Inflation is slowing — but not enough to cheer consumers, who expect inflation to last a long time.

And the latest measures from the government will do little to dissuade them from scrambling to find cheaper alternatives and merchants in order to get their everyday essentials.

To that end, the Bureau of Economic Analysis reported Friday (March 31) at least in headline terms — and as measured by the Personal Consumption Expenditures (PCE) price index — at least some inflationary headwinds are slowing. A slowing, we note, is not the same as a decline, so: Life keeps getting more expensive.

Inflation slowed to an annual rate of 5% in February, down from 5.3% in January, and below the 6.1% rate measured as recently as October. That headline number does include the usually volatile prices tied to food and energy, and of course these latter expenditures are among the most essential that all individuals and families must budget for, adjusting to those changes as adroitly as possible.

At the same time, disposable personal income was up only 0.5% in the latest month, as measured in current dollars. The money left over to keep spending, then, is growing more slowly than the inflationary pressures that are eating away at take-home pay.

The data will do little to ease consumer sentiment that inflation’s entrenched, a stubborn presence that’s going to be here for a while.

Proprietary PYMNTS research shows that, over more than 600 consumers surveyed, the expectation is that inflation’s not going to drop down to pre-2021 levels until the fall of 2024 — October, to be exact.

The PCE data come just days after we reported that consumers are not all that sanguine about current economic conditions, and are slightly more optimistic about the future. But this does not mean they are feeling that happy days will be here again, as the old song goes.

The Conference Board noted that the Expectations Index — based on consumers’ short-term outlook for income, business, and labor market conditions — rose from 70.4 in February to 73 this month.

But, as the Board noted, “for 12 of the last 13 months — since February 2022 — the Expectations Index has been below 80, the level which often signals a recession within the next year,” according to a news release.

In a recent PYMNTS report on consumer sentiment about inflation, we found that 74% of consumers have cut down on non-essential retail purchases.

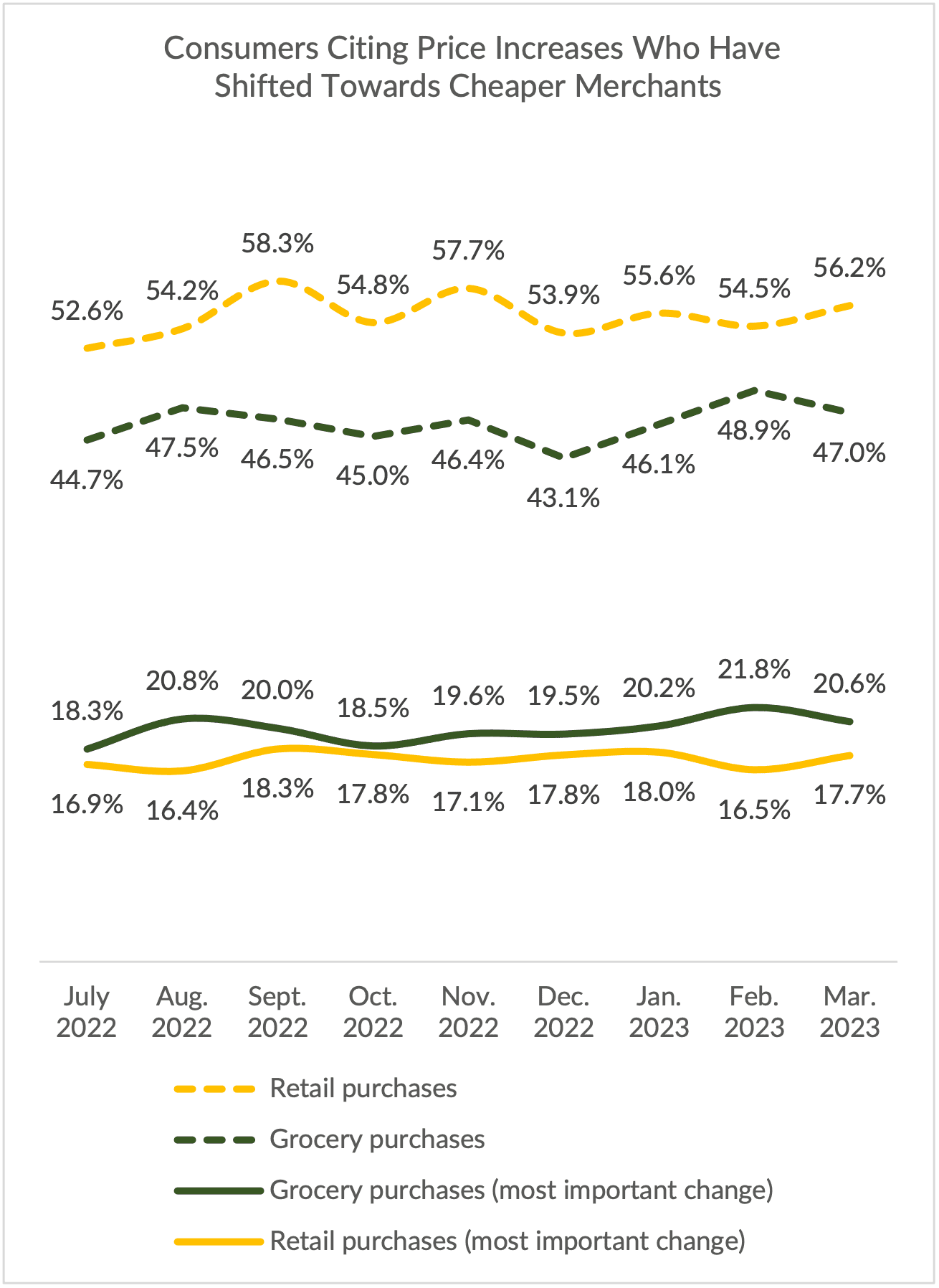

And more recently, proprietary research — which will be discussed in more detail in an upcoming report — 56% of consumers have been shifting their spending to cheaper grocers; 47% have been doing so for their retailers. The graph at right also details the percentages of consumers surveyed who have signaled that shifting to those less expensive merchants have been the “most important” changes they’ve made in re-calibrating their spending.

The fallout, at least over the next couple of months, may be that the continued “downshift” by consumers hits most retailers and grocers, to the benefit of the discount stores and the Big Box merchants. The impact may be prolonged, given the data above that show consumers are settling in for years of price increases.