58% of Consumers Cut Back on Nonessentials Due to Rising Grocery Costs

The rising costs of groceries continue to pressure U.S. consumers to reconsider how they shop — and what they shop for.

As PYMNTS Intelligence reported last year, when stocking their pantries, more consumers are scratching nonessential food items from their shopping lists, regardless of their income levels.

This belt-tightening trend continues even though inflation has steadily declined in recent months. Data from the U.S. Bureau of Labor Statistics shows grocery price inflation is outpacing standard inflation rates.

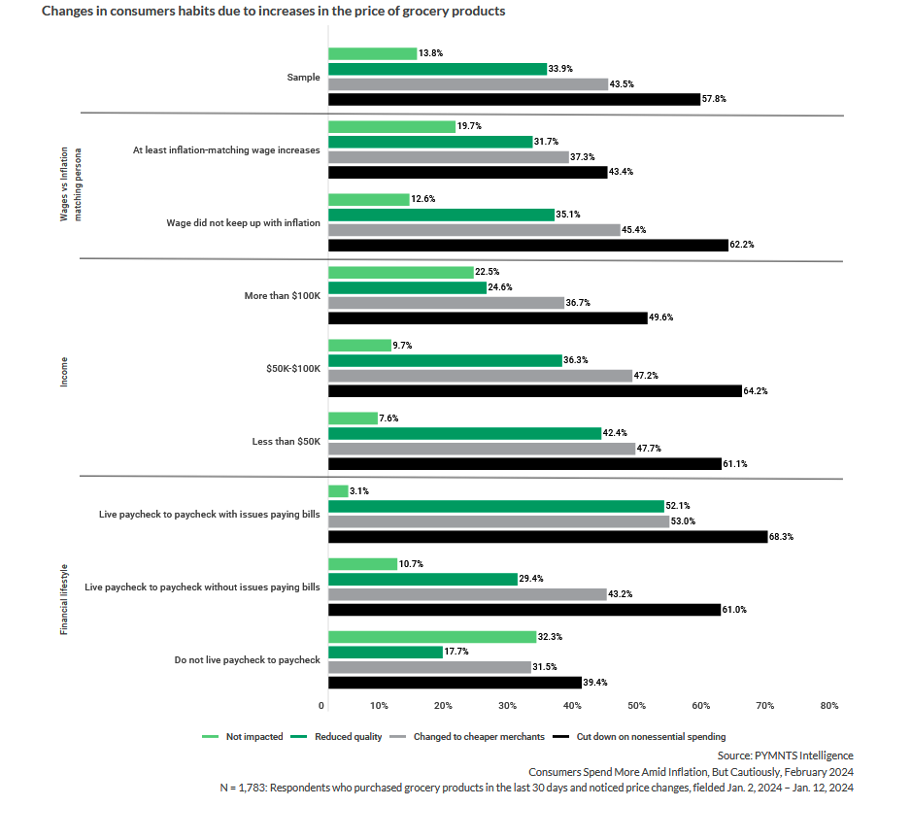

These pricing trends likely explain why nearly 58% of today’s consumers across nearly every income level say they are cutting back on nonessential spending because of rising grocery costs.

Nearly half of U.S. consumers earning north of $100,000 each year say they decrease nonessential spending whenever possible. Sixty-one percent of consumers earning less than $50,000 annually and nearly two-thirds of those earning between $50,000 and $100,000 each year do the same.

Among the entire sample of more than 1,700 U.S. consumers, only around 14% reported being unscathed by higher grocery prices.

On the other end of the spectrum, cost-cutting grocery shopping adaptations are even more pronounced for those consumers who describe themselves as living paycheck to paycheck.

According to the PYMNTS Intelligence study “The New Reality Check: The Paycheck-to-Paycheck Report,” 68% of paycheck-to-paycheck consumers who say they are already challenged paying their bills find themselves making tradeoffs between “essential” items and those they deem “nice-to-have.”

Things aren’t much better for paycheck-to-paycheck consumers who say they can comfortably manage their expenses. Sixty-one percent of the latter group also find themselves saying “no” to nice-to-have items in favor of essential groceries.

The report, which is based on a January survey of more than 4,300 U.S. consumers, determined that high-earning paycheck-to-paycheck consumers (those with annual incomes of more than $200,000) allocate about 18% of their monthly income toward groceries and household supplies.

Meanwhile, paycheck-to-paycheck consumers earning less than $50,000 each year spend 23% of their wages on groceries and household supplies.

Nearly 70% of paycheck-to-paycheck respondents earning less than $50,000 annually say their decision to take a pass on nonessentials is directly related to rising food prices. But even paycheck-to-paycheck consumers who earn more than $100,000 each year feel a similar pinch: 56% say their nonessential cutbacks are due to escalating costs.

One key takeaway from the report is that more consumers across all income brackets now classify themselves as living paycheck to paycheck compared to 2023. The report lists numerous factors that may account for this increase, but chief among them are rising housing and grocery prices, which are beginning to shape how even high-income consumers view their own economic standing.