Fed Keeps Benchmark Rate Steady Because Inflation is ‘Too High’

This week, the Federal Reserve announced it will keep its benchmark interest rate in the same 5.25%–5.50% holding pattern that it has occupied since last July.

The move went against the expectations of many economists who were anticipating a rate cut, but Fed Chair Jerome Powell explained that his agency still sees too many troubling signs littering the U.S. economic landscape to justify a rate reduction.

“Inflation has eased substantially over the past year while the labor market has remained strong, and that’s very good news,”Powell said during a Wednesday (May 1) press conference. “But inflation is still too high, further progress in bringing it down is not assured, and the path forward is uncertain.”

For U.S. consumers, the decision means it will likely still be a while before they see any immediate relief in borrowing costs.

It also means that budget-minded consumers may need to curtail unnecessary spending, at least until policy makers see more certainty in the path ahead.

As PYMNTS Intelligence found in doing research for its most recent edition of the Consumer Inflation Sentiment Report, “The Cautious Spender: US Consumers Now Think First, Spend Second,” it wasn’t that long ago that the average consumer felt free to spend money. At the time of the report, retail spending was up nearly 7% year over year, suggesting consumers were confident that a full economic upswing might be right around the corner.

The report, which was based on surveys of nearly 5,000 U.S. consumers, found the spending uptick played out because inflation was dipping at the time. Prior to that, consumers had been cutting back. But as overall inflation tapered off in late 2023, ending the year at 3.4%, consumer anxiety diminished and, with it, the need to cut corners.

This is not to suggest U.S. consumers were oblivious to the lingering signs of economic uncertainty that Powell and company have continued to call out, but the data implied that they were at least less anxious than they had been even a year before.

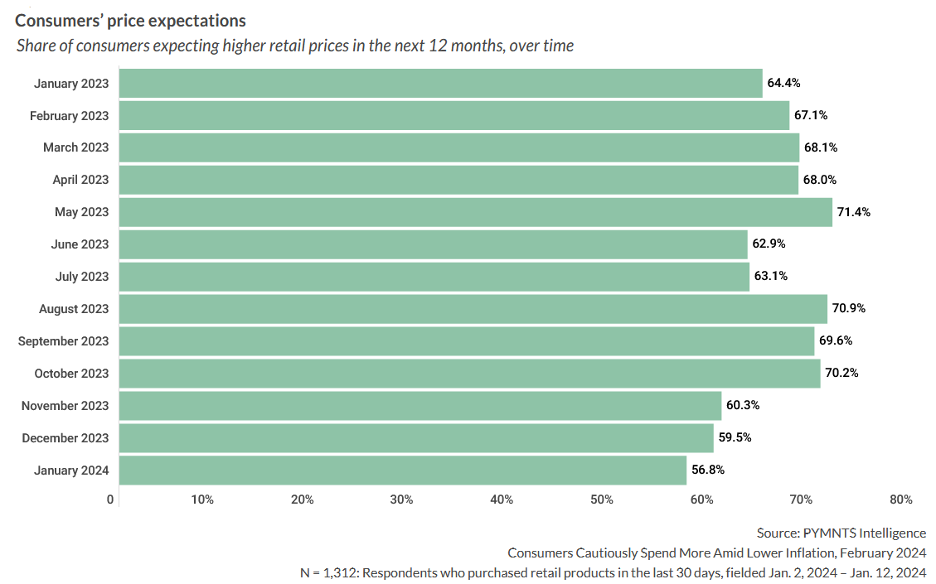

As the chart below illustrates, last January, consumers were optimistic that retail prices would continue falling. The share of consumers expecting higher retail prices year over year dipped from 64% in January 2023 to 57% in January 2024.

Even though inflation is still down from its 9.1% peak in July 2022 to 3.5% as of March, more than half of U.S. consumers are struggling to cover monthly expenses.

According to PYMNTS Intelligence’s recently released New Reality Check report, “Why 60 Percent of Gen Z’s Live Paycheck to Paycheck,” 58% of U.S. consumers are living paycheck to paycheck. And although this reflects a slight drop from the 60% who struggled a year ago, it does confirm that a majority Americans — across all income levels — have a tough time making ends meet.

In fact, 41% of those earning more than $100,000 annually tell us they live paycheck to paycheck. So do 62% of those earning between $50,000 and $100,000 each year and 75% of those earning less than $50,000 annually.

And while insufficient income was the leading reason most consumers cited for their paycheck-to-paycheck status, many consumers also admit their current spending habits — at least for nonessential items — add to their financial woes.

Thirty-four percent of Gen Z consumers identified nonessential spending as a reason they live paycheck to paycheck. Data suggests this behavior declines with age: 13% of millennials, 8% of Gen X consumers and 4% of baby boomers and seniors also blame nonessential spending for living paycheck to paycheck.

With inflation fears remaining top of mind for policy makers and the promise of lower interest rates delayed, it appears consumers may once again find themselves curtailing their nonessential spending, just as they did at the beginning of 2023.