Consumers and microbusinesses have access to many disbursement options, yet they receive a significant share through legacy methods such as paper checks or digital methods that are non-instant. This is despite the fact that these consumers and microbusinesses on the receiving end value faster access to funds and want them to arrive on the same day they are sent. Instant payment methods have yet to gain traction as most receivers are not as familiar with such options, however.

We examine why this is in The Disbursements Satisfaction Playbook: Sizing The Choice Gap, a PYMNTS and Ingo Money collaboration, which analyzes the responses of more than 5,000 United States consumers and 500 microbusinesses that receive disbursements, as well as 600 companies of all sizes that make disbursements. The playbook offers insights on payment choice and interest in adopting instant payments for future disbursements.

We examine why this is in The Disbursements Satisfaction Playbook: Sizing The Choice Gap, a PYMNTS and Ingo Money collaboration, which analyzes the responses of more than 5,000 United States consumers and 500 microbusinesses that receive disbursements, as well as 600 companies of all sizes that make disbursements. The playbook offers insights on payment choice and interest in adopting instant payments for future disbursements.

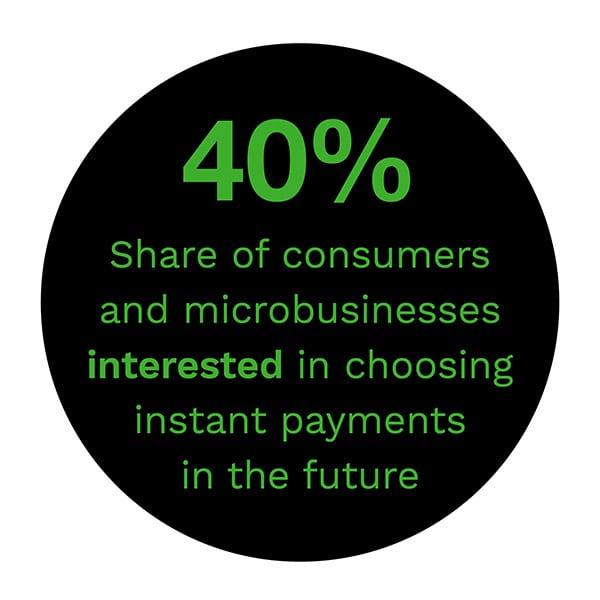

PYMNTS’ research shows that many consumers and microbusinesses made aware of instant disbursements’ speedy and convenient benefits would like access to such options. At the same time, most payers are very likely to offer such payments in the future. The key to instant disbursements success will be educating consumers and microbusinesses about instant payments’ availability and benefits, which could significantly increase uptake and improve disbursements experiences.

Consumers and microbusinesses currently do not always receive disbursements through a method to their liking, though consumers and microbusinesses prefer disbursement methods that give them faster access to their funds. Our research shows same-day ACH is preferred for nearly 40 percent of payments, for example, yet payments are often sent instead via non-instant digital methods or even checks.

Consumers and microbusinesses currently do not always receive disbursements through a method to their liking, though consumers and microbusinesses prefer disbursement methods that give them faster access to their funds. Our research shows same-day ACH is preferred for nearly 40 percent of payments, for example, yet payments are often sent instead via non-instant digital methods or even checks.

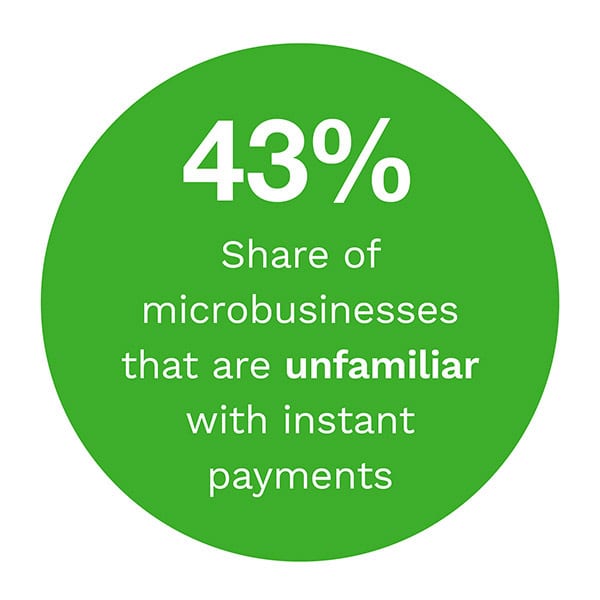

Access to instant payment options would significantly improve consumers’ and microbusinesses’ disbursement experiences, but a significant share are unfamiliar with such payment options. Our findings show that 52.8 percent of consumers and 42.5 percent of microbusinesses are “not at all” or “slightly” familiar with instant payment methods. Lack of familiarity is particularly high among older generations: 68 percent of baby boomers and seniors and 50.4 percent of Generation X consumers are unfamiliar with instant payments, while only 39.3 percent and 34 percent of millennial and Generation Z consumers, respectively, report the same. This demonstrates plenty of  room for instant payment methods to gain traction among receivers who are aware of such payments’ advantages.

room for instant payment methods to gain traction among receivers who are aware of such payments’ advantages.

Receivers often perceive that they have less choice regarding disbursements than what payers claim to be offering. This perception gap shrinks when consumers are offered a variety of payment options from which to choose, however.

These are only some of the findings from our research. To learn more about how consumers and microbusinesses are receiving disbursements, download the playbook.