Good Customers Gone Bad — Retailers Lose $89B Annually to Return Policy and Promotions Abuse

Retailers are well aware that as technology makes it faster and easier for consumers to shop online, bad actors are not far behind in adopting their methods to new retail opportunities.

Many retailers are frustrated, however, by their inability to identify and block policy abuse by known customers at scale, according to a new PYMNTS report. In Beyond eCommerce Fraud: How Retailers Can Prevent Customer Policy Abuse, a PYMNTS and Forter collaboration, PYMNTS found policy abuse by customers costs retailers in the United States more than $89 billion annually. Ranging from false item-not-received (INR) claims to returns of items for a full refund after the customer has used the item but claims it was damaged, customer policy abuse is costly, persistent and challenging to track.

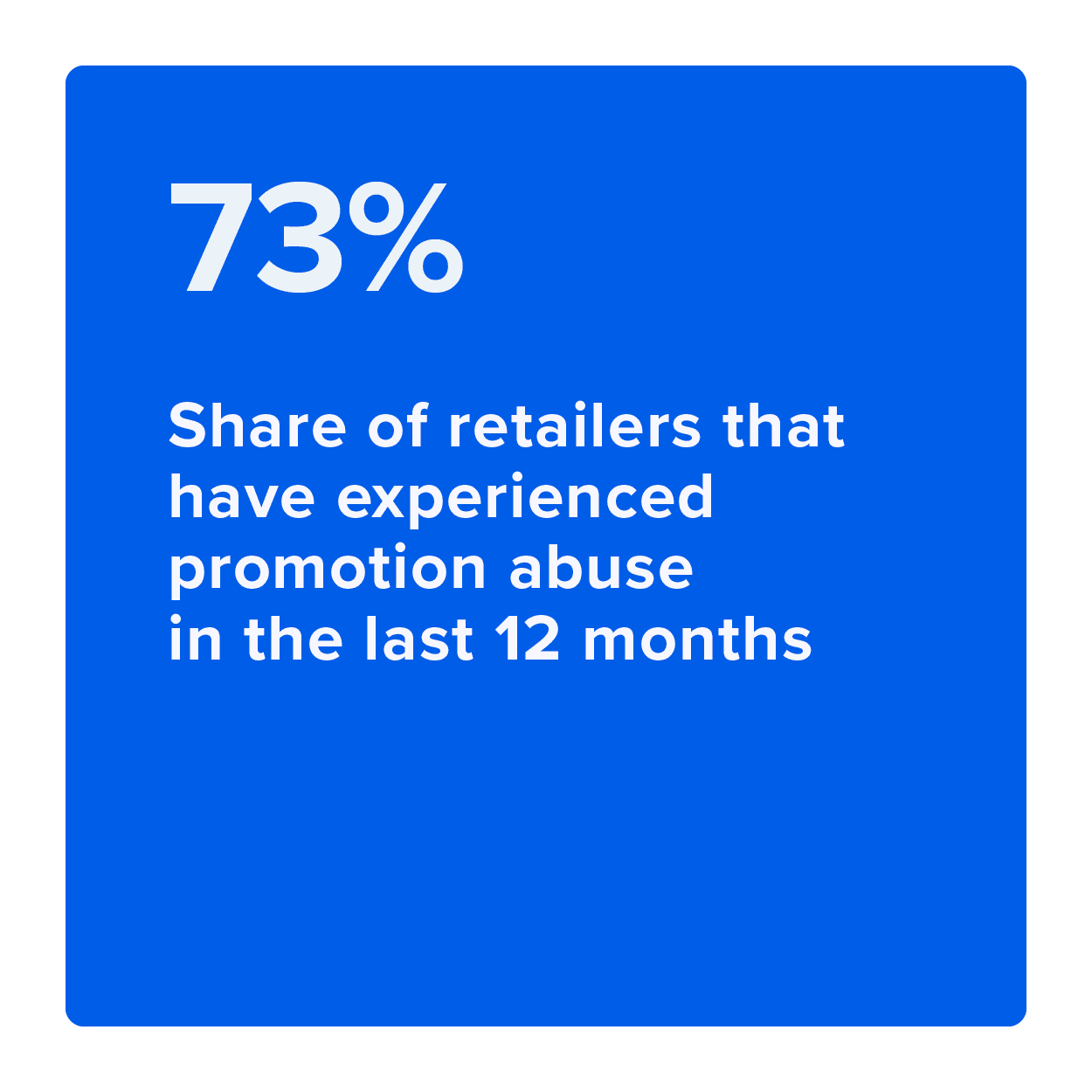

One of the most common types of customer policy abuse is also the easiest to commit, PYMNTS found. Promotion abuse is perhaps the easiest type of fraud for consumers to execute, as misused discount codes, free trials or scanned physical coupons can create “extreme” discounts that are used and reused well beyond their original intent.

The challenge for retailers is how to coordinate policy abuse monitoring at scale and how (and to whom) to assign the daunting task. Because many eCommerce companies manage returns and complaints exclusively through customer service portals, identifying, tracking and blocking offenders, especially sophisticated serial abusers, is challenging without a comprehensive, technology-driven system that eliminates vulnerabilities.

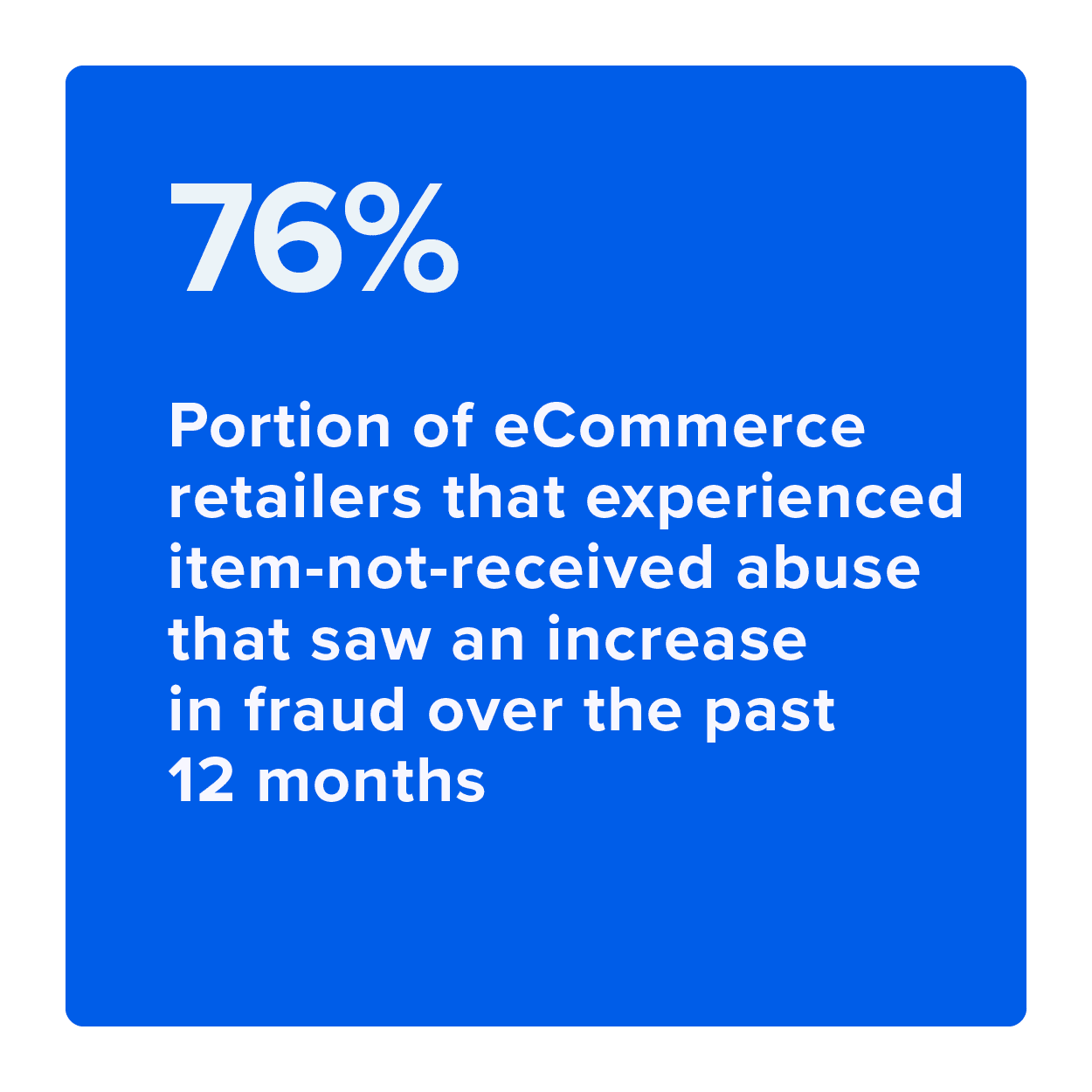

PYMNTS found that the eCommerce surge of 2020 brought most companies with a digital storefront (87%) a wave of new retail customers, and many were ill-prepared for the security risks involved in a burgeoning online business. Retailers have worked to make online shopping easier for consumers, and this willingness to remove friction from shopping has amplified risk. As retailers provided customer experience features like instant credits for online INR claims and other liberal return policies, they faced a new wave of attacks from bad actors.

While brands create these policies in the hopes of boosting consumers’ confidence and building loyalty, these efforts come at a price for some retailers, as some consumers take advantage and initiate fraudulent claims.

The losses incurred are significant.

Many brands have taken the approach of developing their own methods of tracking thes e types of fraud, but few are successful in tracking repeat offenders and blocking new fraud attempts simultaneously. Many retailers still track these fraud attacks manually.

e types of fraud, but few are successful in tracking repeat offenders and blocking new fraud attempts simultaneously. Many retailers still track these fraud attacks manually.

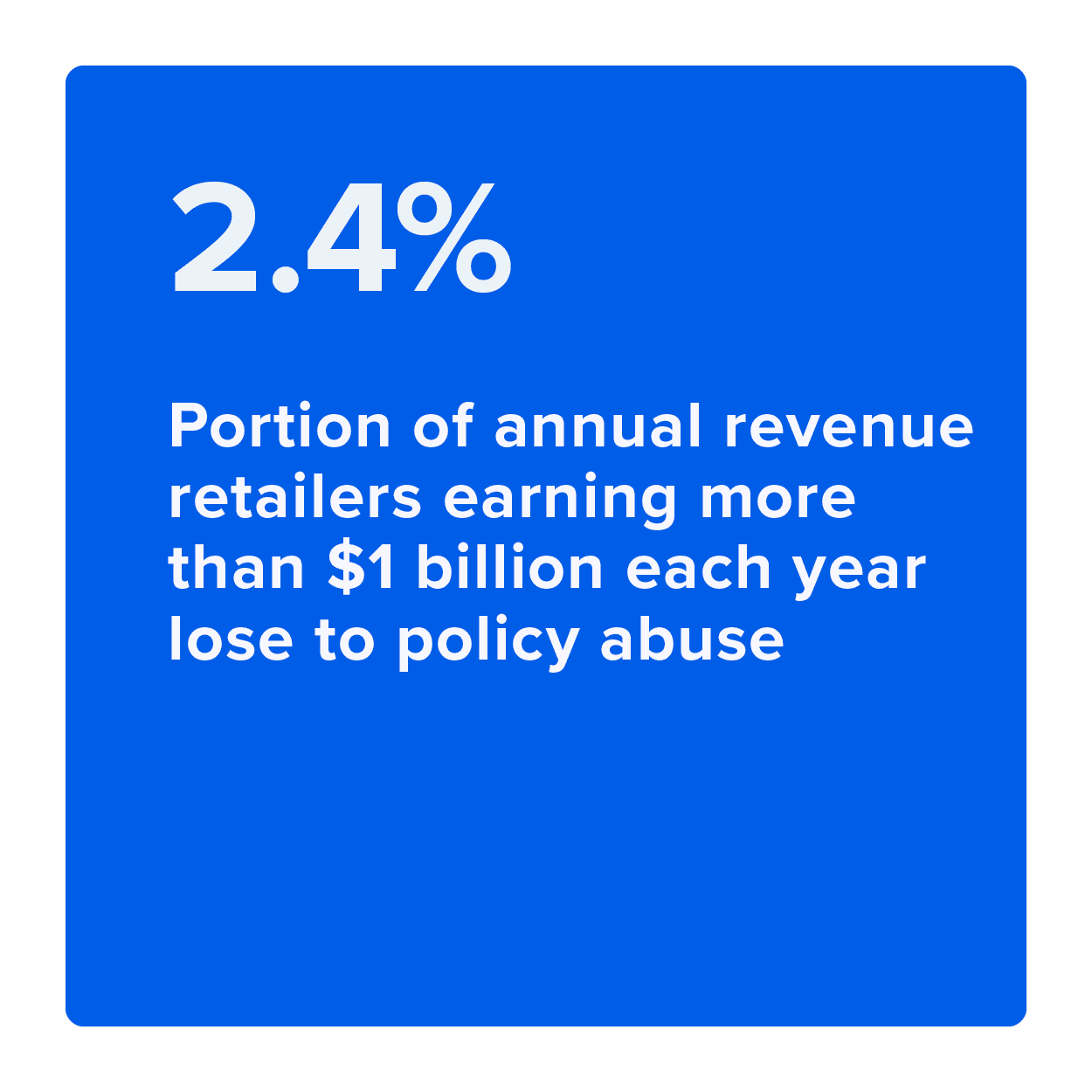

PYMNTS’ research found that 89% of online retailers have suffered at least one type of policy abuse in the past year, and businesses may lose as much as 2.2% of their annual revenues to these types of fraudulent claims. The largest retailers were frequent targets of policy abuse. Retailers earning more than $1 billion in annual revenue lost 2.4% of their annual revenue to these false claims.

To learn more about how retailers are addressing fraud and the options available to track and block known customer abuse at scale, download the report.