Inflation Forces Consumers to Rethink Smartphone, Subscription, Grocery Purchases

Maybe the customer was right all along in reacting cautiously to the news of easing inflation.

The Wall Street Journal reported Monday (Jan. 30) that the U.S. consumer is “starting to freak out,” pointing to dipped car sales, slumping retail and decreased service-based spending as signs of pullback. With consumer spending representing 70% of the U.S. economy, any continued drop in spending could make a negative financial ripple across all sectors, and some experts are raising their recession risk predictions for the coming year.

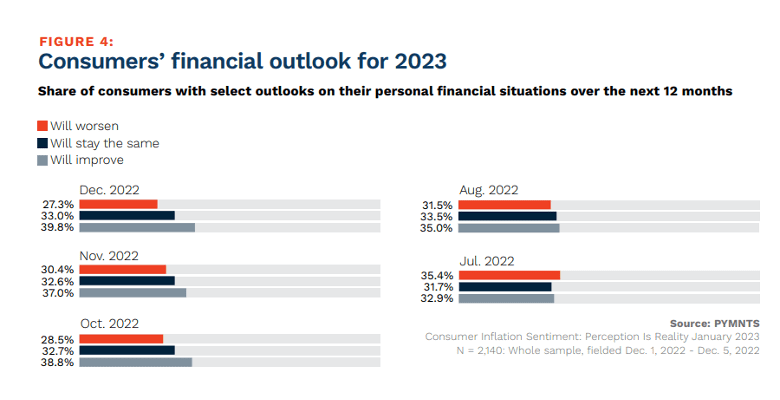

There’s nothing sudden about this consumer spending sentiment, however. As measured in PYMNTS’ ongoing collaboration with LendingClub, “New Reality Check: Paycheck-to-Paycheck Report,” consumers’ concern has been long-running. The ups and downs of consumer sentiment have also mirrored monthly consumer spending for the most part. For example, consumer outlook was at its second most positive in October, keeping pace with that month’s increased personal spending rates.

Source: PYMNTS Consumer Inflation Sentiment: Perception Is Reality January 2023 N = 2,140: Whole sample, fielded Dec. 1, 2022 – Dec. 5, 2022

PYMNTS researchers have been tracking more subtle signals of a coming softening economy, as well. Although inflation overall may have peaked last month, the cost of essentials and groceries has remained high. These continued higher prices on items customers cannot do without are likely contributing to customers’ already cautious habits and perceptions on cost-of-living rates.

As the number of U.S. consumers living paycheck to paycheck rises across all income demographics, discretionary purchases like smartphone sales are experiencing their worst sales drops on record. Service-based subscriptions may also be at risk, as 55% of surveyed consumers say they would cancel their streaming accounts if they were unable to pay all their bills. Smaller consumer behavior adjustments have also occurred, such as the switch to picking up prepared food ordered online.

Even sectors considered essential have felt the pain. December sales data noted that grocery numbers missed a much-needed holiday boost. Paycheck-to-paycheck consumers are now putting off financial planning as well, with 57% believing inflation has reduced their ability to reach their long-term financial goals.

Main Street retailers may have been some of the first to feel the pinch, as slumping small business sales were mainly fought with higher price tags for customers. A more multipronged strategy toward revenue saving may have included (and still could include) approaches such as automated software to free up personnel time. Retailers have been reconsidering their cross-channel selling strategies and groceries are redoubling their discounting efforts, such as coupons.

Consumers are using their credit cards to help cover any funding shortfalls, as recent big bank earnings reports demonstrating increased usage across consumer groups suggest. However, that may not last for long as interest rates continue to increase and the personal spending rate drops for the second month in a row.

The only thing certain about the future is its uncertainty — including gloomy financial forecasts. However, if past and current research — and consumers’ viewpoints — are any indicator, we may be in for a bumpy ride.