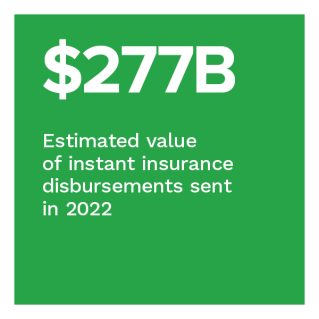

$277B in Insurance Payouts Sent Via Instant Payments in 2022

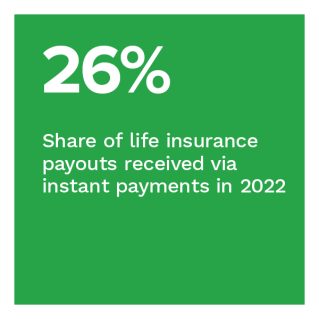

Nineteen percent of consumers received at least one insurance disbursement in 2022, and more of these roughly 49 million consumers are looking at instant payouts than ever before. Insurance agencies sent 20% of all payouts in 2022 via instant payment rails, marking the third consecutive year that the number of consumers receiving instant payouts increased.

Nineteen percent of consumers received at least one insurance disbursement in 2022, and more of these roughly 49 million consumers are looking at instant payouts than ever before. Insurance agencies sent 20% of all payouts in 2022 via instant payment rails, marking the third consecutive year that the number of consumers receiving instant payouts increased.

The growing use of and widespread interest in instant payments means insurance providers must offer payout choices to customers. Those who don’t will likely lose out to competitors offering the disbursements experiences consumers demand and expect.

In “Insurance Disbursements Brief 2022,” a PYMNTS and Ingo Money collaboration, we surveyed 2,421 consumers about how they received insurance payouts in 2022 to determine their preferences and interest in different types of instant insurance disbursements.

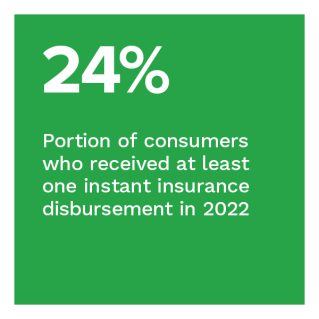

• Instant payments adoption for insurance claims continued to grow in 2022, with 24% of consumers receiving at least one instant insurance disbursement.

More consumers received instant insurance disbursements than ever in 2022: An estimated 12 million individuals received at least one instant payout. Instant payment rails are now the most common way consumers receive auto and life insurance claim disbursements.

• Consumers were less willing to pay fees to receive instant payments in 2022 than they were a year prior.

Just 45% of consumers who received health claim payouts in 2022 were willing to pay extra for an instant disbursement, down from 51% a year prior. This share is similar to property and casualty claims: 45% were willing to pay extra for instant payouts in 2022, compared to 53% in 2021.

• Although payments choice declined in 2022, consumers chose instant payments more often when companies gave them choices.

Companies offered consumers options in how they received the payout for 62% of the disbursements sent last year, representing a 12% decline from 2021. Still, when companies provided customers with options, consumers picked instant payments 23% of the time — up from 19% in 2021.

Instant payments are becoming integral to the U.S. insurance ecosystem, and usage continues to grow year after year. As instant options become commonplace and consumers’ expectations adjust, insurers that fail to deliver could lose business.

To learn more about how instant payments are on the rise in the insurance industry, download the report.