5,000 ‘Need It Now’ Consumers Tell PYMNTS What They Expect, Value Most From Retailers

There was a time not long ago when a shopping trip could take up a consumer’s entire day. They would have scheduled a block of time on their calendar, preferably on the weekend, when they could go to one or several stores and get their errands done for one week, only to have to repeat the process the next.

There was a time not long ago when a shopping trip could take up a consumer’s entire day. They would have scheduled a block of time on their calendar, preferably on the weekend, when they could go to one or several stores and get their errands done for one week, only to have to repeat the process the next.

Those days are long gone, especially since March 2020 when consumers took to shopping online in droves for all the products they only ever purchased in stores before. It is therefore perhaps little surprise that ever-so-slightly more consumers now shop on Amazon than at nationally known brick-and-mortar retailers like Walmart, Target or Costco. A total of 91% shop on Amazon, while 90% shop at the stores of all other nationally known retail chains.

Those days are long gone, especially since March 2020 when consumers took to shopping online in droves for all the products they only ever purchased in stores before. It is therefore perhaps little surprise that ever-so-slightly more consumers now shop on Amazon than at nationally known brick-and-mortar retailers like Walmart, Target or Costco. A total of 91% shop on Amazon, while 90% shop at the stores of all other nationally known retail chains.

This is not to say that shoppers have no use for the brick-and-mortar store. Rather, what they want from their shopping trips has fundamentally changed. Shopping in this brave, new economy is less about choosing whether to buy products online or in stores and more about how shopping fits into consumers’ schedules. Consumers now ask one simple question for every purchase they make: Do I need it today, or can it wait? Everything they need now, they buy from brick-and-mortar stores close to their homes or via same-day delivery aggregators. Everything else, they buy for later-day delivery.

This is one of many findings in How We Shop: Brick-And-Mortar’s Role In The Bring-It-To-Me Economy, a PYMNTS and Carat from Fiserv collaboration. We surveyed a census-balanced panel of 5,266 U.S. consumers about how their shopping habits have changed over the course of the past 19  months to find out more about the way they think about shopping, paying and managing their time now that they can have virtually anything delivered straight to their doorstep at a moment’s notice.

months to find out more about the way they think about shopping, paying and managing their time now that they can have virtually anything delivered straight to their doorstep at a moment’s notice.

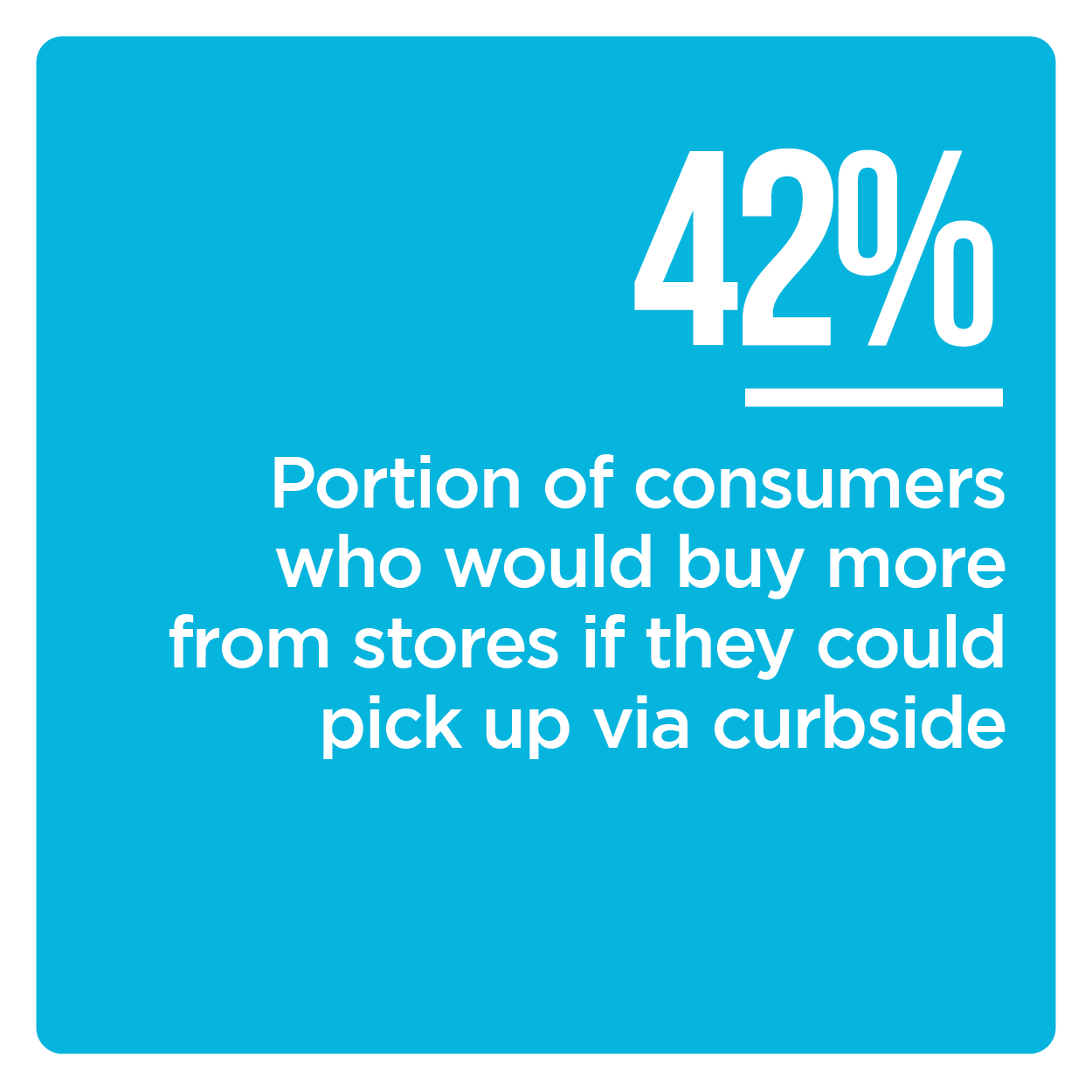

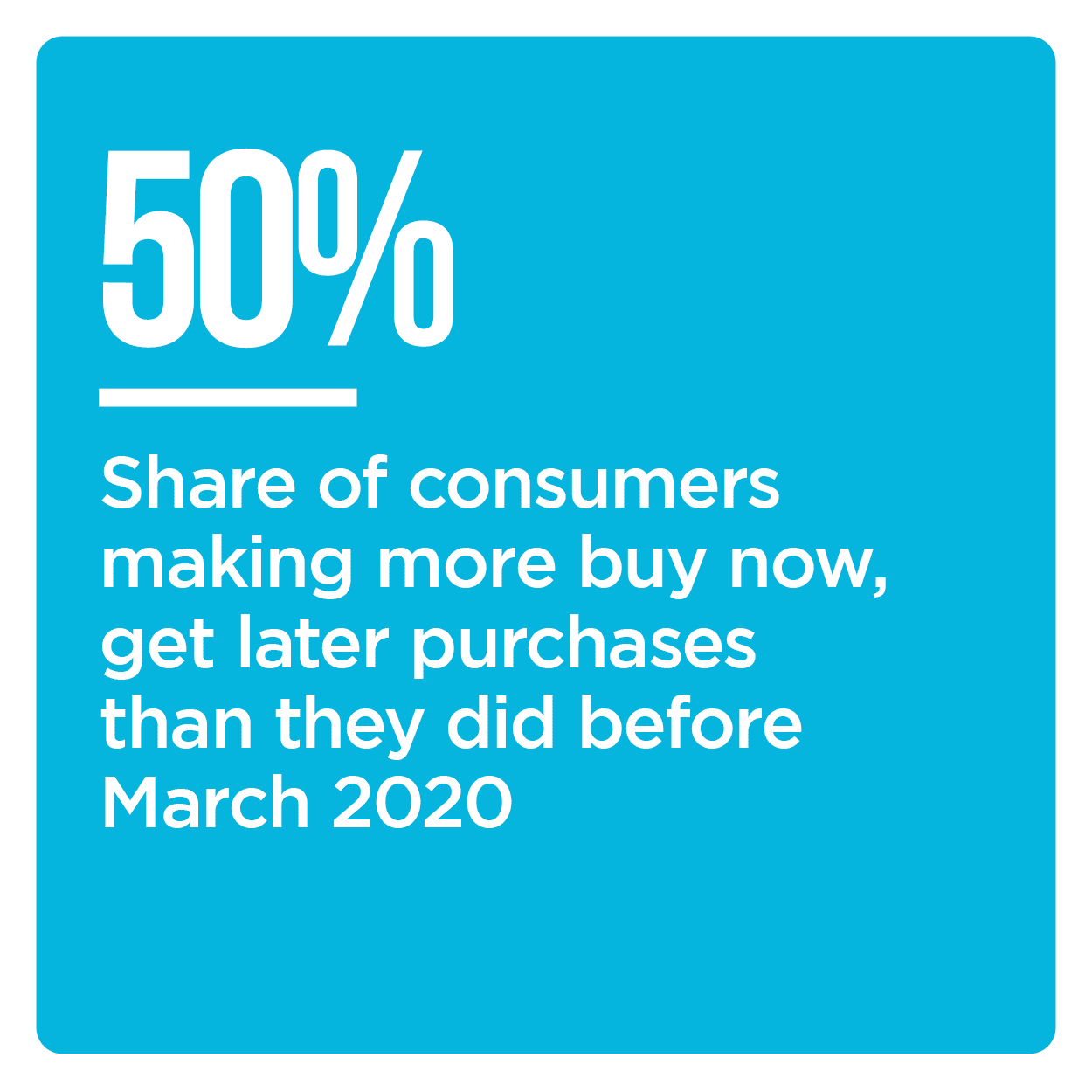

PYMNTS’ research shows that this new paradigm of “buy now, get now” versus “buy now, get later” has also fundamentally changed the ways in which consumers prefer to engage with their retailers. They want to use different payment options, shop through different purchasing channels and even buy different products online now than before. Not only do 50% of all consumers say they are making more buy now, get later purchases than they did prior to March 2020, for example, but 42% also say that they would be more inclined to buy from brick-and-mortar stores if they could pay for their purchases online and pick them up via curbside the same day. Such findings underscore the degree to which this new economy is driven by digital commerce, both online and in store.

There is also a clear and growing importance for digital and omnichannel shopping features in this bring-it-to-me economy. Features such as curbside pickup, in-store pickup and aggregator-enabled same-day delivery options are growing more mainstream with each passing day, to the point where many consumers have come to expect them. This is in turn driving a widespread demand for digital-first payment options to help facilitate such transactions. Consumers who are buying more of their items online for later-day delivery are nearly as likely to pay for their eCommerce purchases via digital wallet, buy now, pay later (BNPL) options, apps and even cryptocurrency as they are to pay via debit card, with roughly six in 10 doing so.

There is also a clear and growing importance for digital and omnichannel shopping features in this bring-it-to-me economy. Features such as curbside pickup, in-store pickup and aggregator-enabled same-day delivery options are growing more mainstream with each passing day, to the point where many consumers have come to expect them. This is in turn driving a widespread demand for digital-first payment options to help facilitate such transactions. Consumers who are buying more of their items online for later-day delivery are nearly as likely to pay for their eCommerce purchases via digital wallet, buy now, pay later (BNPL) options, apps and even cryptocurrency as they are to pay via debit card, with roughly six in 10 doing so.

Even these changes only begin to describe the full extent of consumers’ shifting attitudes toward shopping, paying and obtaining their purchases in this new economy. How We Shop: Brick-And-Mortar’s Role In The Bring-It-To-Me Economy provides a roadmap of what consumers now expect from their shopping experiences, and what merchants must do to deliver on these expectations.

To learn more about the shifting role of brick-and-mortar retail in the bring-it-to-me economy, download the playbook.