A strong labor market may be softening, confirming consumer hesitancy in returning to previous spending patterns.

Department of Labor figures released Thursday (June 8) noted increased initial unemployment claims, marking a sharp U-turn from the tightening labor numbers in recent months. The 28,000 rise from the previous week brings the current total of claims to 261,000 — the highest mark since October 2021. These new numbers, combined with reports of slowing wage growth and mass layoffs in retail, tech and crypto, seems to put on hold much cause for celebration of a return to a pre-inflation economic normal anytime soon.

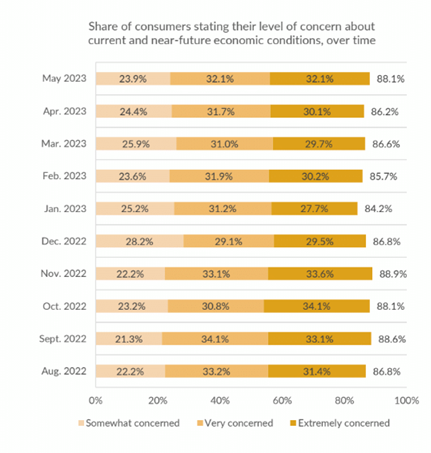

It seems, however, as if consumers were expecting this shift all along. As noted in proprietary research carried out in preparation for PYMNTS’ June “Consumer Inflation Sentiment” report, concerns about current and near-future economic conditions are creeping back up.

From the January low of 28%, the share of consumers extremely concerned about current and near-future economic conditions has steadily increased, reaching 32% in May. These feelings are intensifying, too, as the share of consumers very concerned has also increased during the same time period, meaning that the share of consumers only somewhat concerned about the economy is dropping.

This sentiment shifting further toward concern could be at least partially driven by wage growth slowdown, even as prices keep creeping up. Proprietary research for the same report measures consumers’ change in income compared to costs — and the numbers aren’t pretty.

Here, too, from January, the share of consumers reporting their wages either flatlined or decreased relative to price increases is on the rise again, with a more than 1 percentage point drop each in consumers saying their wages either partially or fully offset inflation. Given these headwinds, it may not be a surprise that consumers have been continuing to keep their spending habits conservative.

This gloomy sentiment has been a long-running theme in looking at previous PYMNTS data focused on consumer and Main Street sentiment. Warnings that neither group felt like the economic landscape would be secure in the near future have been coming for some time, with PYMNTS finding 59% of surveyed Main Street small to- medium-sized businesses expecting a recession to hit during 2023. Banking on resilient customer trade to stay afloat as small businesses struggle to find credit lines, some are seeing the consumer spending slowdown as a sign of things to come. With much of the country’s GDP dependent on spending, the resulting possible recession may spiral down as consumers continue to budget primarily for the essentials.

With its previous robust numbers reversing, jobs data may be somewhat misguiding in reading the tea leaves of the country’s true economic health. As the Federal Reserve considers another rate hike next week, consumer sentiment could more reliably portend the future — one that may well signal a rocky economic time ahead.