Natural Disasters Highlight Insurers’ Need For Faster Payments

Real-time payment ability may take on new importance amid a growing need for instant disbursments.

Property insurance has made many headlines in the past few months, when natural catastrophes caused damage from Florida to Hawaii.

Historically, property insurers generally pay out for these claims if there are no other contributing factors, but times are changing.

Per a June article from the Financial Times, payouts due to natural disasters in the U.S. surpassed $275 billion between 2020 and 2022, the most in any three-year period, while supply chain strain has driven up rebuilding costs. This has strained the profits and stock prices of many insurance companies, leading some companies to pull out of the most high risk areas — even with the highly competitive nature of insurance.

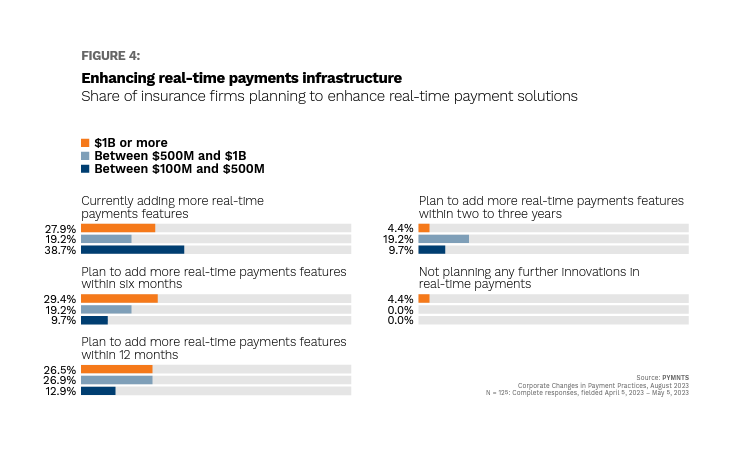

Smaller players seeking to compete with larger names may try to fill this gap. This may be where the importance of real-time payments comes in — and why 39% of small companies with revenues between $100 million and $500 million annually are currently adding more real-time payment infrastructure, per “Corporate Changes in Payment Practices,” a PYMNTS collaboration with The Clearing House.

This move towards real-time payments may benefit industry players of all sizes.

In 2022, over one-quarter of policyholders switched providers, with a main driver behind the move being faster claims processes.

Meanwhile, four in 10 insurers don’t provide the payment options policyholders prefer – real-time or otherwise. Indeed, 60% of all U.S. property and casualty claims in 2022 were paid using instant methods.

Insurance companies seeking to enter higher risk markets without a fully functional real-time payments system should consider establishing one before making market moves. Without the innovations and tools customers demand, insurance companies seeking to grow their clientele may find a stormy path ahead.