95 Million Consumers Say They Want One Digital Place to Bank and Shop

With so many apps vying for attention, consumers are experiencing app fatigue. This fatigue is giving rise to the growing appeal of a single platform that consolidates shopping, banking and other daily digital activities — an everyday app.

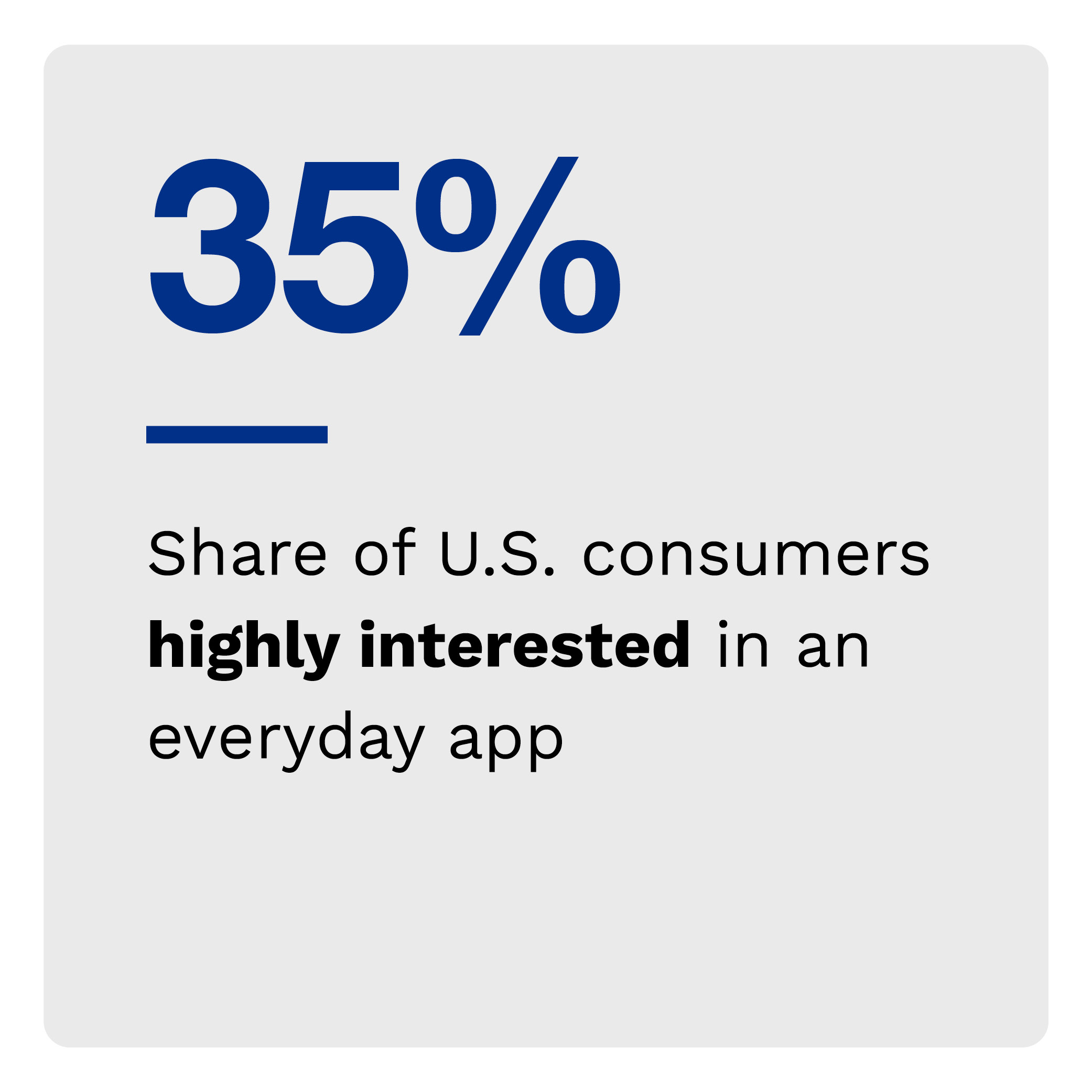

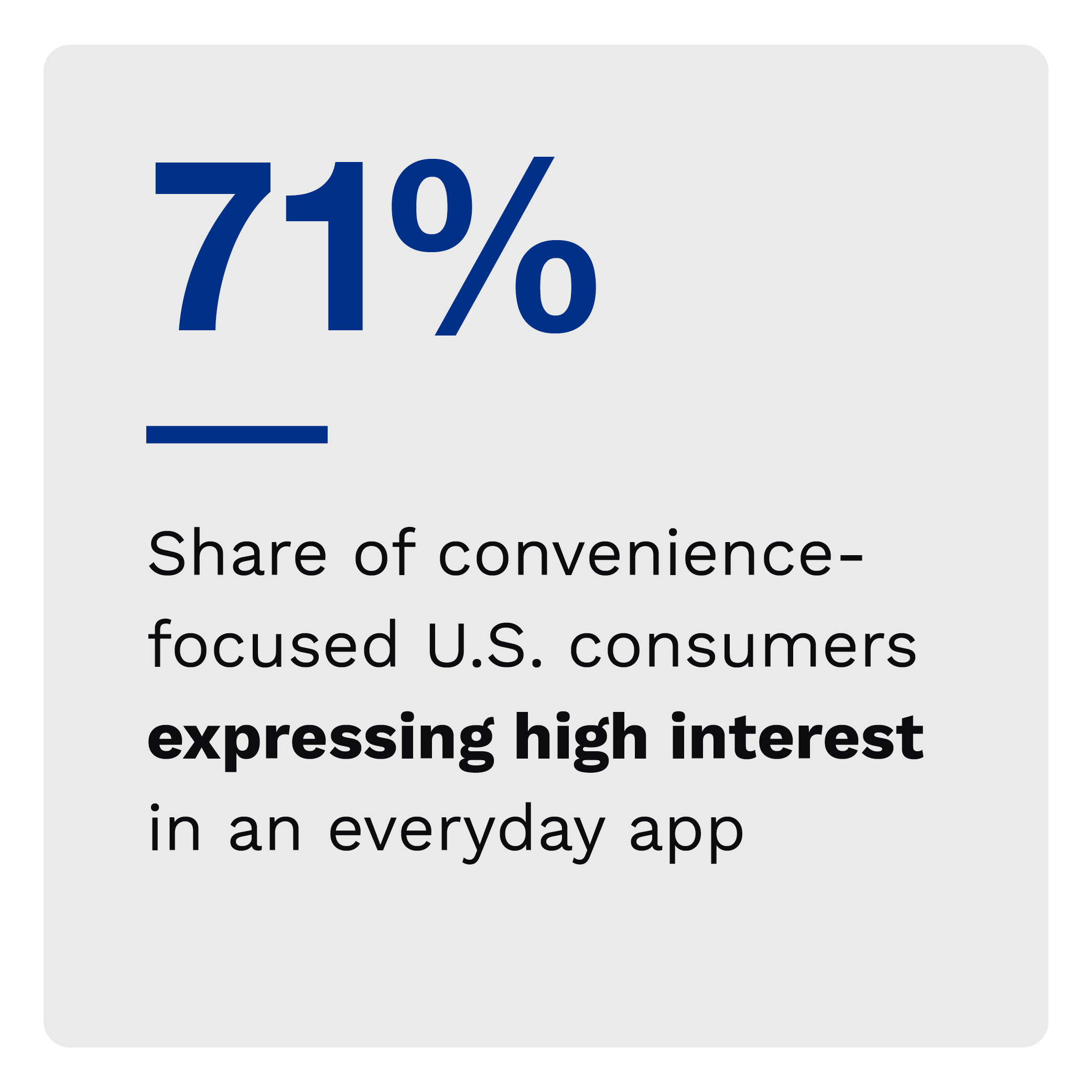

PYMNTS’ latest study shows that 95 million consumers from the United States and Australia crave an everyday app. This sentiment is even more pronounced among convenience-focused consumers: 71% of convenience-focused U.S. consumers and 50% of those in Australia voiced strong interest in an everyday app.

These are just some of the findings detailed in “Consumer Interest in an Everyday App,” a PYMNTS and PayPal collaboration. This report draws on insights from a survey of 3,320 consumers in the U.S. and Australia conducted between March 2 and March 20 that explored the rising demand for an all-in-one finance and shopping app.

Other key findings from the report include:

Banking, shopping and bill tracking are key to everyday apps.

Nearly 7 in 10 consumers in the U.S. and Australia would wrap their digital retail and grocery shopping and bill tracking into a one-stop app. Among them, convenience-focused consumers overwhelmingly prefer managing their banking, investment and various shopping activities through an everyday app.

Convenience and security drive appeal for an everyday app.

Consumers expect an everyday app to deliver sought-after convenience: 59% of U.S. consumers and 37% of their counterparts in Australia cite seamless payment integration as a top benefit of using an all-in-one app. In addition, significant shares of consumers in both markets view an everyday app as a potential solution to minimize their app-related security concerns.

The adoption of an everyday app hinges on robust security.

Security concerns form a significant barrier that impacts consumer enthusiasm for adopting everyday apps: 64% of respondents in Australia and the U.S. said security concerns would prevent them from using an everyday app. The worry is even more prominent among shopping-focused consumers, with more than 2 in 3 consumers expressing unease. Two-factor authentication and data encryption emerged as critical security features that would significantly enhance trust in these apps.

Consumers demand for an all-in-one finance and shopping app is rising, and to be successful, providers must offer the features customers want in these apps. Download the report to learn more about how security features and trust in an everyday app provider shape this demand.