Data Brief: Unexpected Emergencies Cost Consumers Upward of $1,400

Emergency expenses can be relative based on one’s financial wellness, but the fact is, millions of American households don’t have the funds to pay for an unexpected crisis.

Moreover, the $400 emergency figure used for years as a kind of benchmark by the Federal Reserve is woefully out of date. According to the study “New Reality Check: The Paycheck-to-Paycheck Report: Emergency Spending Edition,” a PYMNTS and LendingClub collaboration, in the last 90 days, 46% of emergency expenses cost over $400, averaging roughly $1,400. This puts a new spin on how strapped consumers can respond, including solutions like personal loans.

Emergencies are no respecters of person or pocketbook, and PYMNTS’ latest research found that almost half (46%) of consumers encountered a costly crisis in the past three months. We also found strong generational correlations in the data.

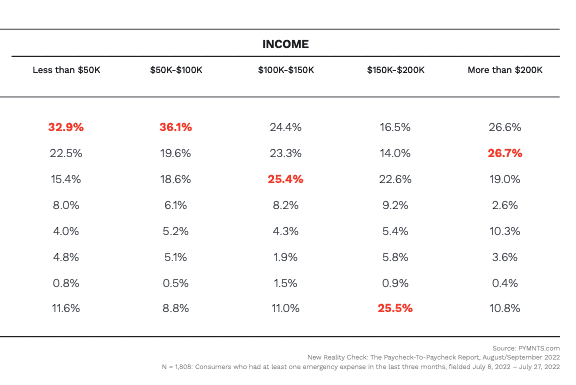

“Fifty-three percent of bridge millennials and 51% of millennials faced unexpected expenses in the last 90 days, just 45% of Generation Z consumers and 40% of baby boomers and seniors did so,” the study stated. “Also, 56% of consumers annually earning more than $200,000 had to pay at least one emergency expense, whereas 39% of those annually earning less than $50,000 had to do the same. Higher-income consumers were more likely to face more than one unexpected expense.”

That oft-quoted $400 emergency expense may have been accurate 10 years ago, but new data shows that emergencies, like almost everything else, are getting more expensive.

“According to PYMNTS’ research, 56% of emergency expenses are far more than $400,” the study found. “In fact, emergency expenses average approximately $1,400, with high-income earners and consumers not living paycheck to paycheck reporting significantly higher expenses on average.”

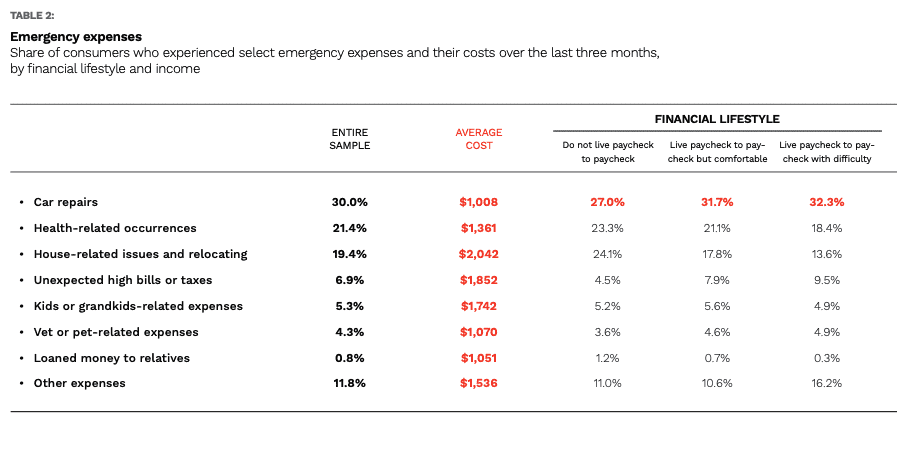

And those emergencies run the gamut from housing to healthcare, but car repair is the most frequently cited one.

“At 30%, car repairs are the most common unexpected expense, and consumers paid an average of $1,008,” the study stated. “The next-most common expenses are health-related, with 21% of consumers facing at least one health-related emergency expense and spending an average of $1,361. Housing- and relocation-related expenses had the highest average cost at $2,042,” faced by 19% of consumers.

Get the study: New Reality Check: The Paycheck-to-Paycheck Report: Emergency Spending Edition