Balance Sheet Management Pressures Push 75% of CFOs to Digitize Payments

Businesses spent years and many millions of dollars modernizing their payments technology stack to handle the rapidly expanding volume and demand for faster payments that are becoming a hallmark of the 21st-century economy. These systems upgrades took on new urgency in March 2020, when the COVID-19 pandemic became a catalyst for companies to accelerate payments digitization projects.

Businesses spent years and many millions of dollars modernizing their payments technology stack to handle the rapidly expanding volume and demand for faster payments that are becoming a hallmark of the 21st-century economy. These systems upgrades took on new urgency in March 2020, when the COVID-19 pandemic became a catalyst for companies to accelerate payments digitization projects.

It was a smart move. PYMNTS’ data shows that 74% of companies say the switch to digital payments improved their management of working capital, and 73% say their data security improved because of their recently digitized platforms. Companies also report that their operating efficiency improved, and costs fell. At the pandemic’s outset, businesses recognized an immediate need to manage balance sheets better, making a compelling case for completing digitization efforts. Companies that got ahead of the curve put themselves in a favorable competitive position against rivals that had been slower to advance their digitization efforts.

It was a smart move. PYMNTS’ data shows that 74% of companies say the switch to digital payments improved their management of working capital, and 73% say their data security improved because of their recently digitized platforms. Companies also report that their operating efficiency improved, and costs fell. At the pandemic’s outset, businesses recognized an immediate need to manage balance sheets better, making a compelling case for completing digitization efforts. Companies that got ahead of the curve put themselves in a favorable competitive position against rivals that had been slower to advance their digitization efforts.

These are a few of the findings PYMNTS uncovered in “Business Payments Digitization: The Fast Track To Payments Systems Upgrades,” a collaboration with Corcentric. Based on a survey of 400 CFOs from middle-market firms in the United States ranging from $400 million to $2 billion in annual revenues, this report explores how firms accelerated their projects to digitize B2B payments systems during the pandemic.

More key findings from the study include:

Fifty-nine percent of CFOs say digitization is a “very” or “extremely” important strategy for improving their company’s balance sheet management. Moving quickly with digitization efforts is a best practice for companies seeking to improve their financial operations. Ninety-six percent of CFOs say improvements to accounts payable (AP) and accounts receivable (AR) management are “very” or “extremely” important for creating a healthy balance sheet. Other factors that CFOs say are highly important for having a healthy balance sheet include asset investments, which 90% cite, and stronger access to sources of working capital, cited by 53% of CFOs.

Fifty-nine percent of CFOs say digitization is a “very” or “extremely” important strategy for improving their company’s balance sheet management. Moving quickly with digitization efforts is a best practice for companies seeking to improve their financial operations. Ninety-six percent of CFOs say improvements to accounts payable (AP) and accounts receivable (AR) management are “very” or “extremely” important for creating a healthy balance sheet. Other factors that CFOs say are highly important for having a healthy balance sheet include asset investments, which 90% cite, and stronger access to sources of working capital, cited by 53% of CFOs.

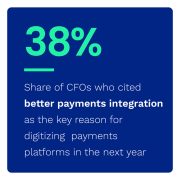

More than seven out of 10 CFOs say their companies accelerated their digitization efforts following the pandemic’s onset in March 2020. Seventy-one percent of CFOs say their organizations accelerated digitization plans once the pandemic set in, demonstrating the importance placed on having the flexibility to adapt to changing and even disruptive circumstances. Sixty-five percent of the CFOs whose companies accelerated the digitization of their payments systems say the pandemic was “very” or “extremely” influential in their decisions. The pandemic also spurred many companies to hasten work on anti-fraud efforts and the use of artificial intelligence.

More than nine out of 10 CFOs say their payments operations became more efficient due to their digitization efforts. CFOs say their businesses netted several benefits from the  digitization of their payments operations, with more efficient payments systems and improved management of cash flow or working capital at the top of the list. Ninety-one percent of CFOs say digitization improved efficiency, and 84% say the digitized systems improved management of working capital. These improvements were among the chief gains companies sought as they worked on their digitization projects and highlighted the benefits available to other companies that adopt and manage innovative technology such as digitized payments systems.

digitization of their payments operations, with more efficient payments systems and improved management of cash flow or working capital at the top of the list. Ninety-one percent of CFOs say digitization improved efficiency, and 84% say the digitized systems improved management of working capital. These improvements were among the chief gains companies sought as they worked on their digitization projects and highlighted the benefits available to other companies that adopt and manage innovative technology such as digitized payments systems.

To learn more about how firms accelerated projects to digitize their B2B payments systems during the pandemic, download the report.