Consumer Shopping Habits Show Continued Caution Despite Easing Inflation

As recession fears reverberate through U.S. households, they’re buying less and trading down at retail.

We see this is the latest PYMNTS inflation report, “Consumer Inflation Sentiment: Perception Is Reality,” sixth in the series, where surveys of nearly 2,150 consumers taken in December find shoppers “actively trimming goods from their grocery lists or even downgrading the quality of their purchases to make ends meet.”

Standing out in the latest report is a continuation of the belt-tightening seen throughout 2022, with consumers cutting down on discretionary retail purchases while trading down retail goods and shopping experiences to cut costs.

“Food prices are among the faster-growing areas of the index,” the study states, adding that “According to the [Bureau of Labor Statistics], the costs of food at home and away from home increased by 11% and 8.5%, respectively, in the last 12 months. Gasoline prices are 10% higher than a year ago, down from a 60% year-over-year increase in July, as recorded by the BLS. Increasing housing costs are contributing 2.3 percentage points to overall annual inflation.”

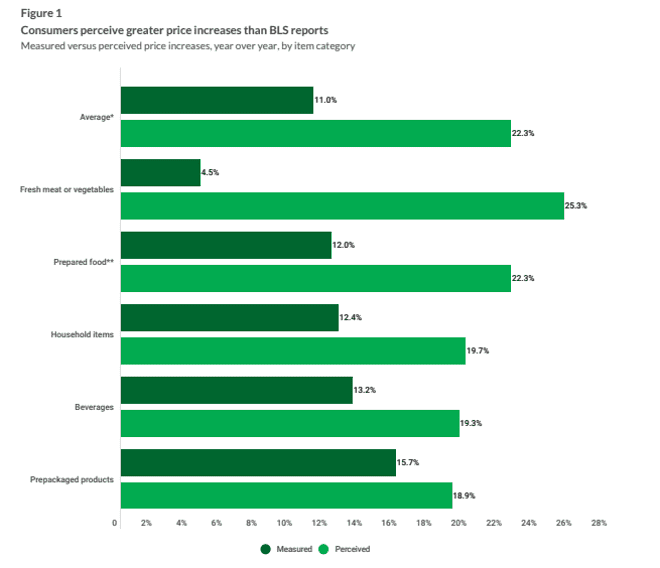

As has been said in previous reports, however, consumer perceptions in this edition of the survey series don’t align all that well with government inflation figures, “reporting increases up to two times higher across multiple grocery categories. On average, consumers report that grocery prices have increased 22% in the last year. The biggest gap can be seen in fresh meat and vegetables, with the BLS reporting a 4.5% increase versus consumers’ perceived 25% increase.”

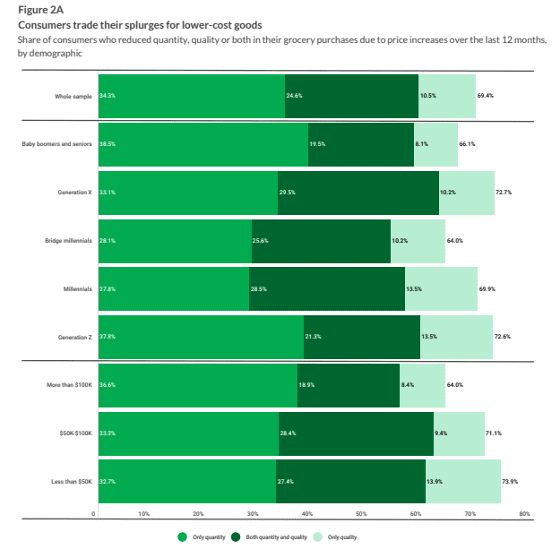

Looking at household types and the goods and services they’re limiting or doing without, it’s a balancing act of quality, quantity, and frequency at the grocery store, the mall, or eCommerce sites as our data found nearly 6 in 10 people (59%) cutting down on nonessential grocery items, with 35% buying cheaper alternatives.

A comparatively low number (11%) have made a strict shift to bargain brands seen as lower quality, while far more consumers surveyed (34%) are buying less of their preferred brands.

“Millennials were the generation most likely to switch to lower-quality goods, at 42%. Baby boomers and seniors were the most hesitant to compromise on the quality of their groceries, with 28% of them doing so,” according to “Consumer Inflation Sentiment: Perception Is Reality.”

Forced to make the toughest calls in retail spending are families with children. In December, 41% of families with kids reported trading down to lower-quality goods, compared to 29% of couples without children. “Families with children were the most likely to reduce both the size and quality of their shopping carts, at 29%, versus single consumers with children, at 20%.”

Hit hardest are struggling paycheck-to-paycheck households, of which 47% reported trading down to lower-quality goods in December to stretch paychecks. “This compares to 36% of non-struggling paycheck-to-paycheck consumers and 20% of consumers who do not live paycheck to paycheck who have switched to cheaper options,” per the study.

The BLS releases its December 2022 Consumer Price Index (CPI) on Thursday (Jan. 12), and widely published speculation is that it will show inflation continuing to ease to a year-over-year number of 6.7% versus 7.1% in November, with the core rate minus food and energy expected to drop to 5.6% annually, down from 6%.

See also: New York Fed Report Sees Some Inflation Relief Despite Consumer Fears

On Monday (Jan. 9) the Federal Reserve Bank of New York’s Center for Microeconomic Data reported that “Median one-year-ahead inflation expectations continued to decline in December, falling by 0.2 percentage point to 5.0%, its lowest reading since July 2021. In contrast, three-year-ahead inflation expectations were unchanged in December at 3.0%.”

Read the report: Consumer Inflation Sentiment: Perception Is Reality

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.