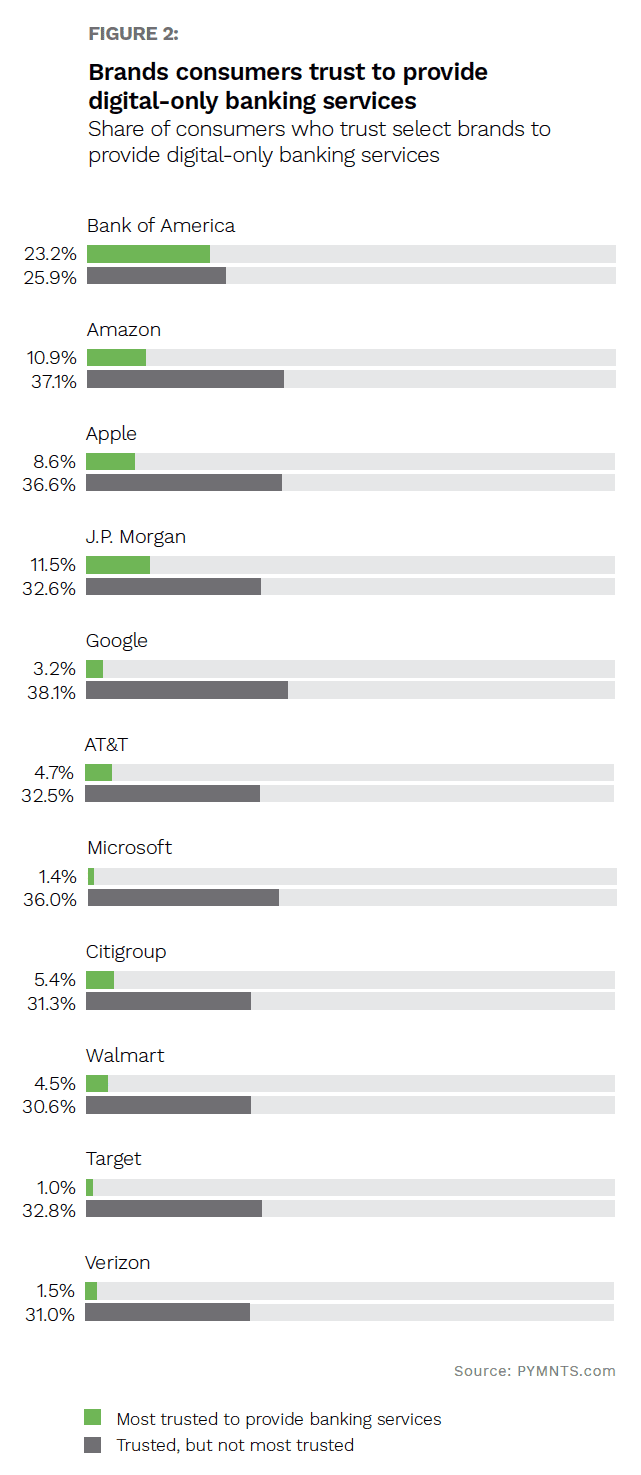

Our research found that consumers value well-known, trusted brand names that have histories of providing outstanding digital experiences and delivering on security — whether those firms are chiefly rooted in the world of banking or not. Just under half of consumers said that they view Amazon and Apple as organizations they would trust if they offered online banking services. Organizations that have backgrounds outside of banking have a sizable opportunity to gain ground within the banking industry if they can build on their strengths to make financial services fun, easy to use and secure.

It also explains why 48% of consumers cited Amazon and 45% cited Apple as the nonbanks they would trust the most if the companies offered digital-only banking services. These stats are very similar to the share of consumers who said they would trust major FIs: 49% said they would trust Bank of America to offer such services and 44% would trust JPMorgan Chase & Co.

In short, open banking technologies offer a great area of opportunity for organizations so long as they can provide secure services and find the right partners. BaaS is disrupting banking, allowing new players to offer consumers improved experiences and more choices.